“Unlock your trading potential” – that’s the alluring tagline of yet another broker proposing CFD trading without a license from any financial authority. Meet a review Stone Bridge Ventures: it’s a UK-based entity boasting over 134,000 active clients spanning 50 countries and a staggering trading volume exceeding $57 billion. They also seem to take pride in their profusion of 5-star reviews. However, our findings might paint a different picture. Curious if the company is truly a dependable CFD partner or just another run-of-the-mill scam? Dive into our comprehensive review to uncover the truth.

Table of Contents

Highlights

| 🏛️ Country | United Kingdom, St. Vincent and Grenadines |

| ⚠️ Regulation | – |

| 🖥️ Website | https://stonebridgeventures.com/ |

| 🎲 Demo Account | No |

| ⏳ Start Time | 2023 |

| 💲 Minimum Deposit | $200 |

| ⚖️ Minimum and Maximum Leverage | 1:30-1:400 |

| ⚙️ Trading Platform | WebTrader |

| support@stonebridgeventures.com | |

| 📞 Phone | +44 8081 753 962 |

First Impression

When you land on the Stone Bridge Ventures official site, a distinguished gentleman in a suit meets you, positioning himself as a seasoned investor and entrepreneur. It’s somewhat unexpected, to be honest. When you visit a broker’s site, the last thing you expect is to be greeted by a random, albeit well-dressed, man. Featuring an elegant woman might have been more engaging, considering the predominantly male audience in trading.

The design and structure of the website appear generic, a feature often seen in pseudo-brokers like Stone Bridge Ventures. You’ll find the usual sections, replete with templated content, making it all feel monotonous. What’s more, there’s a conspicuous lack of specificity and detail, with much of the content coming across as mere fluff. The User Agreement and AML&KYC policies are merely presented as screenshots instead of accessible text. This approach not only complicates finding relevant information but also hints at a probable copy-paste job. To sum it up, the company’s official site looks rather low-budget and fails to make a lasting positive impression.

Partnership and Bonuses

Stone Bridge Ventures provides an avenue for earning, extending beyond just trading, through its affiliate program. Clients have the option to invite other traders to sign up via their unique referral link. In doing so, they stand to receive a commission, calculated as a percentage of their referral’s deposit. For instance, if the deposit amounts to at least $1,000, the inviter benefits from a 10% commission, while the referred party gains an additional 5% added to their balance. It’s worth noting that these rewards are given out in the form of bonuses, so it’s advisable to get acquainted with the bonus policy beforehand.

Such an affiliate model is typically associated with deceptive firms operating under the Dealing Desk business approach. Rather than disbursing actual money, distinct from bonuses, derived from the commissions and spreads that referrals pay, the broker compensates based on a deposit percentage. From that perspective, it’s apparent that the firm’s revenue stems primarily from funds deposited by users.

Account Opening on Stonebridgeventures.com

The firm has standard account registration, which requires you to provide your first and last name, phone number, country and email, come up with a password, and agree to the terms and conditions.

Upon account creation, customers are instantly directed to a web interface integrated into their personal account area. It’s crucial to highlight that Stone Bridge Ventures doesn’t mandate email and phone verification, posing a substantial security flaw.

Standard operations can be performed through the personal cabinet:

- Verification of identity.

- Changes to personal data.

- Deposit and withdrawal of funds.

- Changing the notification system, as well as the language. English (US/UK) and German are available.

- Study the statistics of referrals.

- View the history of transactions and orders.

Verification

Stone Bridge Ventures has a compulsory identity verification process. The method is consistent with other brokers. It entails uploading documents to validate a client’s identity and residence. When funding the account via a bank card, a card photo upload is necessary.

- It’s convenient to upload documents.

- Requires you to take a picture of your bank card.

Trading Software

The trading platform is notably basic and straightforward. Traders can utilize text labels, graphical/technical analysis tools, Elliott waves, Fibonacci, and basic indicators. Users have the option to adjust charts, selecting from Japanese candlesticks, bars, lines, or scatters. Available timeframes span from 1 minute to 1 month. Despite these features, the platform lacks options to modify the color palette, access to professional tools like market depth, and open interest, or the feature to upload personalized indicators.

Stone Bridge Ventures offers its platform exclusively as a webtrader. They lack a dedicated mobile application, requiring users to access the terminal via a browser on their smartphones. That trading software falls short of being termed ‘professional’ or ‘versatile.’ It’s more of a basic mockup of a terminal, merely sufficient for executing buy or sell orders. Relying on it for detailed technical analysis is not feasible. By the way, there is no demo account. And there may be technical problems, which are impossible to check without replenishing the balance with money.

| Features | Stone Bridge Ventures | ForexLive | Mitrade |

|---|---|---|---|

| Demo Account | ❌ | ✔️ | ✔️ |

| Mobile App | ❌ | ✔️ | ✔️ |

| Own Development | ❌ | ❌ | ✔️ |

How Can I Trade With Stone Bridge Ventures?

