We are looking at Bankefex, a brokerage company registered in Comoros and regulated by MISA, as stated on their website. The broker also boasts three awards received in 2021 and 2022, hinting at a certain period of operation, though online reviews are scarce, and the exact founding date is not specified. Can we trust a firm with a license from the Mwali regulator, or is it better not to? Could the regulation be fake, and the organization involved in a scam? We are about to find out. If you’re interested, join us.

Table of Contents

Highlights

| 🏛️ Country | Comoros |

| ⚠️ Regulation | MISA |

| 🖥️ Website | https://bankefex.com/ |

| 🎲 Demo Account | No |

| ⏳ Start Time | 2023 |

| 💲 Minimum Deposit | $250 |

| ⚖️ Minimum and Maximum Leverage | 1:200 |

| ⚙️ Trading Platform | WebTrader |

| support@bankefex.com | |

| 📞 Phone | +18009612110 |

First Impression of Bankefex.com

The acquaintance with the company starts with the official website, which appears in a typical and familiar style: a panel with information about the firm and conditions at the top, the main page listing advantages and opportunities, and the bottom part with legal data and a warning about the risks of margin CFD trading. So Bankefex didn’t bother to innovate and created a standard brokerage site.

The site introduces us to tradable asset classes, account types, available platforms, and much other information. Specifics and evidence are lacking, for instance, three awards are claimed in brokerage services, but where are the confirmations in the form of links? Many details are omitted: the founding date, the brand’s development history, the names of the leaders, and the business model. Anonymity and a lack of transparency are evident.

The site’s language is English only. Furthermore, the resource is not fully completed. There are social media icons that should redirect users to the broker’s accounts, but instead, they reopen the website. Serious spelling mistakes and typos are not noticed at Bankefex, but the quality still leaves something to be desired.

Partnership and Bonuses

Bonus promotions are not indicated on the site but are mentioned several times in the user terms document. Therefore, Bankefex clearly offers various bonuses to traders. However, the details of working off the bonus funds are not disclosed.

Looking ahead, a certain promo code can be specified during account registration. This code is an obvious hint at the presence of an affiliate program in Bankefex. Then why does the broker not specify the type of affiliate program, the size of rewards, and other conditions? Even here, an opaque approach to customer service is observed.

Account Opening on Bankefex.com

Trading without an account is impossible at Bankefex, so the first step is to go through the registration process. This process is quite lengthy because it requires not only providing a name, contacts, and password, but also other personal details: date of birth and residential address.

The logic and purpose of requiring the residential address are somewhat unclear if it doesn’t need to be verified with documents at this stage. It would have been much simpler to just leave contacts and name, and leave the address specification for the identity verification stage. Bankefex seems to be trying to complicate the lives of its potential clients.

Unfortunately, the time spent on providing all this information turned out to be in vain. The registration yields an error: “Request Failed!”. How to solve this problem? Apparently, it is necessary to contact technical support.

Such an error is a serious minus for the company, as is the absence of a demo account. Bankefex does not offer a demo, and this option is not even mentioned on the website.

Verification

The verification procedure at Bankefex is mandatory, without which it is impossible to use the broker’s services. It is not enough to specify personal details; they must be additionally confirmed with documents. The firm requires the following documents:

- Your proof of identification, such as a government-issued ID, passport, or driver’s license.

- Your proof of address or residence, such as a bank statement, residential certificate, government-issued lease contracts, or utility bill not older than six months.

- Copy of the credit card or debit card if such was used for any financial transaction. It is necessary to hide part of the digits of the card number and CVV.

- None.

- Bankefex requires a photo of the card to be uploaded.

- It is unknown how fast the document check is.

Trading Software

Unfortunately, we cannot test the capabilities of the Bankefex platform in practice, as the attempt to register was unsuccessful. Therefore, the only option is to take the broker’s word for how they describe their terminal, which is described as follows:

- Secure, easy to use, and convenient.

- Superior analysis tools.

- 21 different timeframes.

- Up to 100 charts simultaneously.

- Advanced automation and charting tools.

- Financial news and alerts.

- Full set of orders.

Bankefex also assures that the platform has a mobile version available for download on Android/iOS. However, the links can only be obtained by registered users, so there are doubts about the existence of a separate application for smartphones. Additionally, the company offers to download a desktop version, but it is also available only to those who have managed to register.

| Features | Bankefex | Fusion Markets | Mitrade |

|---|---|---|---|

| Demo Account | ❌ | ✔️ | ✔️ |

| Mobile App | ✔️ | ✔️ | ✔️ |

| Own Development | ✔️ | ❌ | ✔️ |

How Can I Trade With Bankefex?

