The Swiss company Fidelis Wealth Management offers trading on financial markets. Moreover, when you enter their website, you are greeted by a motivating phrase: “It’s time for a Trade.” However, can you trust your money with this broker? It is an important question because there is no evidence of any licenses held by the firm, despite their claim of operating since 2012. Additionally, online reviews raise some concerns with an average rating of 4.3 stars. Nevertheless, could such an organization turn out to be a scam? It’s quite possible. Therefore, our task is to examine the platform and understand what it represents.

Table of Contents

Highlights

| 🏛️ Country | Switzerland |

| ⚠️ Regulation | – |

| 🖥️ Website | https://fwm-lmtd.com/ |

| 🎲 Demo Account | No |

| ⏳ Start Time | 2023 |

| 💲 Minimum Deposit | $5,000 |

| ⚖️ Minimum and Maximum Leverage | 1:1-1:400 |

| ⚙️ Trading Platform | WebTrader |

| support@fwm-lmtd.info | |

| 📞 Phone | +41275087694 |

First Impression of Fwm-lmtd.com

The official website of Fidelis Wealth Management does not inspire enthusiasm or surprise, as it is a typical and templated resource. The company has used a standard template where the main sections with information about their activities and conditions are located at the top of the page, and the homepage lists the platform’s advantages.

Upon entering the site, a man in a suit gives us a thumbs-up, which appears rather comical. Furthermore, on the homepage, you can see an image of a skyscraper, but there is no other graphic design to speak of. The quality of the text on Fidelis Wealth Management leaves much to be desired because it lacks specificity and details, with most of the information providing little to no value.

Partnership and Bonuses

Fidelis Wealth Management offers its clients deposit bonuses ranging from 10% to 20%, but with certain conditions. The trader must fulfill a trading volume equal to the bonus received divided by 4. Additionally, there is a time restriction of 2 months within which this must be accomplished. Until the conditions are met, it is impossible to withdraw the bonus and any profits earned, and trading is only allowed in currency pairs. Such conditions cannot be considered favorable and accommodating, as even experienced users may encounter difficulties in working with bonus funds.

The website of Fidelis Wealth Management does not mention a partnership program, but during the registration of a personal account, you can enter a promo code. What is this if not a partnership program? Why is the broker silent about the terms?

Account Opening on Fwm-lmtd.com

The process of creating a personal cabinet is simple, requiring the provision of personal information:

- First and last name.

- Country of residence and address.

- Email.

- Password.

- Phone number.

- Promo code.

Additionally, Fidelis Wealth Management asks users to agree to the Terms and conditions.

However, creating an account was not possible due to an issue with the promo code. The miracle code turned out to be mandatory for registration, and without it, you cannot create a personal cabinet. Where and how to obtain an invitation remains unknown and unclear. It suggests that Fidelis Wealth Management employs a closed registration system, a characteristic often associated with illegal and fraudulent brokers. Furthermore, it is not possible to try out the service on a demo account, as such a luxury is not offered.

Verification

When making the initial deposit, the client is required to provide additional documents confirming their identity and residential address. In other words, the KYC (Know Your Customer) procedure at Fidelis Wealth Management is mandatory.

Users are required to upload a photo/scan of their passport with their name and signature, a copy of their latest utility bill, and a photo of their bank card, where only the first 6 and last 4 digits on the front side are visible, with the CVV on the back side concealed.

Fidelis Wealth Management does not specify any specific processing times for KYC documents, so one can expect anything in terms of waiting periods. Additionally, there is a noticeable absence of a comprehensive section dedicated to KYC; this process is only superficially described on the website. By the way, we do not recommend hastily uploading documents to a company that has not been thoroughly vetted, as it is uncertain whose hands they will end up in and what will happen to them afterward.

- None.

- Processing times for verification are unspecified.

- The KYC procedure is only superficially described on the website.

- Fidelis Wealth Management requires a photo of a bank card.

Trading Software

The broker claims to offer traders the most advanced platform with applications available for all types of devices. However, it provides no detailed description of the trading terminal and its capabilities. At the same time, we cannot verify in practice how the terminal looks because registration without a promo code is impossible. There is no separate section on the Fidelis Wealth Management website dedicated to the platform.

There is a section on the website titled “download”, where users are offered the option to download MetaTrader 5 to their computer. However, there are a few issues here. Firstly, the link does not lead to the official MetaQuotes website, which owns MetaTrader. Instead, a suspicious .7z file is immediately downloaded, which looks highly questionable. We did not dare to run it, and we do not recommend you do so either, as it may contain dangerous viruses. Secondly, where are the links to download the Android/iOS application? After all, MetaTrader 5 supports smartphones. Thirdly, Fidelis Wealth Management is not found in the list of brokers connected to MT5.

