The company claims to be a “No Dealing Desk” broker with top-tier liquidity and allegedly favorable trading conditions. However, it is based in the Seychelles and does not hold a license from any reputable regulator. Instead, it offers a 100% deposit bonus and high leverage — both of which have long been considered red flags for questionable platforms. Is this a reliable broker or just another Forex scam? In this review, we will determine who truly benefits from working with Fyntura — the traders or only the company itself.

Table of Contents

Highlights

| 🏛️ Country | Republic of Seychelles |

| ⚠️ Regulation | – |

| 🖥️ Website | https://fyntura.com |

| 🎲 Demo Account | Yes |

| ⏳ Start Time | 2024 |

| 💲 Minimum Deposit | $10 |

| ⚖️ Minimum and Maximum Leverage | 1:500 |

| ⚙️ Trading Platform | MetaTrader 4 |

| contactus@fyntura.com | |

| 📞 Phone | – |

First Impression of Fyntura.com

Let’s start by looking at the company’s official website. It’s a typical brokerage site where you can find information about pricing plans, the company’s operations, the trading platform, and other aspects. Fyntura lists its legal address, and an SFSA license, and even mentions its NDD and ECN business model — which is surprising. Most platforms of this kind do not disclose their order execution model. However, that alone does not make the broker trustworthy, as all information must be verified.

The website is available only in English. No Russian, Spanish, Arabic — nothing. Yet any self-respecting broker working internationally translates their website into at least 3–5 major languages.

The images of cryptocurrency icons (Bitcoin, Ethereum, Solana) are drawn in a strange, amateurish style, as if they were hastily made. Some images on the Fyntura site are reused. The same monitor displaying a Metatrader 4 chart appears in multiple blocks — just rotated at different angles.

One more thing: all of the company’s claimed advantages are written in emotional language — “superior liquidity”, “fantastic conditions”, and “trustworthy broker”, but with no evidence to back them up. There are even grammar errors, such as missing spaces. For example, in the “About Us” section where Fyntura lists trading assets, there’s a mistake: “including indices, commodities andCryptocurrencies”. The image of a man in glasses looking at a monitor is also one we’ve seen many times on other forex broker sites.

Partnership and Bonuses

Fyntura promises a 100% bonus on deposits starting from $100, up to a maximum of $50,000. The website claims: “No restrictions on withdrawing profits”, but the terms say otherwise. For example, if you withdraw part of your funds, a portion of the bonus is burned proportionally. The company also reserves the right to cancel the bonus at any time without explanation. The reasons could be anything — “abuse of conditions”, “unacceptable strategy”, or “earning too fast”. In other words, if you want to trade, be prepared for your money to turn into thin air at any moment. All bonuses are non-withdrawable.

As for the partnership program — it’s a typical IB (Introducing Broker) model. For each referred trader, you’re promised at least 40% of the commission, plus an additional 10% from your sub-partner’s earnings. The site is filled with phrases like “passive income”, “bonuses for bloggers”, and “a program for those with strong traffic”. However, Fyntura’s real goal is clear — to lure in as many referrals as possible who will deposit funds.

Account Opening on Fyntura.com

Let’s try registering an account here. It takes just a couple of minutes. The first step involves filling out a standard form: first name, last name, email, phone number, country, and password. Fyntura requires a password between 7 and 10 characters long, including a number, an uppercase letter, and a special character. After submitting the form, a verification window appears. A one-time six-digit code is sent to your email, which must be entered to activate the profile.

Even here, the text contains typos. For example, in the password requirements, the word “atleast” is written as one word — a basic spelling error.

