If you’re considering working with Zinzenova, it’s essential to dig deeper before making any decisions. Despite boasting about industry-leading services and a supposed membership with The Financial Commission, this broker raises numerous red flags. The company claims high-tier conditions and an office in the UK, but their lack of proper regulation and transparency is concerning. In this Zinzenova review, we’ll investigate whether this company can truly be trusted or if it’s simply another online scam in disguise. Keep reading to find out the truth behind the promises.

Table of Contents

Key Highlights of the Broker

| 🏛️ Country | United Kingdom |

| ⚠️ Regulation | – |

| 🖥️ Website | https://www.zinzenova.com/ |

| 🎲 Demo Account | No |

| ⏳ Start Time | 2024 |

| 💲 Minimum Deposit | $250 |

| ⚖️ Minimum and Maximum Leverage | 1:1000 |

| ⚙️ Trading Platform | WebTrader |

| 📞 Phone | – |

First Impressions and Review of Zinzenova Platform

The website I visited hasn’t impressed me much: it lacks transparency and meaningful content. Instead of real data, it relies on generic buzzwords like “industry leader” and “innovation” without proof. Key issues that should warn anyone who is going to trade on Zinzenova platform:

- No licenses or regulatory approvals listed on the official website.

- No verifiable trading history or real examples of successful transactions.

- No clear company details — ownership, headquarters, or legal entity remain undisclosed.

- Overuse of vague marketing phrases to create a false sense of credibility.

The site provides no solid evidence of legitimacy, raising serious concerns about its trustworthiness.

Generic stock photos of traders and charts only raise skepticism. They look fake, lack any real connection to the company, and do nothing to build trust. The website fails to make a good first impression.

Partnership and Bonuses

There’s no clear information about bonuses or an affiliate program. Zinzenova briefly mentions a phrase: “Enjoy a generous welcome offer”, but what does that even mean? The absence of an affiliate program seems like a strange decision. Such programs are a great tool for attracting new users and expanding the business.

How to Open an Account on Zinzenova.com

Now that we’ve analyzed the website, it’s time to take a look at the client portal. To do this, one must create an account by providing basic personal information such as name, password, email, phone number, and country of residence.

The Zinzenova.com client area is extremely basic. Interestingly, there was no need to verify registration via email or phone, which raises serious concerns about the platform’s security standards.

Customers have several windows in front of them:

- Transaction history.

- Actions with the account. Change of personal data.

- Verification of identity.

- Withdrawal of funds. Withdrawal request and history.

- My trades. This is the history of all trading deals.

- Deposit. It is strange that this button is at the very bottom.

Overall, there’s nothing exciting or noteworthy here. Furthermore, the trading platform most likely doesn’t offer a demo account, as we couldn’t find any such option in the client area.

Verification Review

To start working with Zinzenova trading platform, you’ll need to provide a pile of documents:

- a passport or another identity verification document,

- a copy of your bank card (both sides),

- proof of address,

- and even a completed deposit confirmation form.

There is no information about how long the verification process will take. Zinzenova simply states that “the sooner you send them, the faster you’ll get access”. This only means one thing — the process can drag on indefinitely. You could easily end up with a blocked account and frozen funds if the broker finds something unsatisfactory in your documents.

Another alarming issue about Zinzenova is the complete lack of information regarding the security standards used to store client data. They mention “high-level encryption”, but what exactly does that mean? Who is responsible for it? Where are the servers located? None of these crucial questions are answered.

- Documents can be uploaded in your personal account.

- Lots of requirements.

- High risk of data leakage.

- Lack of transparency in timelines.

Trading Software Review

The trading platform is basic and lacks functionality. While it might be suitable for beginners initially due to its simplicity and ease of use, experienced traders will quickly find it lacking. Zinzenova does not offer any alternative platforms to meet the needs of advanced users.

Essentially, the platform is just a web trader with built-in features borrowed from the popular TradingView service. The available tools include technical analysis, basic indicators, light/dark themes, watchlists, a calculator, and position history. There are several key drawbacks of Zinzenova’s platform:

- No mobile or desktop versions. Only the web version.

- No demo account.

- No auto-trading, copy-trading, and other similar features.

- The platform of an unknown developer. It is unclear whether it will work stably or not.

| Features | Zinzenova | TrustsCapital | Vourteige |

|---|---|---|---|

| Demo Account | ❌ | ❌ | ❌ |

| Mobile App | ❌ | ❌ | ❌ |

| Own Development | ❌ | ❌ | ❌ |

How Can I Trade With The Broker?

First and foremost, it’s important to note that Zinzenova operates as a CFD broker. This means there are no futures, options, or spot trading available — only contracts for difference (CFDs) on forex, stocks, indices, commodities, and cryptocurrencies. The rest of the trading conditions should be evaluated within the context of their account plans.

All Info About Accounts

Zinzenova has developed four types of accounts:

- Standard. Requires a minimum deposit of $10,000. Leverage is capped at 1:100; spreads start from 2 pips, and includes one month of premium signals, and access to a trading analyst.

