Capitalex Pro is a British company that confidently claims to have been operating in the brokerage services market for several years. It does not hesitate to assert the guaranteed safety for client funds, beneficial trading conditions, a customer-focused approach, and a modern, user-friendly platform. However, the firm falls short of providing any substantial evidence to support these assertions. Additionally, the broker operates without licenses, explaining this gap by stating that a license is pending approval. Despite the presence of positive reviews online, it remains our duty to thoroughly investigate the organization to determine its legitimacy: Is this a scam or not?

Table of Contents

Highlights

| 🏛️ Country | United Kingdom |

| ⚠️ Regulation | – |

| 🖥️ Website | https://www.capitalexpro.com/ |

| 🎲 Demo Account | No |

| ⏳ Start Time | 2023 |

| 💲 Minimum Deposit | $10,000 |

| ⚖️ Minimum and Maximum Leverage | 1:200 |

| ⚙️ Trading Platform | WebTrader |

| support@capitalexpro.com | |

| 📞 Phone | +442033768573, +442033767339 |

First Impression of Capitalexpro.com

If there were an award for creating the most meaningless, uninformative website packed with filler content, Capitalex Pro would undoubtedly win. Their official site is rife with grandiose claims, purported advantages, and eloquent phrases. However, it lacks any form of concrete information or credible evidence to support these statements. While it’s easy to make bold claims, substantiating those claims is crucial, where the broker falls short. Rather than providing concise, accurate information, the company’s website is filled with verbose and impenetrable walls of text.

It’s hard to overlook the poor layout and low-quality design of the website. Capitalex Pro decided not to invest effort and resources even in this aspect. The official website features a homepage and over 10 sections dedicated to trading conditions, purported advantages, unverified merits, trading platforms, and account types. At least the homepage has images, for example, a bull depicted in a high-tech style, computers with charts, and people in suits who look like professional traders and analysts. As for the other sections, they are simply dry black text on a white background with an awful font.

In conclusion, after our initial encounter with Capitalex Pro, we can’t award a high score for the website’s layout and structure. Convenience and comfort for the visitor were clearly not pursued as goals when creating this resource.

Partnership and Bonuses

Capitalex Pro offers both bonus and loyalty programs. The company provides a welcome bonus based on the size of your initial deposit, although these bonus funds can only be used for trading and cannot be withdrawn. Additionally, clients can earn loyalty points redeemable for real money. The firm also features an affiliate program. Notably, the terms and conditions for any of these programs are not clearly outlined.

We want to emphasize that bonuses and loyalty points come with strings attached. Brokers like Capitalex Pro often set specific conditions related to the withdrawal of funds, and until these requirements are met, you can’t withdraw your money. The problem is that these conditions are often virtually impossible to fulfill, causing traders to quickly deplete their deposits. Scam brokers are particularly keen on offering bonuses, as it nearly guarantees that individuals will lose their invested funds.