The broker solely provides trading options in CFDs with leverage. One shouldn’t expect options for spot and futures trading. The specific terms are contingent upon the trader’s selected plan. Let’s delve deeper into the array of available account types.

All Info About Accounts

Traders can choose from four account types, and for the affluent, the broker offers a VIP status. The entry-level deposit stands at $200, which seems comparatively high given that other firms allow for a start as low as $1. The scammers aren’t interested in those who can’t muster a $200 deposit. The beginner’s tariff provides a platform introduction, a guide for cryptocurrency wallet usage, a flexible 1:30 leverage, and spreads starting at 1%. We will delve deeper into these terms when discussing the second tariff plan.

While the initial account type starts at $200, the second demands a leap to $10,000. What accounts for such a significant jump between the two? Newcomers might need years to accumulate a capital of $10,000 to ascend to the next tier, which offers perks like a dedicated manager, weekly market insights, live trading sessions, leverage up to 1:100, and spreads from 0.75%. Following tariffs require dizzyingly high capital for activation. Stone Bridge Ventures aims at the wealthier segment, providing them with diverse privileges and options, whereas beginners only get rudimentary instructions about the platform and crypto wallets. Affluent investors are presented with an extensive asset list, personalized financial planning, analytical tools, leverage reaching 1:400, and spreads from 0.2%. The exclusive VIP club starts at a staggering $250,000, but the specific advantages remain undisclosed.

Why limit traders, who can’t muster more than $10,000, with a 1:30 leverage, but offer an expansive 1:400 leverage to those already armed with significant trading capital? The leverage serves to amplify trading volumes for the former, while the latter hardly needs it, considering their solid capital. Expressing spreads in percentages doesn’t make sense when typically they’re denoted in points. Did Stone Bridge Ventures mix up spreads with commissions? Regardless, a 1% spread seems exorbitant. No reputable firm would set such steep costs.

- None.

- Inadequate conditions in the form of a spread of 1% and limited leverage.

- Lack of demo and Islamic account.

Market Analysis and Education

Stone Bridge Ventures features a complimentary educational segment that encompasses e-books, a comprehensive glossary, an asset index, and FAQs. Moreover, the company furnishes guidance on cryptocurrencies and blockchain, detailing their application. Notably, their official site showcases an “Investment Portfolio” section, presumably highlighting their investment service terms. Surprisingly though, clicking on it redirects users to the trading platform.

Deposit, Withdrawal, and Fees

You can fund your account or process withdrawals via credit and debit cards, as well as through cryptocurrency at Stone Bridge Ventures. They accommodate Bitcoin, Ethereum, USDC, and USDT ERC-20. While bank transfers are mentioned in their official documentation, that method seems absent in the user dashboard. There’s a withdrawal charge of 1%, with a minimum of $30 and a maximum of $300, or the corresponding amount in GBP/EUR.

| Features | Stone Bridge Ventures | TradeCMF | Forexeze |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ✔️ |

| Electronic Payments | ❌ | ❌ | ✔️ |

| Crypto Transfers | ✔️ | ❌ | ✔️ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ✔️ | ❌ | ❌ |

How Can I Contact It?

Stone Bridge Ventures encourages its users to reach out to their representatives via email and phone. You can find the contact details on their official website, which also features a dedicated feedback form. However, upon verification, it turns out the listed email address is non-existent.

- None.

- Email doesn’t exist.

- Social media and online chat are not available.

Is Stone Bridge Ventures Dangerous?

Based on the terms and the presentation of the website, as well as the platform the broker presents, it’s disheartening to infer. It doesn’t come across as a credible or advantageous broker, but seems more like just another scam in the market.

How Long Does The Broker Work?

A company’s operational history often indicates its reputation and reliability. Generally, the longer a company has been around, the more established and reputable it becomes. Stone Bridge Ventures, however, doesn’t specify its inception date on its website, but based on the domain registration, one can make an educated guess. The domain was registered in 2018 and updated in 2023. Snapshot data shows that the domain was available for purchase in 2022 for $2,195. Hence, it’s probable that the broker only started its business in 2023.

How Is It Regulated?