- Silver. Requires a deposit of $25,000. Offers improved conditions and a dedicated account manager.

- Gold. Requires at least $50,000. Provides leverage of 1:200, spreads from 1 pip, ongoing trading signals, and a more experienced personal manager.

- VIP. No details are disclosed; clients must contact account managers for information.

On the website’s homepage, the minimum deposit is listed as $250, yet the first available “Standard” account requires $10,000. What’s the logic here? What’s the point of investing anything below $10,000 if clients can’t even activate a trading plan? Did Zinzenova simply overlook this contradiction?

The broker also advertises leverage of 1:1000, while the account types show significantly lower values. Again, this contradiction raises questions. Regardless, such high leverage levels are not allowed by regulated brokers. Regulatory bodies restrict leverage to 1:30-1:50, meaning Zinzenova’s claims are unrealistic for any compliant firm.

There is no mention of commissions, and the advertised spreads should be taken with skepticism. The company can easily mislead clients, meaning traders may end up with spreads far higher than the promised 2 pips. Additionally, Zinzenova does not offer cent accounts, demo accounts, or Islamic accounts, further limiting options for potential clients.

- None.

- Conflicting information about minimum deposit and leverage.

- Commissions are not specified.

- Demo account, cent tariff, and swap-free are not offered.

Market Analysis and Education With Zinzenova.com

All additional features and services are tied to specific account plans. Not only is the list of features short, but access depends entirely on the client’s deposit size. There’s nothing freely available for all traders. Zinzenova could have at least provided comprehensive educational courses, fresh market analytics, or in-depth market reviews — but none of that is offered.

Deposit, Withdrawal, and Fees

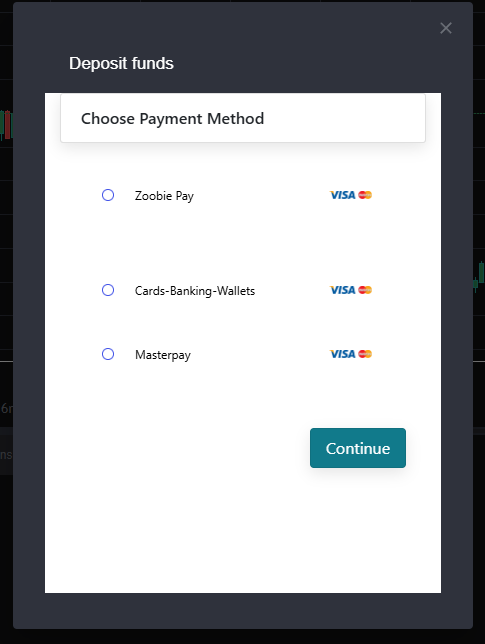

The website lists primary deposit methods such as Visa/Mastercard, e-wallets, and bank transfers. However, the situation changes inside the client area, where the boker offers several funding options, including little-known payment systems like Zoobie Pay and Masterpay.

Withdrawal processing can take up to 7 business days, and when factoring in “additional time” from the bank’s side, the wait could be even longer. There is no clear information on Zinzenova.com about deposit fees, but when it comes to withdrawals, the website vaguely mentions “additional charges from banks”. In other words, clients should brace themselves for hidden surprises.

Another unpleasant aspect about the broker is the inactivity fee. If an account remains inactive for six months, the company starts charging a 10% monthly maintenance fee. All of these factors suggest that the broker is making it as difficult as possible for clients to withdraw their money.

| Features | Zinzenova | Forexeze | SafetradePortal |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ❌ |

| Electronic Payments | ✔️ | ✔️ | ❌ |

| Crypto Transfers | ❌ | ✔️ | ❌ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ❌ | ❌ | ❌ |

How Can I Contact The boker?

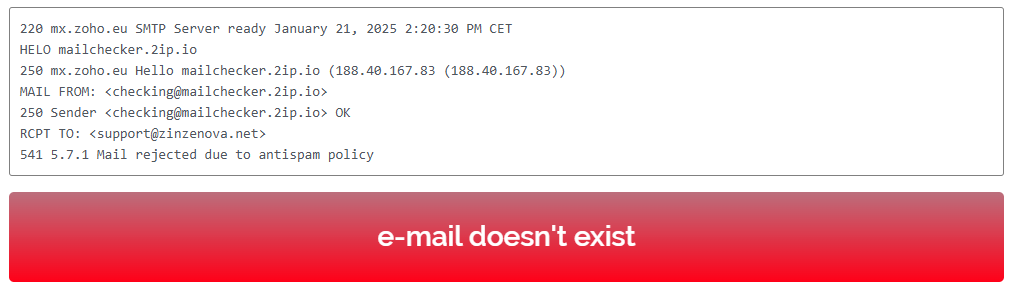

The website provides two email addresses, one supposedly for Canadian clients. However, there is no actual office in Canada. Instead, Zinzenova lists an address in the UK. However, here’s the catch — the contact details provided are fake. Both email addresses are non-functional.

