Fine Capitals confidently claims that your next Forex investment starts here. Perhaps the broker possesses some secret knowledge that allows them to make such bold statements. However, before opening an account here, we would still recommend verifying whether it is a scam. And that’s exactly what we’ll do in our review.

Table of Contents

Highlights

| 🏛️ Country | UK |

| ⚠️ Regulation | — |

| 🖥️ Website | https://finecapitals.com/ |

| 🎲 Demo Account | Yes |

| ⏳ Start Time | 2021 |

| 💲 Minimum Deposit | $100 |

| ⚖️ Minimum and Maximum Leverage | 1:200-1:500 |

| ⚙️ Trading Platform | MT4 |

| support@finecapitals.com | |

| 📞 Phone | — |

First Impression of Finecapitals.com

Fine Capitals has a well-designed website that showcases a professional and visually appealing interface. The color scheme is pleasing to the eye and doesn’t cause any distractions. The navigation on the site is straightforward, allowing users to easily explore the various sections and access the information they need.

The website provides comprehensive information about Fine Capitals, including their services, trading instruments, account types, and etc. However, the website is presented in English only, which raises concerns about the global presence of the company.

Partnership and Bonuses

Fine Capitals offers multiple partnership options for individuals interested in collaborating with the broker. You have the opportunity to become a representative of the company or establish your own referral network. However, it’s important to note that in the referral program, you will receive up to $15 for each traded lot referred. This formulation raises the question of whether referral partners will only receive compensation for the short positions of their invited traders. Moreover, it’s worth considering that one lot represents a substantial volume. Therefore, becoming a representative of the broker may potentially be a more advantageous choice.

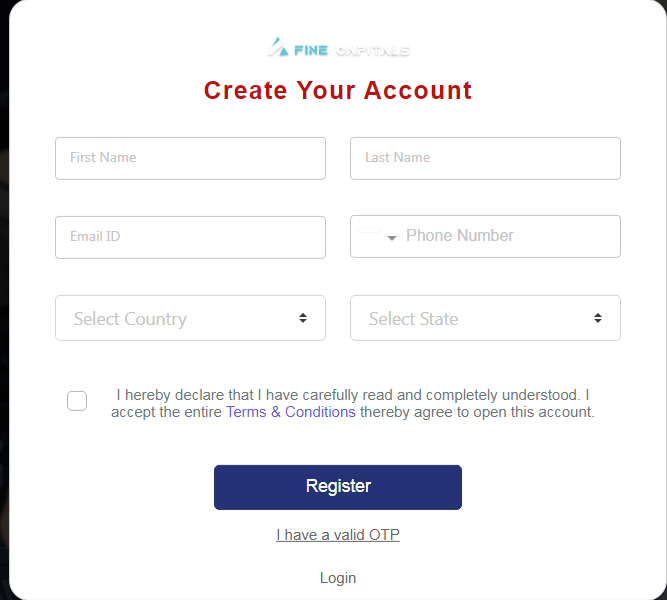

Account Opening on Finecapitals.com

The registration process at Fine Capitals follows a standard procedure commonly seen in brokerage firms. Clients can initiate the registration by providing their personal information, including name, email address, phone number, and country of residence. Once the required information is submitted, Fine Capitals typically sends a verification code to the provided email address.

After verifying the email, clients can get access to the Client Portal, which is designed with a minimalist approach. While the portal’s design is simple, it encompasses all the necessary features and functionalities. Traders can find sections for account management, deposit and withdrawal options, trading platforms, educational resources, and customer support.

Verification

Verification at Fine Capitals is one of the crucial stages of the onboarding process. Without completing this procedure, clients will have limited functionality on the broker’s platform. The standard verification process typically involves providing the necessary documentation to confirm the client’s identity and ensure compliance with regulatory requirements. This may include submitting a valid identification document, proof of address, and, in some cases, additional documents as requested by the broker. Once the submitted documents are reviewed and verified by Fine Capitals’ compliance team, clients can enjoy full access to the platform’s features and services.

