The little-known broker SmartSTP (ex-Equiity) with an average online reviews rating of 4.2 points promises to stand behind its clients as they trade in the financial markets. The former name simultaneously arouses interest and bewilderment. Couldn’t they have chosen another name for the brand, why use a worn-out word and deliberately make a spelling error? And yet the company offers qualified support, solid spreads, and modern trading tools, and also indicates regulation from FSC Mauritius, in whose jurisdiction it is registered. Not a very strict regulation, so a detailed investigation is necessary.

Table of Contents

Highlights

| 🏛️ Country | Mauritius |

| ⚠️ Regulation | MFSC |

| 🖥️ Website | https://www.smartstp.com/ |

| 🎲 Demo Account | Yes |

| ⏳ Start Time | 2022 |

| 💲 Minimum Deposit | $250 |

| ⚖️ Minimum and Maximum Leverage | 1:200 |

| ⚙️ Trading Platform | WebTrader |

| support@smartstp.com | |

| 📞 Phone | 41615083132, 97145429107 |

First Impression of Smartstp.com

The official website of the broker introduces us to the conditions and activities of the company, but not completely, as many details are missing, for example, the period of operation or the business model. The top panel is standard, visitors can explore the following aspects:

- About us.

- Markets.

- Trading platform.

- Account types.

- Legal documents.

- Contacts.

The design and layout are not done according to a template, but with a touch of uniqueness. There are insertions of images, predominantly of women and charts on laptop and computer screens. The footer contains legal addresses and a standard warning about risks. Overall, we did not find anything critically negative about the SmartSTP website, but we cannot praise it either. A typical brokerage resource with an interesting design but lacking important information about the company’s activities.

Partnership and Bonuses

Neither an affiliate program nor bonus promotions are presented in SmartSTP. Although at least a referral program would be nice to see. After all, it’s a good tool for additional income for traders and for attracting new clients to the company. Strangely, there is no affiliate program here.