Account Opening on Capitalexpro.com

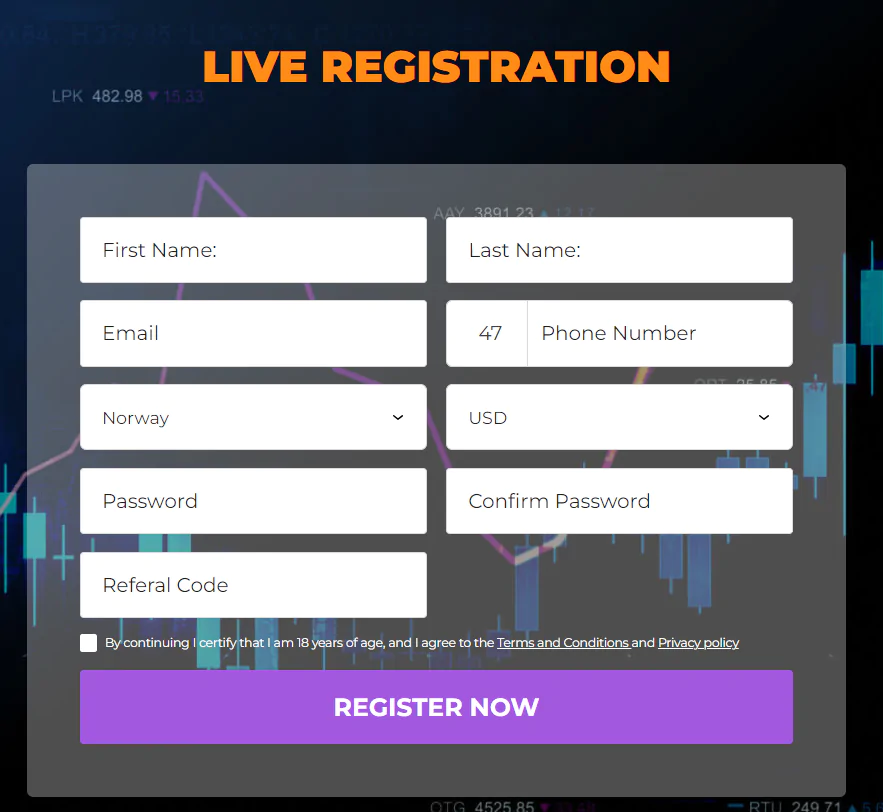

Registration in Capitalex Pro includes specifying first and last name, email, phone number, country, and account currency (USD, GBP, or EUR). You also need to create a password, specify a referral code (if any), and finally agree to the user terms and conditions.

We were unable to create an account with Capitalex Pro due to the broker’s mandatory requirement for a referral code. This code can only be obtained from an existing client or by asking a company manager. As a result, we’re unable to assess the user interface of the company’s client portal. The necessity for a referral code to register is unclear and raises some concerns. Additionally, the absence of a demo account further compounds these suspicions.

Verification

The verification procedure in Capitalex Pro is mandatory. The broker is required to confirm the following aspects:

- Your true identity.

- Your residence and workplace.

- Bank accounts that you own.

- None.

- Requires a lot of documents.

Trading Software

Due to the restrictive registration process at Capitalex Pro, which requires an invitation, we are unable to personally assess the platform’s appearance and functionalities. Therefore, we have to take the company’s word for it based on what is written on their official website.

The trading platform from Capitalex Pro is browser-based, eliminating the need for downloading or installing any software on your PC. Moreover, there’s no dedicated mobile app; the platform can be accessed via a mobile browser as well. Interestingly, the company’s official website offers no comprehensive breakdown of the platform’s capabilities. Indeed, why would traders need to know what functions and options they can use? The question is sarcastic.

| Features | Capitalex Pro | NLM 86 Limited | XFortunes |

|---|---|---|---|

| Demo Account | ❌ | ❌ | ❌ |

| Mobile App | ❌ | ❌ | ❌ |

| Own Development | ❌ | ❌ | ❌ |

How Can I Trade With Capitalex Pro?

Capitalex Pro provides access to CFD margin trading. All clients are offered a maximum leverage of 1:200. The minimum deposit size and additional services depend on the account type selected. Let’s consider it further.

All Info About Accounts

Capitalex Pro offers seven different account types. The first one, “Bronze,” requires a minimum deposit of €10,000, which contradicts information in other sections of the website where the minimum starting point for trading is stated to be €250. Included in this tier are market reviews, an e-book, access to webinars, and social trading. Quite a modest set of services for such a large deposit amount. Across the board, the broker’s account options fail to offer reasonable or customer-friendly deposit conditions, with other account types requiring staggeringly large capital investments.

The second tier starts at €25,000, and the set of additional features only differs by the presence of advanced-level Video on Demand (VOD). Investing €25,000 just for unclear VOD? Who came up with such outrageous conditions? We will not go into detail about the other account types, as it makes no sense. It’s unlikely that anyone would want to invest €50,000, €100,000, or more in Capitalex Pro, which operates without licenses. We will merely list the features of the expensive plans:

- 1 risk free trade.

- Personal assistant.

- Customized account.

- Trading room.

Capitalex Pro fails to provide any details about spreads and commissions. Similarly, there is no comprehensive contract specification available. Information about the qualifications or credentials of the so-called “analysts” is conspicuously absent. And the company has entirely overlooked the option for an Islamic account, another significant gap in their offering.