We suspect that the company’s platform is presented as a regular WebTrader with a minimal set of features and options. The mobile application is likely absent, and MetaTrader 5 is mentioned solely for prestige. However, we won’t be able to verify its actual functionality.

| Features | Fidelis Wealth Management | Virgobanc | Graystone Venture Capital |

|---|---|---|---|

| Demo Account | ❌ | ❌ | ❌ |

| Mobile App | ❌ | ❌ | ❌ |

| Own Development | ❌ | ❌ | ❌ |

How Can I Trade With Fidelis Wealth Management?

Clients can trade over 400 assets across various market classes with Fidelis Wealth Management, including forex, metals, indices, commodities, cryptocurrencies, indices, and ETFs. The homepage even mentions financial instruments such as options, futures, and bonds, but it is hard to believe in their actual availability, as this is a CFD broker. The minimum deposit and additional services at Fidelis Wealth Management depend on the chosen pricing plan.

All Info About Accounts

The company offers four types of accounts:

- Classic. The minimum deposit is $5,000. Traders receive assistance from a personal analyst, including private sessions, as well as weekly market research and reviews.

- Silver. Starting from $25,000. It offers the same features as the Classic account, along with the smart money plan, a 10% bonus, and 3 protected trades.

- Gold. Starting from $50,000. On this plan, Fidelis Wealth Management offers clients a direct line to a personal analyst, a long-term trading plan, more protected trades, a bonus of up to 20%, and staking.

- VIP. This account type prioritizes staking and offers a managed account. The minimum deposit threshold is not specified, as you need to contact a manager.

The trading conditions at Fidelis Wealth Management don’t even come close to comparing with the conditions offered by other brokers. For instance, the minimum deposit requirement of $5,000 raises eyebrows, especially considering the absence of a demo account and cent-type accounts where traders could test the service without risk or with small sums that they wouldn’t mind losing. However, the initial deposit amount is too substantial and serious. Such a practice is not seen among well-known and reputable firms.

Details regarding the services of personal analysts, market reviews, and research are not disclosed. What results have analysts achieved historically? What experts are presented here, and can they substantiate their professionalism and experience? What is meant by “staking”? If it refers to cryptocurrency staking, which digital currencies are supported? What commissions await the trader? What about spreads and their types? Where is the contract specification? Why are so many crucial conditions and parameters not disclosed? Fidelis Wealth Management gives the impression of being a super-secretive broker that deliberately keeps users in the dark about the conditions they can expect.

Islamic accounts are also not presented, nor are ECN accounts. There is no mention of STP/NDD/ECN on the website, so it’s easy to guess the company’s business model. Fidelis Wealth Management operates as a dealing desk, meaning there is a conflict of interest, and therefore, it doesn’t make sense for traders to trade here since the organization is not interested in their success and earnings. It is further confirmed by leverage of up to 1:400, which is only available in unregulated organizations.

- None.

- Some unreasonable requirements for the minimum deposit.

- Many options and features are missing, such as demo and Islamic accounts.

- Commissions and spreads are not specified.

Market Analysis and Education With Fwm-lmtd.com

The homepage of the website features a scrolling ticker with current quotes for popular assets. Additionally, the broker mentions various types of services beyond those described in the tariff descriptions, including mutual fund advisory, investment advisory, smart portfolio, and others. However, Fidelis Wealth Management does not provide simple widgets or educational resources.

Deposit, Withdrawal, and Fees

Deposit and withdrawal conditions are hardly described. It is known that Fidelis Wealth Management accepts credit/debit cards for transfers without charging commissions. However, there is no information available regarding other payment methods. This further confirms the company’s maximum secrecy and lack of transparency towards users.

| Features | Fidelis Wealth Management | Legends Financial Company | Lig Broker |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ✔️️ |

| Electronic Payments | ❌ | ✔️ | ❌ |

| Crypto Transfers | ❌ | ✔️ | ❌ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ❌ | ❌ | ✔️️ |

How Can I Contact It?

For contacting broker managers, only two methods are available: phone and email. However, in reality, there is only one method, and it requires additional verification, which is the phone. The reason is that the email provided by Fidelis Wealth Management turned out to be fake, as it does not exist.

Furthermore, it’s worth noting the absence of an online chat as a means of quick communication with managers. There are also no social media accounts.

- None.

- Online chat and social media accounts are absent.

- Fake email.

Is Fidelis Wealth Management Dangerous?