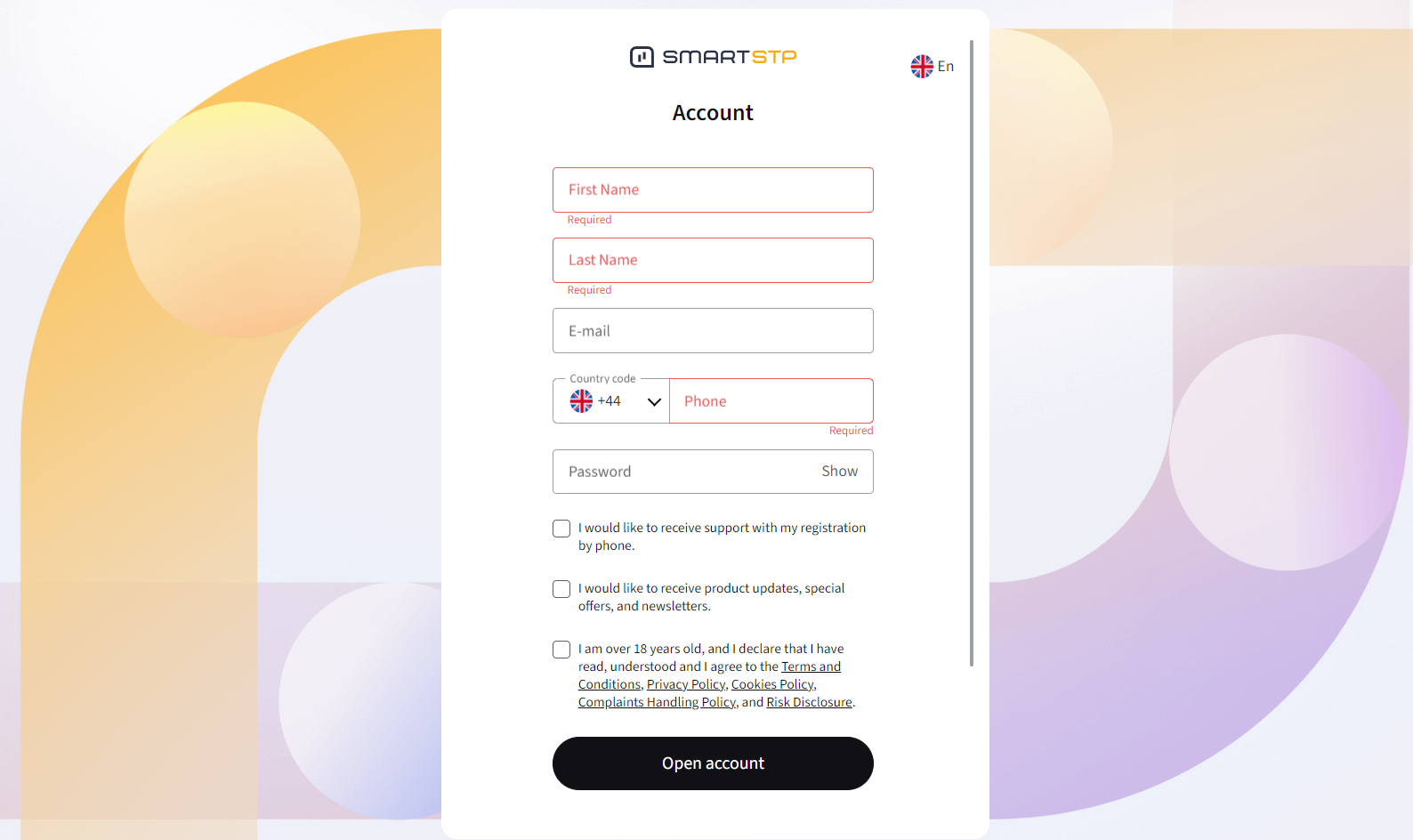

Account Opening on Smartstp.com

Before studying the interface of the personal cabinet and platform, you need to register. The first stage of registration in SmartSTP includes providing your name, contacts, and password, and agreeing to the terms of all legal documents. The second stage is adding information about your address of residence and date of birth. Next, you need to answer 12 questions about income, capital in USD, the main source of income, education, goals, and trading experience in the financial markets. The fourth step involves immediately depositing funds, but this can be postponed. And finally, identity verification.

The process of creating a personal account turned out to be very lengthy, which may deter a potential client. After all the steps, the client portal opens, which includes the trading platform. You can immediately start testing the service on a demo account for a virtual 10,000 euros. SmartSTP’s decision to combine the personal cabinet and platform can hardly be called successful. It is not that safe and quite inconvenient.

The account management panel is located to the left of the terminal. Users can view current accounts and their balances, deposit and withdraw money, upload documents for KYC, submit requests to technical support, download statements, and edit personal data. Overall, everything is standard and clear.

Verification

Verification is a mandatory process, and if it is skipped at the time of registration, the broker recommends not doing so, but uploading documents for KYC immediately. SmartSTP requires two types of documents: proof of identity and address of residence. In addition, you need to provide confirmation of a bank card if it is used for money transfer.

The document dedicated to the AML & KYC policy is missing. It is also unknown how long the document verification will take.

- It is convenient to upload documents.

- There is no document with the AML & KYC policy.

- It is unknown how long the verification will take.

Trading Software

The trading platform at SmartSTP is available as a WebTrader, but the terminal can also be downloaded to a computer. Mobile applications were not found, but possibly the software is adapted for mobile browsers. Clients can use the main tools and options:

- Pending orders, including stop-losses and take-profits.

- Analytical tools: lines, levels, indicators, and other graphic elements.

- News feed.

- Several types of timeframes.

The absence of mobile applications brings some inconvenience for those who prefer to trade on smartphones. We also did not see the possibility of connecting advisors for auto-trading or a copy-trading service. The terminal does not support the uploading of custom indicators, and the number of built-in ones is severely limited. So the functionality is quite poor, and the platform is unlikely to be suitable for serious trading.

| Features | SmartSTP | Exton Global | Fidelis Wealth Management |

|---|---|---|---|

| Demo Account | ✔️ | ❌ | ❌ |

| Mobile App | ❌ | ❌ | ❌ |

| Own Development | ❌ | ❌ | ❌ |

How Can I Trade With SmartSTP?

The firm offers trading in a wide range of assets: commodities, cryptocurrencies, forex (minors, majors, and exotic pairs), indices, metals, and stocks (Europe, UK, and USA).

All Info About Accounts

SmartSTP has developed 3 types of accounts, which differ in swaps and spreads:

- Silver. Spreads from 2.5 pips, qualified technical support, leverage up to 1:200, and account currency USD/EUR.

- Gold. Additionally, there are services of a personal manager, webinars, and educational videos. Discount on swaps and spreads of 25%. The rest of the conditions are the same.

- Platinum. Spreads and swaps are twice as beneficial as in “Gold”, and there are also news alerts.

The minimum deposit is oddly not indicated in the description of account types, but in the user agreement. Moreover, the amount for the initial deposit is $250 – this number is often encountered in illegal brokers. Will SmartSTP be an exception?

Leverage up to 1:200 suggests non-compliance with the rules and requirements of financial regulators. Regulators prohibit offering leverage higher than 1:30-1:50. Spreads are indicated in the contract specifications, but commissions are not.

The minimum transaction volume in SmartSTP is 0.01 lots, which allows managing risks by entering a position with a small volume. The stop-out level is 5%, and the margin call is not indicated. Clients can also activate the swap-free function, in other words, open an Islamic account.

Since commissions are not indicated, and there is no ECN account, it can be assumed that SmartSTP operates on a dealing desk business model. It is a conflict of interest, where the broker does not benefit when traders make a profit, quite the opposite. The company is interested in the losses of its clients, as only in this case will it generate income.

- There is a specification of instruments with current spreads.

- Islamic account and demo.

- Commissions are not indicated, or are absent.

- The business model is a dealing desk with a conflict of interest.

