FinBitPro calls itself a company that values its customers, who, according to the description on the official website, already number more than 150,000. This is a broker that has been operating for 21 years, but there is no evidence to support this claim. Although the firm indicates that it is regulated, it does not provide the names of any regulatory bodies. Meanwhile, its offices are located in Switzerland and Canada. Reviews about the organization on the internet are rare, and although they can also be seen on the site, trusting them completely is not recommended. Moreover, the platform boasts 18 awards and more than 2,000 experts working on its staff. In general, all this requires thorough verification to determine whether it is a scam or not.

Table of Contents

Highlights

| 🏛️ Country | Switzerland, Canada |

| ⚠️ Regulation | – |

| 🖥️ Website | https://www.finbitpro.com/ |

| 🎲 Demo Account | No |

| ⏳ Start Time | 2023 |

| 💲 Minimum Deposit | $10,000 |

| ⚖️ Minimum and Maximum Leverage | 1:1500 |

| ⚙️ Trading Platform | WebTrader |

| support@finbitpro.net | |

| 📞 Phone | +447451289267 |

First Impression of Finbitpro.com

The official website is neatly done. FinBitPro followed a standard approach in creating their brokerage resource. At the top, there’s a panel with the main sections where almost all the information about the company and its trading conditions can be studied:

- About us. Info about the broker, PAMM, and partnership.

- Trading. Platform, conditions, commission, and education resources.

- Markets. Tradable assets.

- Account types.

The homepage consists of blocks describing the possibilities, some conditions, advantages, and so on. For the most part, the text is meaningless, for example, FinBitPro states “Strong and transparent”, but does not provide any confirmations or explanations. The same can be said about regulation, which is mentioned, but there are no specific names of financial commissions.

The site is only translated into German, contacts and addresses are available in the footer, but there’s no classic risk warning. A user agreement is also missing. Among similar documents, FinBitPro only provides a privacy policy and a deposit/withdrawal policy.

Partnership and Bonuses

FinBitPro has an affiliate program, which is presented in two options:

- Introducers. Revenue share up to 50%. The broker highlights the following advantages of this affiliate program: competitive fee model, customized strategies, and marketing assistance. Suitable for traders, coaches, private and corporate introducers.

- Affiliates. CPA up to $800. For blog and website owners, media buyers, email marketers, and influencers. Advantages include: an affordable flat charge model, options for flexible payments, and continuous performance evaluation.

Additionally, FinBitPro offers bonuses for deposit replenishment. However, it’s important to remember the conditions that must be met to withdraw these funds. Clients will have to achieve a trading turnover equal to the sum of the deposit and bonuses multiplied by 25. For example, if the deposit is $1,000 and the bonuses are $200, then the trader must achieve a turnover of $30,000. However, it’s not specified whether this turnover is in dollars or lots.

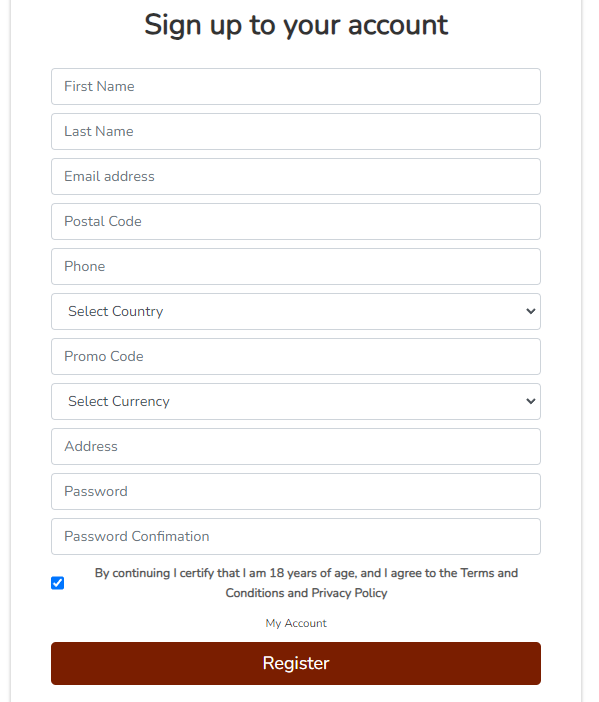

Account Opening on Finbitpro.com

The official website provides instructions on how to start collaborating with FinBitPro:

- Registration is within minutes.