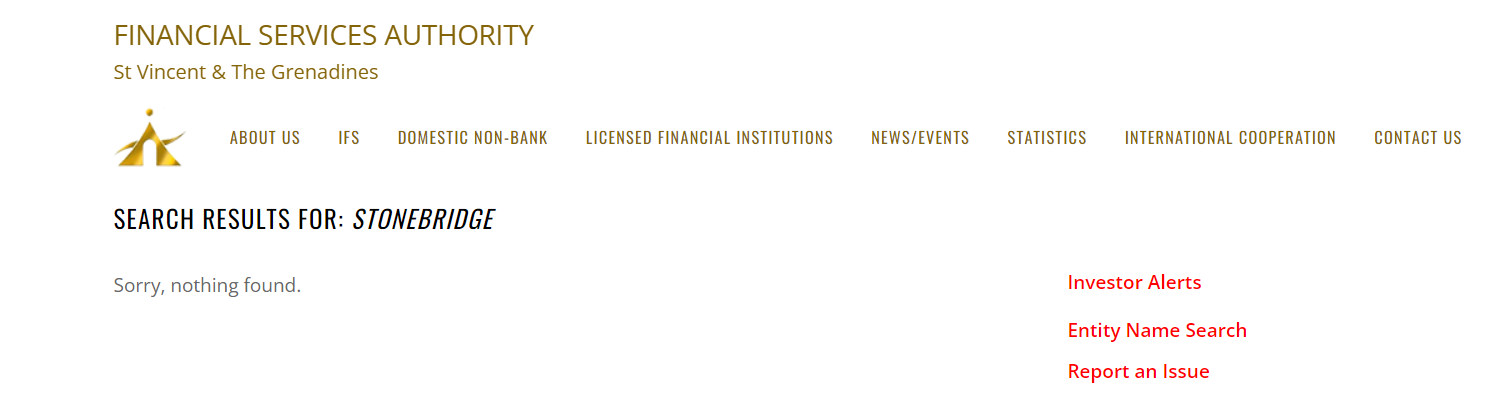

The company lists a UK phone number, yet references the jurisdiction of Saint Vincent and the Grenadines in its user agreement. Upon checking the FCA register, there’s a firm named Stonebridge International Insurance Limited, which isn’t related to the entity under our scrutiny.

Could it be that Stone Bridge Ventures is overseen by the SVGFSA? Regrettably, a search in their directory was also fruitless. No such company appears in the financial commission’s records.

| Features | Stone Bridge Ventures | Gainful Markets | Spotinvest |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ❌ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ❌ | ❌ | ❌ |

Frequently Asked Questions (FAQ)

Kevin Berry

Kevin Berry It’s clear now that Stone Bridge Ventures’ claims, from having hundreds of thousands of traders to boasting a $57 billion turnover, are misleading. Their promises about the security of client funds seem like nothing more than blatant lies and marketing tricks aimed at entrapping the unwary and seizing their money. Fellow traders, take heed. The company’s activities appear illicit, so it’s imperative to avoid opening an account or depositing funds here. If you do, you might find it impossible to reclaim even a fraction of your investments in such a dubious organization.

Stone Bridge Ventures rating

4 reviews about Stone Bridge Ventures

I have invested many thousands and they won’t let me withdraw anything.

Stone Bridge Ventures total scam. Befriend you, get you to deposit as much as you can, pretend to trade bitcoin and make huge profits then you ask to withdrawn and they proceed to pretend to loose it all and oops you have lost all your money. All of a sudden they are extremely hard to get a hold of, don’t reply to your emails and don’t phone you back and you can’t phone them. Less than one star total scam. Zero support. No withdrawal.

These thieves, liars and scammers aka Stonebridge Ventures are destroying people’s lives, stealing people’s life savings. Nothing is real about what they state about themselves: location, the managers names, type of trades, website, email addresses that have been changed 3 times in less than 1 year, everything is fake and fraudulent!!! Soon they will change their website domain again, as per a mass email sent to their clients. The only certain thing about these bastards is that they will do everything possible to suck your money! They are diabolical!!! Some names that they use: Michael Cohen, Jason Miller, Daniel Andino, Michael Kazlowski, Joseph Hertz, Evelyn Hollander, Sofi Belkin, Alexa Thomson, Troy Debeers…all fake names, but real description…SCAMMERS!!! Stay away and spare your life from dealing with these diabolical individuals! I hope they will rotten in jail soon!

Total lowlife scum – lies from the beginning

Fake names- Mike Paleo, Michael Kazlowski Joseph Kiss, Mark Albert – No contact- 3 Domain changes- Now called SB – Global-

They have robbed me of everything- reported to authorities. If you have $$ invested you will never get it back- report them.