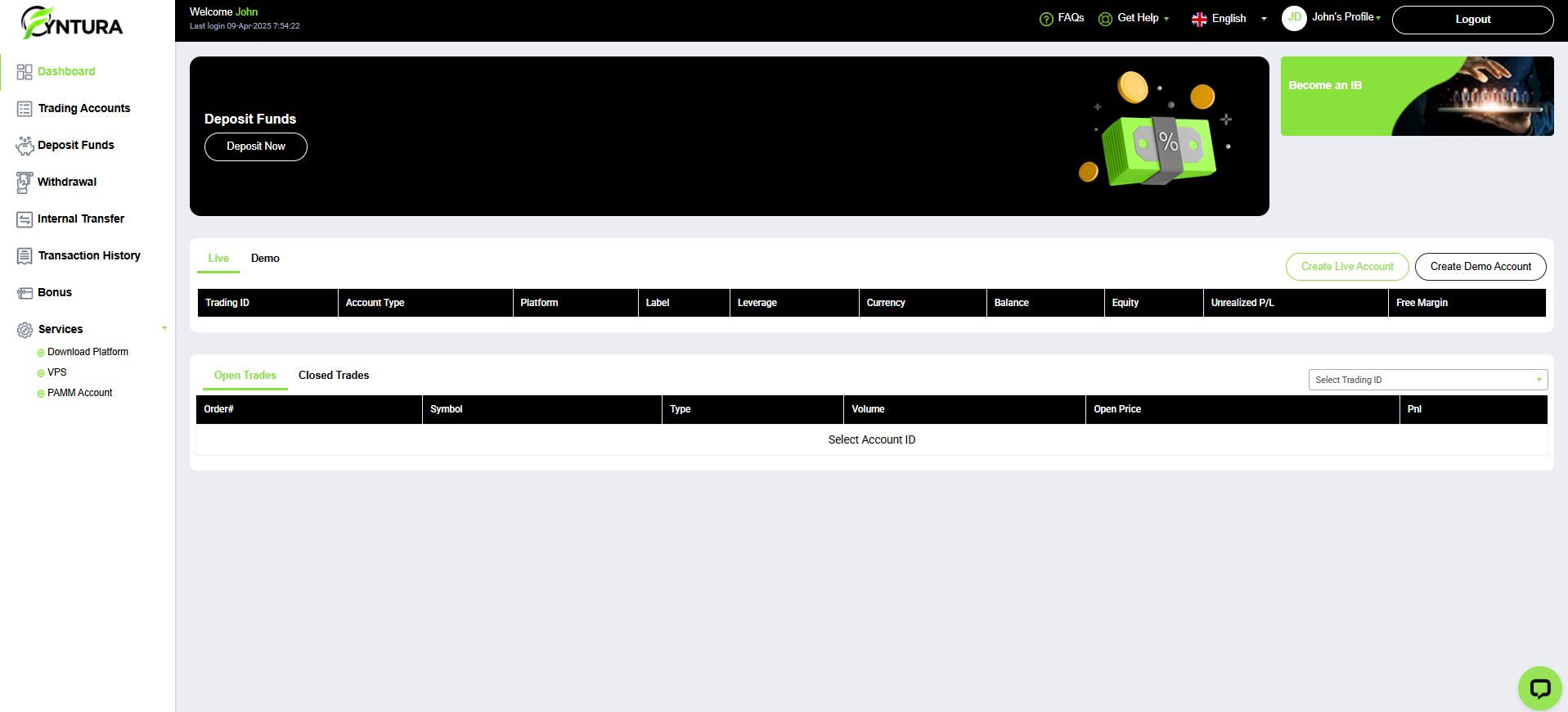

The Fyntura personal account dashboard looks like a typical admin panel from a pre-made template. On the left is the menu: account creation, deposits, withdrawals, transaction history, internal transfers, bonuses, platform download, VPS, and even PAMM accounts. The main screen displays the account status: ID, account type, platform, leverage, balance, and margin. There’s also the option to open a demo account.

Verification

There is no information about identity verification at Fyntura. The personal cabinet lacks a dedicated section for uploading documents, and there is no “Verification” or “KYC Documents” tab.