- Identity verification.

- Deposit replenishment.

There is no mention of a demo account or training with virtual dollars, which presumably means such an option is not available. The registration process at FinBitPro is no different than other companies. Here, users must also provide their name, contact details, promo code (if available), address, password, and currency. It is also mandatory to agree to the terms and conditions and privacy policy. However, while the privacy policy is accessible in the footer, the document outlining the user terms is missing. How can one agree to something they are unaware of?

Next, the interface of the personal account opens. It looks as if its creation was abandoned halfway and not completed. The perfectionist’s eye will definitely twitch after seeing it.

Users can perform operations such as depositing funds, requesting withdrawals, and changing their personal information. A demo account was not found. Moreover, it should be noted that FinBitPro’s personal account is poorly optimized. Sections load very slowly, and navigation is quite complicated.

Verification

We’ve already mentioned the step-by-step instructions on how to start collaborating with the company, taken from the main page of the official website, with identity verification as the second step. Therefore, it can be assumed that FinBitPro mandatorily requires all clients to upload documents for KYC.

The document upload functionality is located in the “Profile” section of the client portal. Although an AML&KYC policy is missing and specific types of documents are not described, judging by the personal account, FinBitPro requires standard documents: proof of address, identity verification, deposit declaration, SWIFT, and a photo of the bank card.

- None.

- No KYC policy.

- The broker requires a lot of documentation.

Trading Software

FinBitPro claims its platform is proprietary. The terminal supports not only a computer version but also mobile applications. At the same time, the broker highlights the main advantages of the platform: indicators and tools for graphical and technical analysis, fast order execution in less than 0.05 seconds, and an easy-to-use interface.

Unfortunately, we cannot see what the platform actually looks like and what capabilities it truly has. The reason is that it’s unknown how to access WebTrader. Usually, there is a button in the personal account for transitioning to the platform, but we couldn’t find one at FinBitPro. Moreover, no links to download the terminal on smartphones. Therefore, there’s no choice but to trust what the company says about its platform.

| Features | FinBitPro | Lovacrypto | BitPlus Capital |

|---|---|---|---|

| Demo Account | ❌ | ✔️ | ❌ |

| Mobile App | ✔️ | ❌ | ❌ |

| Own Development | ✔️ | ❌ | ✔️ |

How Can I Trade With FinBitPro?

The broker provides access to more than 800 financial instruments, including forex, metals, commodities, cryptocurrencies, indices, and stocks. The minimum deposit is $10,000. This figure depends on the specific tariff plan, which we will examine in more detail later.

All Info About Accounts

FinBitPro offers five types of trading accounts:

- Basic. The minimum deposit is $10,000. Owners of this tariff receive only two additional services: assistance from a personal manager and basic-level training lessons.

- Silver. From $25,000. Adds personalized alerts, risk-free trades, and practical guided trading sessions.

- Gold. From $100,000. The same opportunities, but with increased leverage.

- Platinum. Not less than $250,000. Exclusive access to our VIP trading signals telegram channel and risk management strategies.

- Black. To be clarified with managers.

The requirements for the initial deposit are simply astonishing. Such an approach cannot be called client-oriented, because the amount is too high. And it’s impossible not to note FinBitPro’s intention to extract as much money from the client as possible. After all, the range of tariff plans is based on the principle of “pay more – get more”.

Besides trading accounts, the broker offers an investment tariff, which allows clients to earn 8.25% monthly. Unfortunately, detailed information about such a service is missing. It’s unclear where FinBitPro gets such high percentages, but it’s stated that this is a Crypto Savings Account. So, there’s a scent of a financial pyramid (HYIP).

If we believe the official website, the company offers spreads from 0.1 points, which is quite advantageous. Commissions are $30 per $1 million turnover for Forex and metals, 0.1% for cryptocurrencies, and 0% for stocks.

