BNP Groups claims to be a trustworthy global broker, boasting the trust of over a million traders. However, is the reality behind this assertion as solid as it seems, or is it potentially another scam waiting to be uncovered? In our in-depth review, we will closely examine the details.

Table of Contents

Highlights

| 🏛️ Country | UK |

| ⚠️ Regulation | — |

| 🖥️ Website | https://bnpgroups.co.uk/ |

| 🎲 Demo Account | No |

| ⏳ Start Time | 2023 |

| 💲 Minimum Deposit | – |

| ⚖️ Minimum and Maximum Leverage | From 1:100 |

| ⚙️ Trading Platform | WebTrader |

| support@bnpgroups.com | |

| 📞 Phone | +447418359202 |

First Impression of Bnpgroups.co.uk

It seems to us that BNP Groups doesn’t consider its official website as a crucial aspect of its image. Why else would the broker be so neglectful of it? The design is unpretentious, lacking any noteworthy elements, and the menu sections are rather sparse. There is almost no information about the company itself, and the description of trading conditions is quite brief. It takes considerable effort to navigate through the menu and find something valuable. The documentation seems to be limited as well. Could it be that the website is still under construction? Otherwise, it’s challenging to understand why it’s executed in such a lackluster manner.

Partnership and Bonuses

There is no mention of an affiliate program or trader bonuses on the website. It’s possible that the site is not fully developed, so for more precise information regarding the existence or absence of an affiliate program and other loyalty programs, it’s recommended to contact the broker directly.

Account Opening on Bnpgroups.co.uk

The registration process with BNP Groups follows the standard path. You’ll need to fill out a form with personal details, including your phone number and email. Create a strong password, as there is no additional layer of security. BNP Groups doesn’t send verification codes to your email or phone; instead, the broker immediately grants you access to the client portal.

The client portal of BNP Groups leaves much to be desired, displaying only barebones functionality and sporting a rudimentary design. It is strikingly apparent that the portal lacks sophistication and fails to provide traders with essential tools for a comprehensive trading experience. Minimalistic features fall short, offering only the most basic functionalities.

Moreover, the absence of a demo account option on the client portal is a significant drawback. Without the ability to practice trades in a risk-free environment, users are left without a crucial resource for honing their skills and strategies.

Verification

BNP Groups enforces a mandatory verification process for all users, aiming to enhance security and compliance. To initiate verification, users are required to submit identification documents. As always, government-issued photo ID (such as a passport or driver’s license) and proof of address (utility bill or bank statement) are requested.

Following document submission, users must await confirmation from BNP Groups. This step involves the manual review of the provided documents by the platform’s verification team. However, traders are left uninformed about when to expect the completion of the verification process.

- The heightened security the verification process brings.

- Lack of clarity regarding the timeframe for document verification.

Trading Software

BNP Groups offers a web-based trading terminal, eliminating the need for downloadable mobile or desktop applications. While this provides accessibility, the platform, unfortunately, falls short in various aspects.

The web terminal provided by BNP Groups is characterized by its minimalistic approach, lacking several essential features that traders commonly rely on. Key functionalities, such as advanced charting tools, technical indicators, and in-depth market analysis capabilities, are notably absent. Traders accustomed to a comprehensive toolset may find the platform restrictive and inadequate for detailed market assessments.

Another one of the significant drawbacks of the platform is the scarcity of technical indicators.

| Features | BNP Groups | Blantomic | ModMount LTD |

|---|---|---|---|

| Demo Account | ❌ | ❌ | ✔️ |

| Mobile App | ❌ | ❌ | ❌ |

| Own Development | ❌ | ❌ | ✔️ |

How Can I Trade With BNP Groups?

Well, let’s examine whether the broker’s conditions are genuinely as attractive as claimed, considering that over a million traders have allegedly joined this platform.

All Info About Accounts

It appears that BNP Groups promotes the use of a unified account. Nowhere on the website did we find confirmation of the existence of different account types. This implies that traders can immediately open a single live account. Unfortunately, the minimum deposit for this account is not specified. In fact, the platform provides minimal information, offering only a vague description of some instruments. Spreads are not mentioned, and the platform only presents the contract size for each instrument. For all currency pairs, it is set at 100,000 units of currency, with a 1:100 leverage specified for each instrument.

