Prime-CC has positioned itself at the forefront of forex brokers, offering an exciting journey named trading on its platform, boasting an abundance of advantages in the form of advanced tools and educational resources. This sounds very pompous and exaggerated. At the same time, curiously, this top-1 broker intermediary lacks a license, conceals its founding date, and does not provide a legal address. How so? And why are there so few reviews on the internet about the organization? In short, one can say anything they like, but evidence also needs to be provided. We will examine the company to find out whether it can be trusted or if it is a typical scam.

Table of Contents

Highlights

| 🏛️ Country | St. Vincent and the Grenadines |

| ⚠️ Regulation | – |

| 🖥️ Website | https://prime-cc.com/ |

| 🎲 Demo Account | No |

| ⏳ Start Time | 2023 |

| 💲 Minimum Deposit | $250 |

| ⚖️ Minimum and Maximum Leverage | 1:400 |

| ⚙️ Trading Platform | WebTrader |

| support@prime-cc.com | |

| 📞 Phone | – |

First Impression of Prime-cc.com

Instead of the usual top panel with basic information about the firm’s conditions and activities, we see a pop-up menu on the right side of the website. The decision is interesting but inconvenient. Prime-CC introduces us to its trading platform, account types, additional features, and contacts. However, the broker reveals nothing about itself. In general, the official website looks unfinished regarding specifics and useful text.

The theme of ancient architecture is mixed with modern technologies. There are also clichéd images taken from free photo stocks, depicting skyscrapers and people intensely discussing something, perhaps investment ideas.

On the site, one can find reviews that are clearly written by fictional characters. Prime-CC uses complex motivational and philosophical phrases to highlight its advantages and merits, and to motivate visitors to open a brokerage account more quickly. Overall, the resource can be characterized as formulaic and standard.

Partnership and Bonuses

For inviting new clients, Prime-CC pays a reward in the form of 10% of the deposit of the invited trader. The maximum earnings are limited to $25,000 for a single referral. In addition, the invited friend receives a 5% bonus on their deposit. However, it should be noted that the rewards received are bonuses, so certain rules for their utilization need to be kept in mind.

A bonus can be activated upon depositing funds. The amount of bonus funds is not specified, but for them to be available for withdrawal, the user must make a turnover exceeding the bonus amount by 50,000 times. Attempting to withdraw more than 20% of the deposit results in the burning of the bonus capital and the profit earned. Such conditions from Prime-CC cannot be considered favorable and loyal. Attracting new traders becomes less attractive.

Account Opening on Prime-cc.com

To study the broker in more detail, an account needs to be created. This procedure at Prime-CC is quick and simple. Just provide your name, contact details, and password, agree to the terms, and confirm that the trader is not a resident of the USA.

However, we were mistaken about the quick registration, because after entering all the data, a request is sent to technical support, which must review it. How long the review will take, how representatives will contact the client, and why this is necessary at all is unknown and unclear. This approach is often observed in illegal companies. Will Prime-CC be an exception? We’ll find out further.

It is worth noting one significant drawback. The firm does not have a demo account. At least, we did not find such an option.

Verification

In order to get permission to use the broker’s services, traders must undergo identity verification. It is not enough to just provide information about oneself; the required documents need to be uploaded. Prime-CC asks for two documents to be provided:

- Passport, driver’s license, or any other document confirming the user’s identity.

- Color copy of a valid utility bill as proof of current address. The document must not be older than 6 months.

Additionally, if the deposit is made using a credit/debit card, it needs to be verified. The photo must show the first 6 and the last 4 digits of the card number, the cardholder’s name, and the expiration date. Other data, including the CVV, must be concealed.

- None.

- Without verification, you can’t try the company’s service.

- The firm requires a lot of documents.

Trading Software

The Prime-CC trading terminal is nothing serious. It is a Webtrader lacking most of the advantages, accessible through any browser. However, mobile applications and desktop versions have not been developed, only a web version. Do such serious shortcomings of the platform need to be commented on? A web platform cannot be considered comprehensive software for successful and serious trading.