Upon reviewing Capitalex Pro’s trading conditions, we found several inconsistencies, including typos and errors. For example, the “Diamond” account offers the same services as the “Platinum” account but inexplicably includes one feature written in French: “specialiste du commerce.” This is perplexing, given that all other information is provided in English. What’s the rationale behind this abrupt language switch? Additionally, the account description mentions a “CMTrading EBook,” raising questions about its origin. Is CMTrading an educational platform or another brokerage? A quick Google search revealed a brokerage by that name, which begs the question: Did Capitalex Pro blatantly copy services from CMTrading without even bothering to remove the name?

- None.

- High minimum deposit.

- Uniform additional conditions.

- No demo and Islamic accounts.

- Important parameters are hidden.

Market Analysis and Education With Capitalexpro.com

There are no additional widgets and analytics on the firm’s website. However, there is a lot of educational content explaining how the market works, what trading is, and many other things.

Deposit, Withdrawal, and Fees

Capitalex Pro offers different payment methods for money transfers: bank wire transfer, debit/credit card, Neteller, Skrill, and crypto wallets. There is no commission for deposit and withdrawal of money.

| Features | Capitalex Pro | Sollari | Signet Capital |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ✔️ |

| Electronic Payments | ✔️ | ❌ | ✔️ |

| Crypto Transfers | ✔️ | ✔️ | ✔️ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ❌ | ❌ | ❌ |

How Can I Contact It?

Capitalex Pro offers the main ways to contact managers: two phone numbers (the first for technical issues, the second for trading) and e-mail. Also, it specifies the address of the United Kingdom, and there is a special form for feedback.

Our attempts to verify contact details yielded no meaningful information. Strangely, the broker lacks a social media presence. Given that this is an online business, one would expect social media channels to be a staple for customer engagement. There is also no option in Capitalex Pro for immediate communication via online chat.

- None.

- No social media or online chat.

Is Capitalex Pro Dangerous?

Upon analyzing Capitalex Pro, several red flags concerning the company’s reliability have emerged. The broker restricts free account registrations, requires a hefty initial deposit of $10,000, and fails to provide detailed information on most trading conditions. Thorough verification of the company’s legal address, licensing, and operational history is essential to draw a definitive conclusion about its credibility.

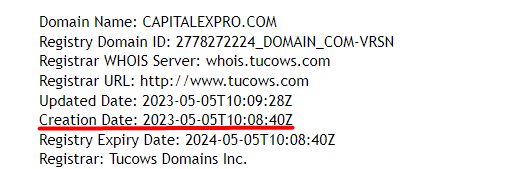

How Long Does The Broker Work?

Capitalex Pro’s official website briefly claims that it has been operating for several years. However, we quickly identified this as false information. The website’s domain was only registered in May 2023.

Contrary to its claims, Capitalex Pro has not been operating for several years, but for just a few months. Additionally, there are no documents to substantiate any different timeline. Therefore, it’s accurate to describe the broker as both new and unestablished.

How Is Capitalex Pro Regulated?

The firm provides a legal address based in the United Kingdom. In that case, it would be necessary to check this with the Companies House and FCA registries. Companies House serves as the official register of companies, while the FCA is the regulatory body that supervises broker activities within its jurisdiction.

We were unable to find a broker named Capitalex Pro in the Companies House registry. While there are firms with similar names, they are distinct entities and have no relevance to our review. It suggests that we have been provided with a fake address. Additionally, our search in the FCA database confirmed that no such brokerage organization exists.

| Features | Capitalex Pro | TheFinancialCentre | Fin Reserve |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ❌ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ❌ | ❌ | ❌ |

Frequently Asked Questions (FAQ)

Kevin Berry

Kevin Berry It was very easy. Identifying the reasons why Capitalex Pro is a scam proved to be a straightforward task. Regulatory authorities do not know of such a company, and there are no legal documents confirming its existence. However, even without these critical red flags, it’s apparent that the broker serves as a financial pitfall for naive traders. Requiring a minimum deposit of $10,000 is downright ludicrous, and the restricted registration process only further substantiates this claim. There’s no talk about genuine trading here; it’s just a dealing desk telling tales about itself and fabricating bogus benefits. Now you know about yet another scam broker.