Conducting straightforward mathematical calculations reveals that to open a position of even 0.01 lots, you would need $1,000 in your account, assuming you utilize the 1:100 leverage. This doesn’t sound as advantageous anymore, does it? Additionally, it’s worth noting that such elevated leverage is actually prohibited among British brokers. So, there are certainly some aspects to consider before deeming these conditions as favorable.

- None.

- High minimum deposit.

- High leverage.

- Trading conditions are not described in detail.

Market Analysis and Education With BNP Groups

It seems that the broker doesn’t offer any additional features such as analytics and education. On the website, there are only a couple of articles discussing what forex is and what a forex broker is. Surprisingly, even in the client terminal, there are no additional functions related to analysis and market forecasts. It’s quite unusual that BNP Groups provides such a limited range of services. Currently, they might be still in the early stages of development, and the broker may introduce additional features in the future.

Deposit, Withdrawal, and Fees

BNP Groups offers only a limited number of options for depositing funds. In the client portal, only debit and credit cards are mentioned along with a cryptocurrency wallet. However, upon reviewing the client agreement, we found several interesting details. According to this document, the broker indeed has an account tier system. Furthermore, all accounts below platinum status are subject to a payment commission ranging from 12% to 24.5%. It’s important to note that this commission needs to be paid separately as it won’t be deducted from the account. Unfortunately, withdrawal details, including processing times and associated fees, are still unclear.

| Features | BNP Groups | Kiplar | Spotinvest |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ❌ |

| Electronic Payments | ❌ | ❌ | ❌ |

| Crypto Transfers | ✔️ | ❌ | ❌ |

| Deposit Fee | ✔️ | ❌ | ❌ |

| Withdrawal Fee | ❌ | ❌ | ✔️ |

How Can I Contact It?

You can contact BNP Groups through various channels. Clients have the option to call the provided phone number or send an email. An office address is also given. However, it appears to be more of a nominal address than a physical office, as the working hours are not specified, and it’s unclear if visits are possible.

- Complete contact details.

- No physical office presence.

Is BNP Groups Dangerous?

Well, let’s take a closer look together at the most crucial aspect that concerns us — whether it is safe to trade on this platform.

How Long Does The Broker Work?