Traders have access to over 1,500 assets at Bankefex, exclusively in the form of CFDs. Trading options include more than 90 currency pairs, popular indices (S&P 500, FTSE 100, NASDAQ, and others), energy resources (gas and oil), metals, stocks, and cryptocurrencies. The maximum leverage is 1:200, but it is only for forex; for other market classes, it’s lower.

All Info About Accounts

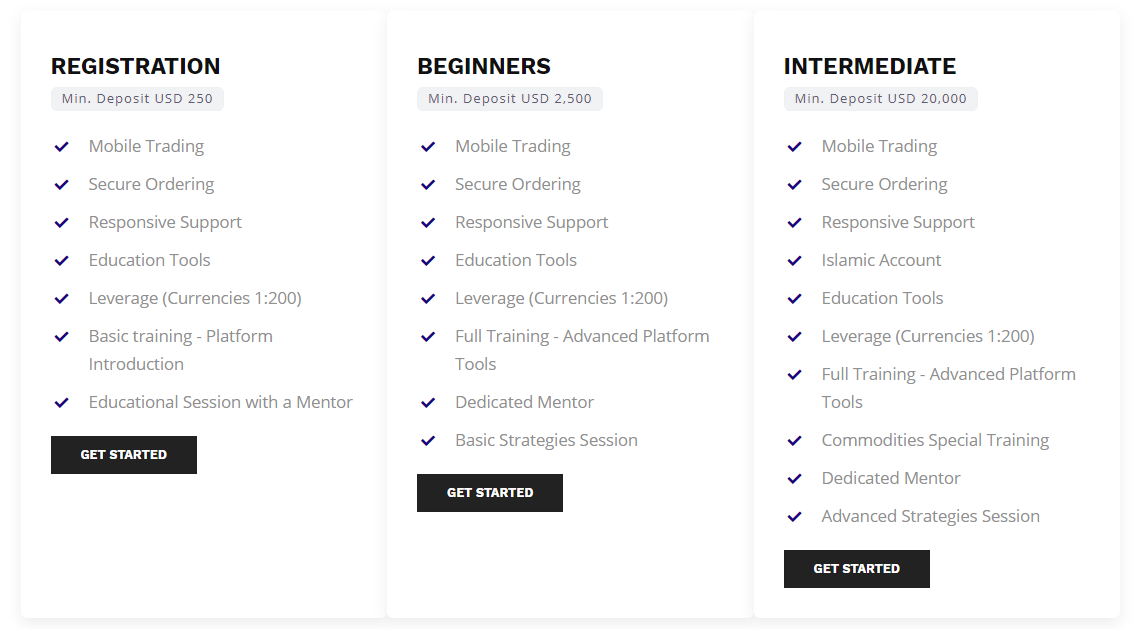

The minimum deposit at Bankefex is $250, depending on the type of account chosen by the trader. There are a total of 7 tariffs. The better the account type, the higher the minimum deposit, but more privileges and opportunities are available, so it’s fair to say that the broker operates on the principle of “if you want better conditions – pay more money”.

Those who can only afford the first account type get a rather meager set of features: technical support, educational materials, one session with a mentor, and guides on using the platform. The second account type at Bankefex, named “Beginners,” requires a deposit of $2,500 and includes comprehensive training, help from a dedicated mentor, and a basic strategies session.

The other tariffs are almost not worth considering, as the requirements for the minimum deposit are inadequate: $20,000, $50,000, and more. To enter the elite VIP Club, one needs to deposit 1 million dollars, but are there any willing to risk such an amount?

There is an Islamic account, but it’s only available with a balance of $20,000, though such an option should be offered to every client. Isn’t this an outright extortion of money? Meanwhile, Bankefex hides important trading conditions: commissions, spreads, and swaps.

The account types differ little from each other, apart from the deposit requirements. The broker tries to lure traders with unclear and meaningless pseudo-services, such as extra market events, private strategy, or special training. While popular and verified firms at least offer to try a demo or a cent account, here you need to invest $250, which is a substantial amount.

- None.

- High minimum deposit.

- Lack of standard options: demo, cent tariff, and ECN.

- Islamic tariff is available with a deposit of $20,000.

- The broker tries to extract as much money as possible from clients.

- Important conditions are hidden.