It’s also worth noting that the broker has not provided an AML & KYC policy document, which is mandatory for any financial firm dealing with client funds. Neither in the “Terms of Use” section nor in the website footer is there any mention of client verification, anti-money laundering policy (AML), source of funds, or anything of the sort. Not even a formal reference. This is a blatant violation of both financial ethics and the international standards set by the FATF.

Any company handling other people’s money, including Fyntura, is obligated to know who its clients are. This is a basic regulatory requirement. If there is no KYC, then there is definitely no license, but we will discuss regulation later on.

- Not found.

- There is no information about identity verification, but it is a mandatory procedure for any legitimate financial company.

Trading Software

Fyntura uses the MetaTrader 4 platform as its trading terminal. This is one of the most well-known and widely used software solutions in forex trading. Many brokers rely on this platform. We will not go into detail about its features and functionality, as there are plenty of guides, articles, and videos available online. We’ll simply add that the platform is accessible on all devices: mobile phones, web version, and desktop (Windows, Mac, and Linux).

| Features | Fyntura | Bullishcap | London Partners Ltd |

|---|---|---|---|

| Demo Account | ✔️ | ❌ | ❌ |

| Mobile App | ✔️ | ❌ | ❌ |

| Own Development | ❌ | ❌ | ❌ |

How Can I Trade With Fyntura?

The broker claims to provide access to all major classes of financial markets: forex, commodities, metals, indices, cryptocurrencies, and stocks. It also promises fast order execution and 24/5 customer support. There is nothing unique about this — every broker says the same. Let’s take a look at the account types.

All Info About Accounts

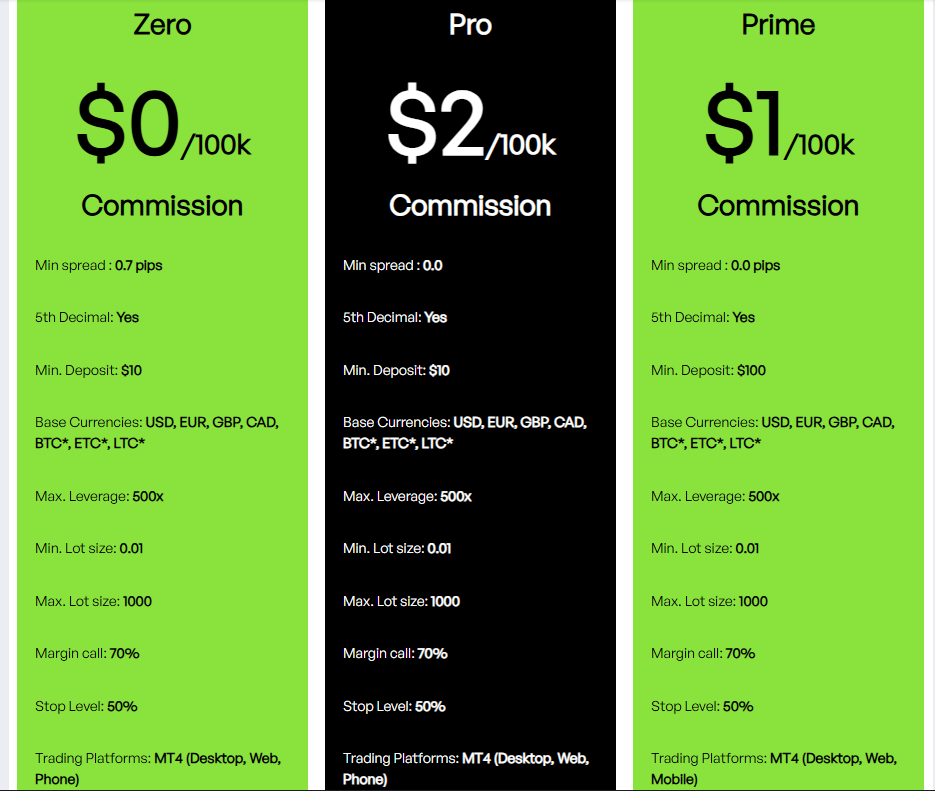

Fyntura offers three account types:

- Zero. This is a commission-free account with spreads starting from 0.7 pips. The minimum deposit is $10; the maximum leverage is 1:500, and the lot size starts from 0.01. Supported deposit currencies include USD, EUR, GBP, CAD, and several cryptocurrencies (BTC, LTC, ETC, etc.). The account runs on the MT4 platform.