There is also no phone number or live chat. Despite account descriptions mentioning support via email, phone, live chat, and even WhatsApp, none of these are actually available.

- None.

- Fake contacts.

- No online chat.

Is Zinzenova Dangerous?

Would a legitimate and trustworthy broker provide fake contact details? Highly unlikely. Moreover, trading conditions bear a striking resemblance to those of many fraudulent firms. There’s little doubt left that Zinzenova it is a scam. Claims about its operational history, FinCom license, and legal address in the UK are misleading or unsubstantiated.

Why? Go on reading to find out more…

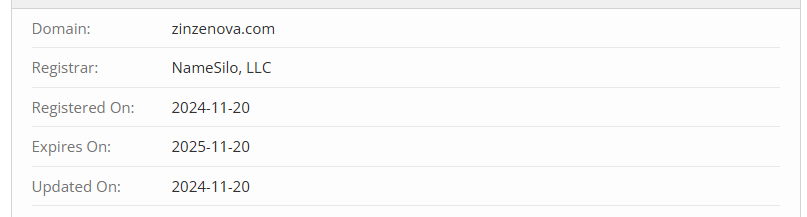

Domain History Review of Zinzenova.com

Scammers often either hide their founding date or lie about it. In this case, it’s the first option. However, there’s a way to find out how long the platform has been operating — by checking when their website was launched. According to Whois records, it was registered on November 20, 2024. That’s just two months ago — an extremely short period of operation.

Another red flag: If you visit whois.com to check the domain owner and hosting provider, you won’t find any details. Zinzenova.com uses Cloudflare proxying to hide its real servers and contact information. Would a company confident in its flawless reputation go to such lengths to conceal itself?

How Is Zinzenova Regulated?

The company claims to have its headquarters in England, but this should be verified rather than blindly trusted. If they truly have an office in London, they should be listed in the Companies House registry, which contains information on all firms registered in this jurisdiction. However, a search reveals that Zinzenova broker does not exist in the registry.

The company also boasts about having a license from The Financial Commission. However, since the broker-under-discussion claims to be based in the UK, they should be regulated by the FCA, the official British regulatory authority. A quick check on the official FinCom website reveals the truth, you can also see the scam warning about Zinzenova here.

This is why it’s crucial to verify all information independently — otherwise, you could fall victim to outright fraud.

| Features | Zinzenova | SafeTradeNet | AllTradingEurope26 |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ❌ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ❌ | ❌ | ❌ |

How to Trade With Zinzenova?

Is Zinzenova Legit?

How Risky Is It?

Kevin Berry

Kevin Berry It’s good that regulators warn against companies falsely claiming licenses. FinCom has confirmed Zinzenova is not licensed and not a member of their organization. It seems like another platform, aiming to deceive inexperienced traders. Be cautious and don’t trust their promises.

Zinzenova rating

4 reviews about Zinzenova

How can I get my money back from zinzenova.com? I invested $500, but to activate their lowest account tier, I need $10,000, even though their website states the minimum deposit is $250. I don’t have $10,000, so I want to withdraw my $500, but they are not approving my withdrawal request. What should I do? Where can I seek help? Should I contact my bank? Is a chargeback possible? Please help, the broker’s support is not responding to me!!!

There are far too many signs of fraud with this pseudo-broker. I’ve been in the forex market for a long time, and it takes me just 1-2 minutes on a website to figure out if it’s a scam. In this case, it took me only 15 seconds to realize it’s a fraud. Fake licenses, a fake address, no founder names, and so on. It’s just a complete set of classic scam signs. I strongly recommend avoiding this broker; otherwise, you will lose all your money.

Hey, I’m from Canada, eh, and I don’t like Zinzenova! You know, I started looking for reviews on Google, and I found a bunch of fake-news website titles. They sound like: ‘Canadian, Australian traders prefer this broker’ – they’re lying, eh! I don’t like it, and, moreover, I’ve never even heard of them. The domain Zinzenova.com is only a few months old – just another fake without licensing, eh. Hey, what are you talking about? Wake up! Too many sweet reviews about this trading platform, and none of them are close to the truth! My friends from Canada, a little friendly advice – always check if a broker is IIROC-regulated and a CIPF member. That’s how you know it’s legit. Maple syrup and good vibes, eh!

Doesn’t it seem suspicious to you that the website is registered under the .com domain, but their contact email is on the same name domain but with a different extension, like support @zinzenova.net? I checked both domains using Whois, and found that both were registered on the same day – November 20, 2024. What could this mean:

1. Perhaps the broker realized their current website will be probably flagged soon, and they plan to switch. To avoid losing clients, they’ve placed information about the email with the different domain on their website.

2. Serious companies always use the same domain for corporate email and their official website, as they care about branding and customer trust. Zinzenova clearly doesn’t seem to be making an effort to earn such trust. My verdict: I would steer clear of these shady folks.