Special attention should be paid to leverage. On the main page, it is indicated at x1500 – which is quite a lot. For comparison, many serious regulators prohibit brokers from offering leverage higher than x30-x50, but here it is x1500. Finally, the absence of an Islamic account, as well as a demo, is also a clear minus.

- Not found.

- Very high minimum deposit.

- Inadequate leverage.

Market Analysis and Education With Finbitpro.com

On the main page of the FinBitPro site, you can find a table with current quotes, educational information about the traded asset classes, and articles on “what are CFD and Forex trading”.

In addition, the firm offers an additional service of copying transactions. Clients can open PAMM/MAM accounts by applying via email.

Deposit, Withdrawal, and Fees

The deposit balance can be replenished using bank wire transfers, e-wallets, and credit/debit cards. Withdrawals are made using the same methods, with a commission ranging from $25 to $50 depending on the method. Also, remember that when withdrawing money from an account where 200 lots of turnover were not executed, FinBitPro charges 10%. The same applies to unverified accounts. Processing time for requests takes up to 4-7 days.

| Features | FinBitPro | Kane LPI Solutions Limited | RippelCapital |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ✔️ |

| Electronic Payments | ✔️ | ❌ | ❌ |

| Crypto Transfers | ❌ | ✔️ | ❌ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ✔️ | ❌ | ✔️ |

How Can I Contact It?

Users can try to contact the managers by phone or email. However, they are unlikely to get a response. Why? Because FinBitPro provides fake contact details. We checked the email, and it turned out to be non-existent.

There are no other ways to contact FinBitPro representatives. The firm could create an online chat or manage accounts on social networks where subscribers could turn to get some information. However, this is not the case.

- Not found.

- The email is fake.

- No online chat and no account on social media.

Is FinBitPro Dangerous?

As practice shows, brokers that require a high minimum deposit and do not offer a demo account are often found to be fraudulent and illegal. Moreover, fake contacts directly hint that we are dealing with another representative of a fraudulent organization. What remains is to check when FinBitPro started operating and whether it has any licenses.

How Long Does The Broker Work?

For any brokerage firm, the length of operation is important. Traders have more trust in a company that has been on the market for a long time and has a positive reputation. Despite confident statements about 21 years of experience, we suspect this is not the case. Why then was the domain of the official website only registered in 2023, and in December, at the very end of the year? Why are there so few reviews on the internet? A broker with 20 years of experience and 150,000 clients should have many comments. Therefore, FinBitPro blatantly lies about its duration of operation, especially since there is no evidence.

How Is FinBitPro Regulated?

Now, let’s consider the last but most important point – regulation. The website footer mentions Canada and Switzerland. Therefore, it is there that we will look for FinBitPro’s regulation.

Neither in IIROC nor in FINMA was such a broker found. Although the firm claims to have licenses, in reality, this is a lie.

We also decided to check if FinBitPro is actually located at the addresses provided. It turns out that in Switzerland, a company with such a name is not registered. Either the name is incorrect, or the firm does not exist. We think it’s the latter.

| Features | FinBitPro | Partners Special Capital Limited | Algexia |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ❌ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ❌ | ❌ | ❌ |

Frequently Asked Questions (FAQ)

Kevin Berry

Kevin Berry Absolutely all facts and data that can be found on the site are fake. What is this, if not direct evidence of fraudulent activity? How beautifully they lie: “21 years of experience”. Yes, yes, of course, while reviews on the internet can be counted on the fingers of one hand. They even provided addresses in Switzerland and Canada, which are easily checkable. Meanwhile, legal documents are missing. And as for the license? FinBitPro boldly talks about itself as a regulated broker, but in reality, there is no license here. Instead, there is illegal activity and a guarantee of scam. Therefore, fellow traders, do not fall for the blatant nonsense, and cooperate only with real brokerage organizations.

FinBitPro rating

1 review about FinBitPro

I cannot say anything positive because I lost $15,000 at finbitpro. I don’t know how it happened, but the firm turned out to be illegal. And all the information on the website is fictional. They are not withdrawing my money. I have already calmed down and accepted the loss. I was lucky that these were not my last funds.