- $250 – high minimum deposit.

Market Analysis and Education With Smartstp.com

Fresh market analysis is absent from the broker, except for small posts on Instagram, which mainly cover significant falls or rises of any financial asset. SmartSTP, apparently, also does not offer educational programs and training courses. There is only a small line with online quotes and basic information about traded market classes. Even an economic calendar is missing. How does the broker compete with popular brokerage companies that create entire educational academies for their clients and analytical centers?

Deposit, Withdrawal, and Fees

By default, the firm offers to deposit funds using a bank card. However, traders can also use bank wire transfers and electronic wallets, such as Skrill and Neteller. SmartSTP does not charge a commission for depositing funds.

Withdrawal requests are processed within 3 days, and then you have to wait another 5-7 days. The size of the commission for this is not indicated.

| Features | SmartSTP | Neotrades | National Trade Center |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ✔️ |

| Electronic Payments | ✔️ | ✔️ | ✔️ |

| Crypto Transfers | ❌ | ✔️ | ✔️ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ❌ | ❌ | ✔️ |

How Can I Contact It?

SmartSTP managers are available in various ways: phone, email, and online chat. In the online chat, responses are fast, within 1 minute, although it is indicated that the average response time is 7 minutes. Looking at the listed phone numbers, one can conclude the geography of clients – the Middle East, as numbers from the UAE, Qatar, Bahrain, Kuwait, Oman, and Saudi Arabia are listed, and Switzerland is also included in this list.

In addition, the broker has accounts on social networks like Facebook, Instagram, Twitter, and LinkedIn. There are few subscribers there, but the content is published regularly, although we will not judge its quality.

- 7 phone numbers are listed and there are accounts on social networks.

- Responses in online chat are fast.

- The only email address.

Is SmartSTP Dangerous?

So far, we cannot be sure of any guaranteed fraud. Overall, the conditions are more or less normal, the platform looks good, and there is mandatory verification, but the leverage made us doubt the legality of the company. Therefore, we must definitely understand the legitimate status of SmartSTP, as well as its operating period.

How Long Does The Broker Work?

The operating period for any brokerage firm is a very important factor in its activities, as the older the firm, the more tested and safe it is. It is worth noting the ignoring of the foundation date on the SmartSTP website, so we will have to look for this information in other ways. First of all, the broker previously operated on a different domain, equiity.com. But don’t think that it started way back in the 2000s.

The small number of Equiity reviews online hints at a relatively short operating period. At the same time, the domain of the official website was registered in 2016, and updated on October 5, 2023. To obtain more detailed data, we need to refer to WebArchive. By reviewing snapshots from the WebArchive, we discovered that in 2021 the domain was up for sale. Social networks only appeared in 2022, so we cannot talk about extensive experience of this project.

Moving on, in 2024, the company announced its rebranding to SmartSTP, citing the uniqueness of its name as a reflection of its commitment to smart technology. Sounds great. But how about the UAE’s Khaleej Times, which published a news story on March 27, 2024, claiming Equiity was a scam? The journalists claimed that MRL Investments, operating under the website equiity.com, had defrauded many people, including celebrities, so the UAE Securities and Commodities Authority (SCA) issued a warning.

Thus, the true reason for the rebranding is more than obvious. As always in such cases, the scammers attempted to clear their reputation and continue their malicious activities under a new name.

How Is SmartSTP Regulated?

The first place where we will look for the company is Mauritius. The legal entity MRL Investments has a license from the FSCM. Indeed, checking the registry of the financial commission showed that the broker was registered in 2022. Okay, but where are the other licenses? From Switzerland, UAE, and other countries? One regulation from an offshore controlling body is not enough, as we can see from the sad example of a broker’s activities in the UAE.

| Features | SmartSTP | FCG Trade | LumineTrade |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ❌ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ✔️ | ❌ | ❌ |

Frequently Asked Questions (FAQ)

How to Trade With SmartSTP?

Is SmartSTP Legit?

How Risky Is It?

Kevin Berry

Kevin Berry I see nothing good and safe about this broker. How will the Mauritian regulator help if SmartSTP refuses to process fund withdrawals? Will it punish the company and return the money, or somehow compensate for the lost deposits? Of course not. If we are to consider specific financial commissions, then only the most serious and strict ones, such as the FCA, FINMA, ASIC, or others. Also, the rebranding due to the exposure of fraudulent activity speaks for itself. There’s your answer on whether you can trust such offshore organizations or not.

SmartSTP rating

2 reviews about SmartSTP

I have been waiting for my money for a week, and the technical support does not want to answer me. I submitted documents for KYC, but they do not confirm them, consequently, the withdrawal of funds does not work. What should I do, does anyone know what to do in such a situation?

Smartstp is an offshore dump that needs to be shut down. Scammers steal money from trusting people without even blushing. This anonymous and fake platform urgently needs to be closed to finally put an end to this fraud. And how they managed to exist for a year, where they got clients from if they can’t even provide guarantees.