Market Analysis and Education With Bankefex.com

Traders have access to a small section named “Research”, which includes financial news and an economic calendar. Additionally, Bankefex provides information on the operating hours of major stock exchanges and the expiration dates of futures contracts. According to the descriptions of the tariff plans, clients are promised educational resources and assistance from experts.

Deposit, Withdrawal, and Fees

It is impossible to determine the exact methods for depositing and withdrawing funds at Bankefex, as access to the personal account is closed. Looking at the official website, one can see logos of Visa/Mastercard and Bitcoin, but the FAQ section also mentions bank wire transfers.

The processing time for withdrawal requests is either 5 business days or 7. Different places on the website provide contradictory information. The firm also promises not to charge commissions for money transfers.

| Features | Bankefex | Oanda | FxPro |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ✔️ |

| Electronic Payments | ❌ | ✔️ | ✔️ |

| Crypto Transfers | ✔️ | ❌ | ❌ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ❌ | ✔️ | ❌ |

How Can I Contact It?

To contact the managers, there is a phone number, email, and online chat. All contact details are real. However, the phone number is marked as “not available”, and its code starts with +1, which belongs to Canada or the USA, which is quite strange. Icons for social media X, Facebook, and YouTube are presented only for appearance, as Bankefex actually does not have accounts on these social media.

- There is email and online chat.

- The phone is not available.

- Social media accounts are absent, despite the presence of logos.

Is Bankefex Dangerous?

The inability to register an account to explore the broker’s internals looks highly suspicious. Moreover, the conditions are very reminiscent of any other fraudulent organization, as the parameters and services are very similar. Overall, the company has shown itself to be very secretive and opaque, but a final verdict requires checking the operational period of Bankefex and its licenses.

How Long Does The Broker Work?

The founding date is not specified on the company’s website. However, some details are provided: the legal entity Direct Prime Ltd, a license, and a registration number. For instance, the license was issued in 2022, but the official website domain for Bankefex was only registered in 2023. The awards claimed to be received in 2021 and 2022 are obviously fabricated, especially since the platform provided no confirmations.

How Is Bankefex Regulated?

We found out that the legal entity Direct Prime Ltd indeed obtained a license from MISA. However, this firm has its own website, direct-prime.com, where the conditions and brokerage services can be studied. Is it true that bankefex.com belongs to and is managed by Direct Prime Ltd? We can’t ascertain that, but in any case, it looks very suspicious and risky, and we believe these are two separate organizations. Why have a second site, especially under a different name?

Moreover, registration in Mwali and having a license from MISA are not guarantees of the firm’s safety and reliability. If Bankefex had obtained a license from more well-known and strict regulators, such as the FCA, ASIC, or CySEC, then we could talk about some guarantees. Additionally, the company doesn’t even have representations anywhere.

| Features | Bankefex | FXChoice | IC Markets |

|---|---|---|---|

| European Zone | ❌ | ❌ | ✔️ |

| Asian Zone | ❌ | ❌ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ❌ | ✔️ | ✔️ |

Frequently Asked Questions (FAQ)

How to Trade With Bankefex?

Is Bankefex Legit?

How Risky Is It?

Kevin Berry

Kevin Berry I lean towards the idea that Bankefex might be masquerading as a completely different brokerage organization. Otherwise, I don’t understand why Direct Prime would create a second website with a different name. Is one platform not enough? Even if I am mistaken, collaborating with this broker remains unsafe. It’s a definite B-Book operation, meaning there’s a conflict of interest, and there’s not much to say about the trading conditions since commissions and spreads are undisclosed. Additionally, issues with creating an account often indicate a fraudulent firm. In short, why take the risk when you can avoid it?

Bankefex rating

4 reviews about Bankefex

It’s hard to believe in the reliability of such a broker. Trusting your deposit with offshore companies is not the best idea. If you decide to take the risk, at least risk only a small portion of your deposit, as it could easily turn out to be a scam.

I won’t dissuade you from trading with Bankefex, as ultimately, you decide what to do with your money. But I must warn you. You may be able to deposit funds, most likely only through Bitcoin, as other methods will be “unavailable for unknown reasons”. Then, you’ll trade under very unfavorable conditions, and when you want to withdraw your money, you’ll encounter problems – withdrawals won’t work. That’s my forecast. Whether you want to lose money or not, you’ll lose it if you invest in this fraudulent and fake pseudo-company.

I am amazed by the variety of assets available for trading. It’s allowed me to diversify my portfolio beyond just stocks and bonds.

I am impressed by the customizability of the trading dashboard. I can tailor it to my preferences, making my trading experience smoother.