- Pro. This is supposedly an ECN account. It advertises spreads from 0.0 pips, with a commission of $2 per $100,000 in volume. The deposit starts from $10, with the same currencies and conditions as the Zero account.

- Prime. This plan looks like an odd mix: zero Bid/Ask, a $1 commission per $100,000, but with a minimum deposit of $100. Essentially, it’s just an “improved version” of the Pro account due to the lower commission — but the logic behind it is unclear. If you offer better conditions, why not provide them from the very first account type? It seems to be a marketing trick: showing a “discount” to attract larger clients.

And now the key point — nowhere does it say who the liquidity provider is, how the spreads are formed, where orders are executed, or whether there is slippage protection. Just three columns with numbers and loud marketing claims. Serious brokers provide detailed specifications for each account: execution speed, slippage statistics, and market depth. Fyntura merely pretends to be an ECN broker, which it is not.

There are several signs that the broker is lying about being an ECN and in reality operates as a dealing desk, meaning it profits from client losses:

- The commission is too low. The firm charges up to $2 per lot, which is far below the standard. Most genuine ECN brokers charge around $6. With such low commissions and zero spreads, the platform cannot make money.

- Access to interbank liquidity starts at a minimum of $100,000. If you’re being told you can deposit $10 and trade on the “real interbank market”, you’re being deceived. That market only handles large orders — in the millions and hundreds of millions of dollars.

- Leverage up to 1:500 and 100% deposit bonuses — yet another indication that this is not a true ECN environment. Firms with real ECN access usually cap leverage at 1:30 and never offer bonuses that double a trader’s capital.

Based on all of this, we can conclude that Fyntura is lying about the absence of a conflict of interest. The broker’s main goal is to lure in clients with money and then drain them in order to profit.

- Low initial deposit.

- There is a demo account.

- False information about ECN.

- The platform is interested in client losses.

- A huge leverage of 1:500 is a huge risk for traders.

Market Analysis and Education With Fyntura.com

There are no unique additional tools offered here. Fyntura merely provides a calculator for trading position parameters. A PAMM service is also promised, but it is unclear whether there are actually any profitable traders to connect with and copy in order to earn money.

Deposit, Withdrawal, and Fees

The deposit and withdrawal process at Fyntura appears extremely simplified, but that is not a positive sign — it is a red flag. Deposits can only be made via cryptocurrency: Bitcoin, Ethereum, Litecoin, USDT, TUSD, and Dogecoin. There are no bank cards, no payment systems like Skrill, and no bank transfers. This is important: if a broker only accepts anonymous funding methods, it means that in case of problems, it will be impossible to recover funds — not through a bank, not through a chargeback.

The site states that deposits are processed within 30 minutes, while withdrawals may take between 12 and 24 business hours. However, the “Deposit & Withdrawals Policy” notes that this timeframe may be extended if “additional information is required” — without clearly defining what that information is or why it is needed. This gives the company the ability to delay withdrawals indefinitely.

According to the company, there are no fees. And finally, the most critical point — clauses #7 and #8 in the terms and conditions: Fyntura reserves the right to withhold withdrawals if it deems that the trader has “abused the system”. What exactly that means is not disclosed. A user could have simply used arbitrage, made a profit, and left — and Fyntura could have labeled it as “fraud” and blocked the account.

| Features | Fyntura | PanaceaCapitals | Rentalzi |

|---|---|---|---|

| Debit/Credit Cards | ❌ | ✔️ | ✔️ |

| Electronic Payments | ❌ | ✔️ | ❌ |

| Crypto Transfers | ✔️ | ✔️ | ✔️ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ❌ | ❌ | ❌ |

How Can I Contact It?