Only beginners might find this terminal suitable, and that too temporarily, as once a trader gains experience and knowledge, they will realize that the platform lacks tools and options. Prime-CC offers a primitive webtrader, where only technical analysis, a few timeframes, and graphical elements with indicators are available. Many advanced functions are not accessible. For example, this includes auto-trading, copy-trading, and custom platform settings.

| Features | Prime-CC | Gainful Markets | Legends Financial Company |

|---|---|---|---|

| Demo Account | ❌ | ❌ | ❌ |

| Mobile App | ❌ | ❌ | ❌ |

| Own Development | ❌ | ❌ | ❌ |

How Can I Trade With Prime-CC?

Next, we will take a detailed look at the tariff plans, as they determine the conditions and the set of additional features.

All Info About Accounts

So, Prime-CC offers 6 types of accounts:

- Self Managed. Requires a balance of $250. This tariff is more intended for beginners who need training. Here, the broker provides instructions on using cryptocurrency wallets and the platform, as well as electronic books.

- Basic. The minimum deposit is $5,000. In addition to the previous account type, it includes assistance from a senior personal manager, video lessons, leverage up to 1:100 (what was the leverage in “Self Managed”?), spreads from 1.6 pips (the same question – what spreads are offered in the first rate), and tier-1 arbitrage.

- Innovative. At least $10,000. Priority in fund withdrawals, analytical sessions, trade room analysis, leverage up to 1:200, spreads from 1.5 pips, and tier-2 arbitrage.

- Main. From $25,000. More advanced trading tools, weekly webinars, and other more favorable conditions.

- Exclusive. From $50,000. Webinars offered daily, VIP events, the most prioritized level of fund withdrawal, zero spreads, and leverage up to 1:400.

- VIP. Invitations to exclusive VIP events, custom-tailored premium conditions, and one-on-one trading sessions with senior analysts.

Why do companies like to set a minimum deposit of $250? Moreover, such firms often turn out to be fraudulent. Maybe it’s some kind of magic number, or what’s the real reason behind it? Additionally, the leverage of 1:400, which is against all rules and regulations, catches attention. If Prime-CC had a license, regulators would hardly allow offering such a high leverage.

The first tariff is nowhere near the second, yet the trading conditions are unknown. What spreads and what leverage can owners of “Self Managed” accounts trade with? And what are the platform’s commissions? Such important parameters, but not specified.

Essential options like a demo, Islamic account, or cent tariff are missing. Moreover, there is no ECN, meaning Prime-CC operates as a dealing desk. Therefore, it should not be surprising if the firm starts acting against traders, as it is profitable for them; they do not earn on commissions and spreads, their profit is the money lost by users in trading.

- None.

- No demo, ECN, and swap-free.

- Commissions are not marked.

Market Analysis and Education With Prime-cc.com

In Prime-CC, there is a small educational section that includes electronic books, a glossary, an asset index, and an FAQ. Besides, the broker offers basic educational materials on cryptocurrency and blockchain, but at the time of writing this review, this section is empty, as is the news from finance and economics. The service of ordering a debit card seems interesting, but the issuer is not specified, nor are the terms of acquisition. The card is available only to holders of Innovate tariffs and above.

Deposit, Withdrawal, and Fees

The firm supports several ways of transferring money. In the footer of the website, symbols of cryptocurrencies are indicated: Bitcoin, Ethereum, Litecoin, and Tether. In the FAQ section, credit/debit cards, electronic payment systems, and interbank transfers are mentioned. Prime-CC has set a minimum withdrawal amount at $100 with a commission of 1%, but not less than $30 and not more than $300.

Processing of withdrawal requests takes a long time – up to 7-10 business days. Why such a long processing time is not quite clear to us, as many other brokerage firms complete it in no more than 1-2 business days.

| Features | Prime-CC | General Trust Group | CauvoCapital |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ✔️ |

| Electronic Payments | ✔️ | ❌ | ❌ |

| Crypto Transfers | ✔️ | ❌ | ✔️ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ✔️ | ❌ | ❌ |

How Can I Contact It?

It’s amusing to see how in the FAQ, Prime-CC states: “You can contact us via email, phone, or the live chat button”. However, in reality, there is only email, and both phone and online chat are missing. Moreover, it is unlikely that you will get a response via email because it is fake. And how can one actually get in touch with the employees?

- None.

- The email is fake.

Is Prime-CC Dangerous?

Not only is the company maximally opaque and anonymous, hiding important details about itself, but also the trading conditions leave much to be desired. There are many suspicious points hinting at scam activities, especially the latest identified fact of fake contacts. Let’s figure out how long Prime-CC has been in existence and what licenses it possesses.