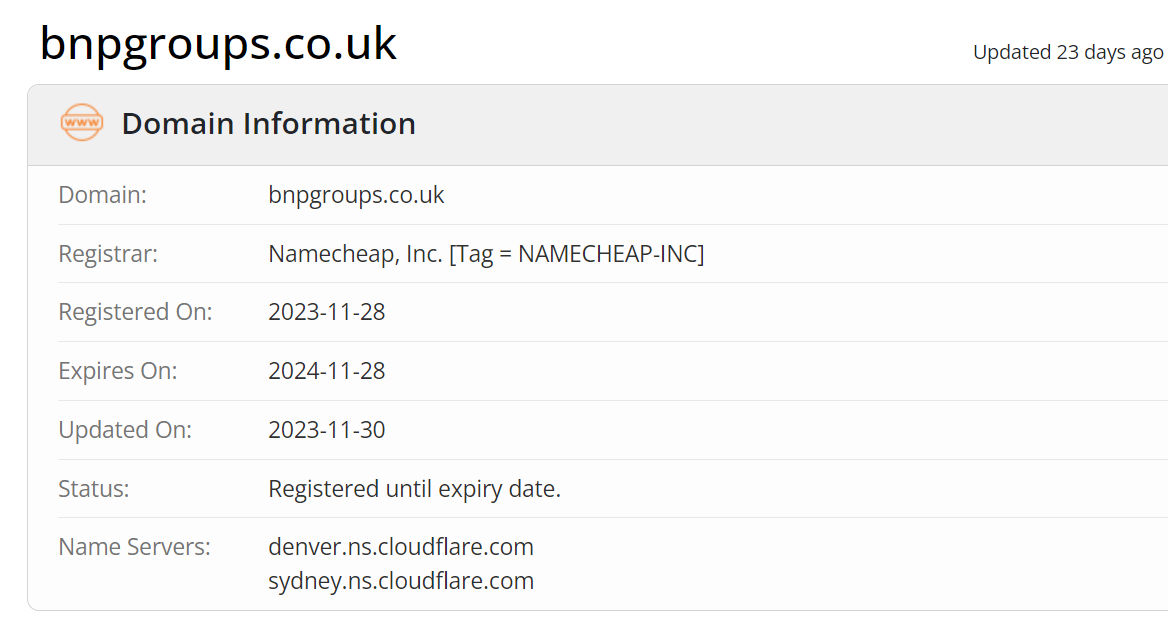

You won’t find any information about the company’s history on the official website. Seriously, they don’t seem eager to elaborate on this topic. However, judging by the self-proclaimed statements, the impression is given that the project has been in operation for a long time. Unfortunately, this impression is shattered when we check the domain. According to the Whois service, the broker’s website was created in 2023, precisely on November 28th. So, can a project that is only a few weeks old realistically be called a global broker?

How Is BNP Groups Regulated?

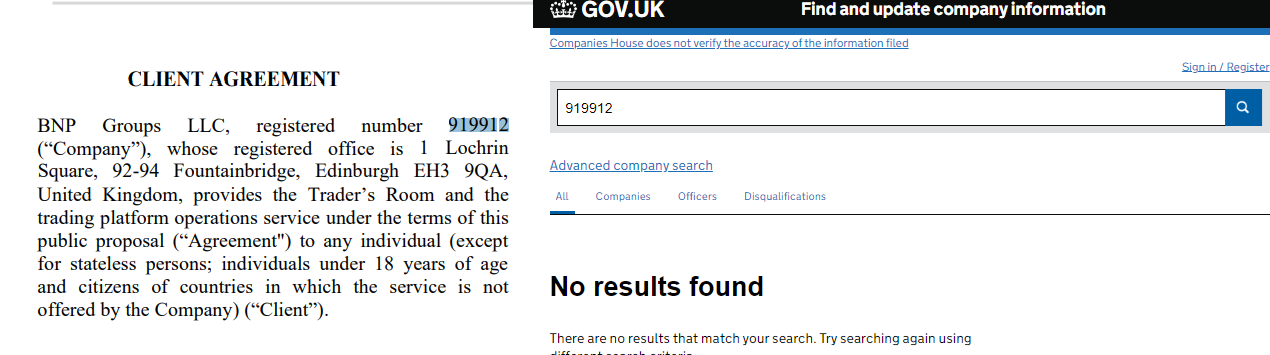

In the company’s trading conditions, it is stated that it is managed by a certain BNP Groups LLC with registration number 919912. They provide an address in the United Kingdom. We checked the registry of this state and found no matches for the registration number. It turns out that this broker is not officially incorporated. Consequently, it couldn’t obtain a license for its operations. There are no records about this firm in the FCA, either. However, this was to be expected since, as we mentioned earlier, leverage up to 1:100 is prohibited by reputable regulators.

| Features | BNP Groups | Xtrader365 | Sollari |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ❌ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ❌ | ❌ | ❌ |

Frequently Asked Questions (FAQ)

How to Trade With BNP Groups?

Is BNP Groups Legit?

How Risky Is It?

Kevin Berry

Kevin Berry Delving deeper into the intricacies of BNP Groups, one cannot overlook the unmistakable attempt to associate itself with BNP Paribas through its name. Nevertheless, a thorough examination of the UK registry reveiled that this broker is a mere shadow of the reputable financial giant, akin to passing off a knockoff as the authentic product. For traders seeking reliability and legitimacy, it’s a red flag waving boldly – a clear indication to steer clear of this imposter.

BNP Groups rating

1 review about BNP Groups

Well, well, well, haven’t seen such nonsense in ages! A reliable global broker operating since November – sign me up! But on a serious note, when will these scammers be shown the door? It feels like everyone and their grandma is trying their hand at this scamming game. All it takes is setting up a shady website, a bit of ad spending, and buying a list for potential victims. The legend they’ve come up with here is laughable; you could expose it in five minutes flat. In short, look for legitimate forex brokers, and steer clear of BNP Groups. It’s not even a forex broker; it’s a sorry excuse for a CFD. In other words, it doesn’t execute trades on the interbank market, and you’ll be dealing with a conflict of interest here. Who needs that? Certainly not anyone with a shred of common sense.