All questions can theoretically be directed to customer support. Fyntura lists two email addresses and offers an online chat. However, there is no phone number or messaging app contact for some reason.

- There’s online chat and email.

- No phone and no social media.

Is Fyntura Dangerous?

The company appears highly suspicious: it accepts only cryptocurrency, does not require identity verification, and misleads users by calling itself an ECN broker. Next, we need to check how long this platform has existed and whether it has legal registration and licenses.

How Long Does The Broker Work?

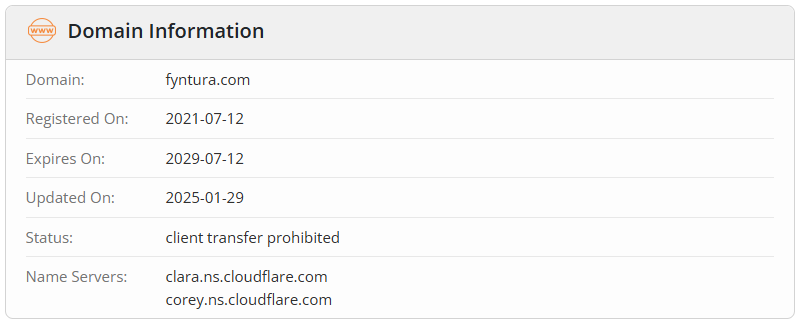

Fyntura does not list its founding date anywhere on the website. Let’s try to determine how long the platform has been around using other indicators. First, the earliest reviews appeared online in early 2024. Second, the domain fyntura.com was registered in 2021, but the WebArchive shows no snapshots for 2021, 2022, or 2023 — only for 2024. This suggests that the broker has been operating for just over a year, which is not very long.

How Is Fyntura Regulated?

The company mentions that it is registered in the Republic of Seychelles under number 186731. This is written in small print in the website footer — and that’s it. There is no mention of a license, no name of a regulatory authority, and no link to a registration entry in any oversight body’s database. In other words, the company is not regulated by any legitimate financial regulator.

The user agreement actually references a different jurisdiction — Saint Vincent and the Grenadines. So where is this company really based? We checked the registries of both Seychelles and Saint Vincent and the Grenadines, and found no trace of Fyntura. In the screenshot below is the SFSA registry, listing all companies starting with the letter “F”. Fyntura is not among them.

Fyntura operates entirely outside the bounds of legal regulation. In the event of fraud, clients will have nowhere to file a complaint. This is an unlicensed broker.

| Features | Fyntura | Geetle | ApexProfits |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ❌ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ❌ | ❌ | ❌ |

How do I verify my identity at Fyntura?

Is Fyntura Legit?

How Risky Is It?

Kevin Berry

Kevin Berry Everything about this company points to its fraudulent nature. You cannot fund your account using bank cards — only cryptocurrency is accepted. Scammers avoid chargebacks by relying on anonymous transfers. The promises of ECN access and low commissions are bait for inexperienced traders. Fyntura cannot route client positions to interbank liquidity because it lacks the most crucial element — a license. Do not trust their claims or fake advantages; it is nothing more than a pathetic attempt to scam you out of your money.

Fyntura rating

2 reviews about Fyntura

I regret trusting the scammers at fyntura.com. I deposited $1K, and when the time came to withdraw my profits, I never received my money. I’ve tried contacting the managers at this fake brokerage, but they ignored me. I fell for their sweet promises of guaranteed security… for nothing.

These scammers cannot even register their fake brokerage platform in an offshore jurisdiction. It is laughable. But the fact that they publish fake reviews about themselves is even more ridiculous. People, do not trust these fraudsters. Their website is filled with nothing but lies and deception.