Capitalex Pro rating

5 reviews about Capitalex Pro

Believe it or not, Capitalex Pro is a scam organization engaged in fraudulent activities. It’s not a legitimate broker but rather a dealing desk, essentially making it a fake broker. Both the quotes and liquidity they offer are fake. All the so-called virtues and benefits of this deceitful company are also bogus. Importantly, the scam can’t produce any legitimate documentation to validate its operations.

Capitalex Pro is an illicit operation that hasn’t secured any licenses. These con artists mislead people by claiming they are in the process of obtaining a license, which is inherently a lie. The firm has only been in operation for a couple of months, easily verifiable by checking the date of domain registration. Operating as a dealing desk means they don’t execute traders’ orders through an exchange or liquidity providers, indicating a blatant conflict of interest. Last but not least, their trading conditions are both terrible and ludicrous. To start trading, you are required to deposit an astonishing $10,000. Who in their right mind would agree to such a term?

What surprised me isn’t that this is an unauthorized broker lacking a license and reasonable trading conditions. What astonished me is that most online reviews for Capitalex Pro are overwhelmingly positive. Google seemed to have lost its mind. When I searched for reviews about Capitalex Pro, the search engine described it as a “reliable and efficient trading platform.” That’s absurd! This information appears to be based on fake positive reviews. The scammers are clearly involved in a fraud scheme to defraud people out of their money. Paid and fake reviews aid them in finding unsuspecting traders who will eagerly buy into the lies spun by these fraudsters.

In summary, don’t trust what you read online about this firm. Capitalex Pro is an outright scambroker that will gladly take your money and never return it. It’s a typical scam lacking legal documentation and any form of guarantees. Any investments made into this venture are essentially funds thrown away.

fraud scheme to defraud people out of their money. Paid and fake reviews aid them in finding unsuspecting traders who will eagerly buy into the lies spun by these fraudsters.

In summary, don’t trust what you read online about this firm. Capitalex Pro is an outright scambroker that will gladly take your money and never return it. It’s a typical scam lacking legal documentation and any form of guarantees. Any investments made into this venture are essentially funds thrown away.

Just to illustrate how these scammers work:

This summer, I was persuaded to open an account at CapitalExPro through the Bitcoin Sprint adds on LinkedIn, featuring well known people like James Dyson, Richard Branson, and others. The premise was that a deposit of €250 or £200 would open the door to great returns, without having to do anything else but to deposit such an amount.

To my surprise I appeared to have been given an “Account Manager” who started calling me daily and trying to persuade me to open a bitcoin wallet, and deposit considerably larger sums of money. Otherwise, they could not make more money for me. I was not in a position to deposit more money, but they kept pressurising me to do so. In the meantime, over a period of three weeks, my initial deposit had nearly doubled, which was a nice return, however small my account. I initiated a withdrawal request, but I could not see any action being taken on that request.

Suddenly, “the markets turned on them”, and my account was in the red. They could not stop their own “sophisticate AI-trading platform” generating more trades, which were now all showing negative results. My account was passed on to another Account Manager, and another. They both tried to have me deposit more funds to “recoup my losses”. I refused.

After very unpleasant email exchanges and intrusive phone calls, I urged them to stop contacting me and remove all my data from their systems. They still kept calling me, every time from a different number, even from untraceable Dutch mobile numbers. I was unlucky enough to answer one, in which yet another “account manager” told me there was €88.000 euro’s in my account, because they had “gifted” me a 1:1000 leverage effect on trading. That amount even grew to €120.000, after which he insisted on embarking on an “investment plan” to retire on. To do that, I had to invest another €130.000 to ensure an average monthly withdrawal of €27.000 for the next 11 years. As I am in no position to invest that kind of money, I asked to be allowed to withdraw from the €120.000. I have had no answers how to do that, other than I had to open a crypto wallet account somewhere, because CapitalExPro cannot provide funds in Euro’s, but only in crypto currencies. Even after I did open a crypto wallet account, no funds have been transferred.

CapitalExPro is not registered at the UK Companies House, and has no licence from the UK Financial Conduct Authority. The latter states: “This firm may be providing financial services or products without our authorisation. You should avoid dealing with this firm and beware of potential scams.”

AVOID AT ALL COST!!!

roubaram todo o meu dinheiro, nunca mais se consegue retirar nada