The presence of fake contact information appears highly suspicious. Is it really not possible to create email and social media accounts over the course of 10 years, as indicated on the website? Moreover, unreasonable minimum deposit requirements and hidden conditions are also not positive indicators. Fidelis Wealth Management appears extremely suspicious and dangerous. However, let’s investigate whether the company was indeed founded in 2012 and if it holds any licenses.

How Long Does The Broker Work?

So, the website states that it was founded in 2012, but this claim cannot be trusted, and it’s always essential to verify information. There are some online reviews, but not enough to draw a conclusion about a 10-year history. Instead, it seems like the firm started operating relatively recently. The official website’s domain was registered in August 2023, which reveals the actual period of Fidelis Wealth Management’s operation. The platform was launched in August of 2023.

How Is Fidelis Wealth Management Regulated?

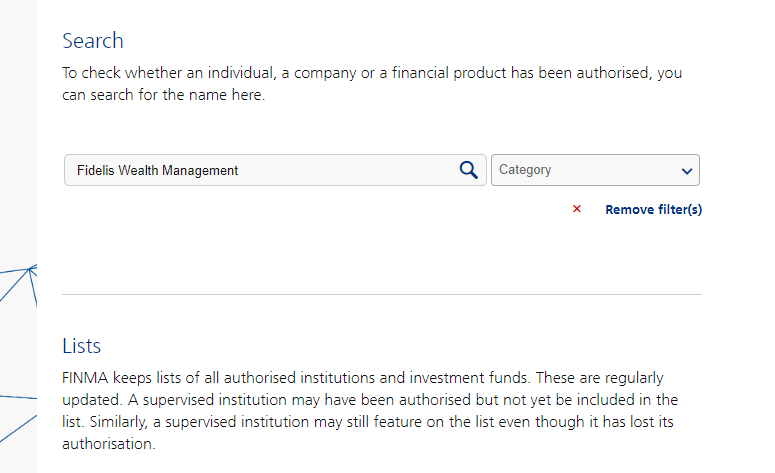

Now, let’s check the regulation. The company mentions its headquarters in Switzerland, where the activities of brokerage intermediaries are monitored by FINMA. However, there is no mention of our review subject in the FINMA records. We did a check, including the names FWM-lmtd and Fidelis Wealth Management.

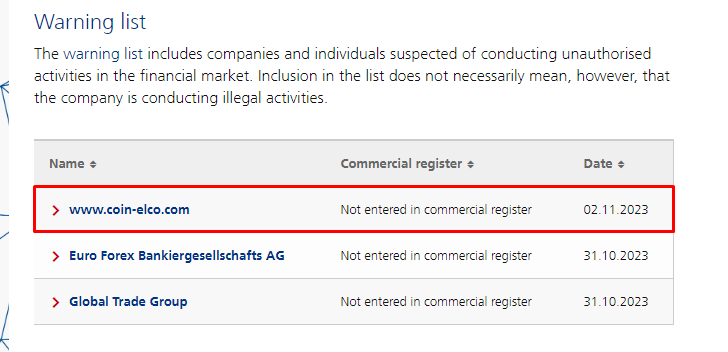

In the website footer, there is a mention of “FWM-lmtd (Switzerland) AG. Managed by Coinelco SA.” However, Coinelco is not authorized by FINMA either, which means the broker has no licenses. What’s more interesting is that Fidelis Wealth Management is also absent from the Swiss Commercial Register, while the mentioned Coinelco is listed. However, it is irrelevant because the license is still missing, even though it should be present.

Lastly, regarding Coinelco, the company is included in the Warning List by FINMA. It seems further comments are unnecessary.

| Features | Fidelis Wealth Management | Mitrade | Geratsu |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ✔️ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ❌ | ✔️ | ❌ |

Frequently Asked Questions (FAQ)

How to Trade With Fidelis Wealth Management?

Is Fidelis Wealth Management Legit?

How Risky Is It?

Kevin Berry

Kevin Berry Serious red flags were discovered during the investigation of the broker, making this company not recommended for trading. In fact, it’s a good thing that registration on Scambroker is closed. This way, newcomers won’t be able to create personal accounts, and therefore won’t be able to transfer money to scammers. There are absolutely no doubts about the fraudulent activities of Fidelis Wealth Management, so be cautious, do not invest here, or you will lose all your money. And one more thing – do not trust positive online reviews, as they are likely fake.

Fidelis Wealth Management rating

1 review about Fidelis Wealth Management

FWM is a group of scammers who have created a fake platform to deceive people for money. I am an experienced trader, so I see through such fraud. I myself once fell victim to a scam when I trusted a Swiss broker. Fidelis Wealth Management does not have a license from FINMA, and their website was created just a few months ago. That’s all you need to know about these scammers. Do not trust fraudsters!