How Long Does The Broker Work?

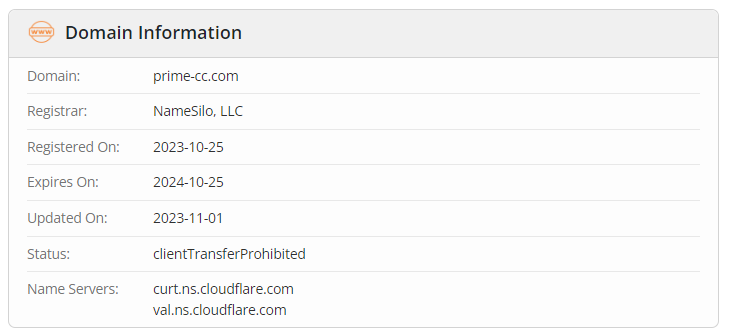

How to find out the date of establishment if the firm hides it? Additional tools are needed. For example, the date of domain registration, as without a website, no online broker can operate. The domain Prime-CC’s website was registered on October 25, 2023. This happened quite recently. Moreover, the number of reviews on the internet can be counted on the fingers of one hand, meaning the platform was launched very recently.

How Is Prime-CC Regulated?

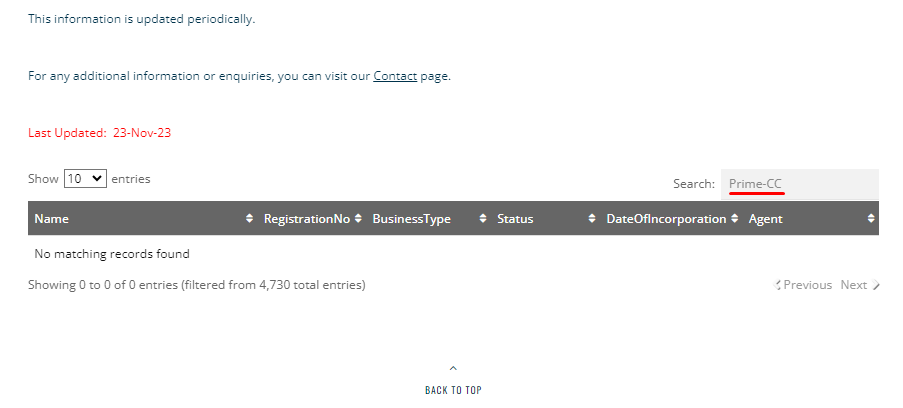

The broker also conceals its legal address and says nothing about regulation. However, in the user agreement, we managed to find a mention of the offshore jurisdiction of Saint Vincent and the Grenadines. This mention in itself doesn’t provide much, as the regulators of this country do not control the activities of forex brokers, so having such a jurisdiction is a serious minus rather than a plus. Out of curiosity, let’s still check if Prime-CC exists in the SVGFSA or not.

The SVGFSA registry is empty. Such a company is not found there, which is not even surprising.

| Features | Prime-CC | Mitrade | Xeodis |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ✔️ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ❌ | ✔️ | ❌ |

Frequently Asked Questions (FAQ)

How to Trade With Prime-CC?

Is Prime-CC Legit?

How Risky Is It?

Kevin Berry

Kevin Berry Somewhere, I have already encountered a similar “antique” broker with the same website design and layout. I don’t remember the name, but it’s not important. In short, Prime-CC is engaged in fraudulent activities, and this should be as obvious as two times two. Not only is there no license, offices, or guarantees, but the organization itself hardly exists in the legal sense. That is, it’s just some ordinary scam website, where a minimum of $250 is requested to trade on financial markets. It is unsafe and unprofitable here, and there are no reviews on the internet. Nobody knows about the company. Can such a pseudo-broker be trusted with money? Obviously not.

Prime-CC rating

1 review about Prime-CC

Hello. Prime-cc are scammers. Do you know why? Because I once made a mistake and chose the wrong broker. That scambroker, who eventually scammed me out of money, had exactly the same website, similar conditions, also offered a debit card, and several types of accounts with VIP. I lost $5,000 then, so I know what I’m talking about.

If you don’t want to give your money to some anonymous scammers and fraudsters, then don’t even think of trading here. It’s some group of fraudsters, creating identical websites to scam people out of money. Pure fraud. Here, there’s fake trading and the platform, so don’t believe them.