- Verification at Fine Capitals is mandatory.

- Convenient uploading form.

- Deadlines for verification of documents are not specified.

Trading Software

Fine Capitals offers MetaTrader 4. MT4 is a widely recognized and established trading platform in the financial industry. It offers a range of features and tools that cater to the needs of both novice and experienced traders. With its user-friendly interface, MT4 provides a seamless trading experience, allowing clients to access various markets, execute trades, analyze charts, and employ automated trading strategies.

One of the notable advantages of MT4 is its extensive library of technical indicators, charting tools, and customizable features.

However, it’s worth mentioning that MetaTrader 5 (MT5) offers enhanced functionalities and a broader range of assets.

| Features | First Capital | Spotinvest | StockHome |

|---|---|---|---|

| Demo Account | ✔️ | ❌ | ✔️ |

| Mobile App | ✔️ | ❌ | ❌ |

| Own Development | ✔️ | ❌ | ❌ |

How Can I Trade With Fine Capitals?

At Fine Capitals, the pricing structure offers a range of account options that allow you to trade currencies and CFDs on various assets. While the broker doesn’t offer anything particularly unique, it provides a selection of three different account types to cater to different trading preferences.

All Info About Accounts

The first account type is the Classic account, which can be funded with a minimum deposit of $100. It’s worth noting that the minimum deposit requirement might be considered relatively high, and cent accounts are not available at Fine Capitals. However, for beginners, there is a demo account available. The Classic account offers a leverage of 1:200 and starts with spreads as low as 1.2 pips. There are no commissions associated with this account type.

The next account type is the ECN account, which requires a minimum deposit of $5,000. With the ECN account, clients of Fine Capitals can enjoy a higher leverage of up to 1:300. The spreads are slightly lower compared to the Classic account, but there is a commission charged on trades.

Lastly, there is the VIP account, which requires a minimum deposit of $20,000. This account type provides clients with the highest leverage available, up to 1:500. Spreads start at zero, but commissions are still applicable.

- Low spreads.

- Commissions.

- High leverage.

Market Analysis and Education With Finecapitals.com

On the Fine Capitals website, we didn’t come across a specific section dedicated to education or market analysis. It appears that the broker is more focused on catering to experienced market participants. Even a small glossary of terms is not included on the website.

On one hand, this can be seen as a positive aspect since Fine Capitals doesn’t engage in unnecessary auxiliary services like signals and others that many other brokers offer. On the other hand, it is still important to provide at least a minimum knowledge base, especially for beginners.

Deposit, Withdrawal, and Fees

Fine Capitals offers a range of unconventional deposit methods. Among them are bank transfers, TronLink, BHIM, and Stripe. However, the list does not include credit cards or well-known payment systems. It is possible that these options are available, but not explicitly mentioned in the user’s account dashboard or personal cabinet.

To withdraw funds from Fine Capitals, it is necessary to go through the verification process. However, the availability of deposits without verification may raise concerns.

| Features | Fine Capitals | Fusion Markets | InternationalReserve |

|---|---|---|---|

| Debit/Credit Cards | ❌ | ✔️ | ✔️ |

| Electronic Payments | ✔️ | ✔️ | ✔️ |

| Crypto Transfers | ✔️ | ✔️ | ❌ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ✔️ | ✔️ | ❌ |

How Can I Contact It?

Fine Capitals offers limited communication options, primarily relying on email as the main method of contact. Unfortunately, live chat support is not available, which may be inconvenient for clients seeking immediate assistance. Additionally, there is a lack of clarity regarding the functioning of their office, as it is unclear whether it can be visited or if it serves as a legitimate physical address. It is important for potential clients to consider these limitations when assessing the level of accessibility and responsiveness they expect from a broker.

- The email address is specified.

- No live chat.

- Most likely no real office.

Is Fine Capitals Dangerous?

Fine Capitals may appear relatively more advantageous compared to some other brokers, but it is important to examine some key aspects.

How Long Does The Broker Work?

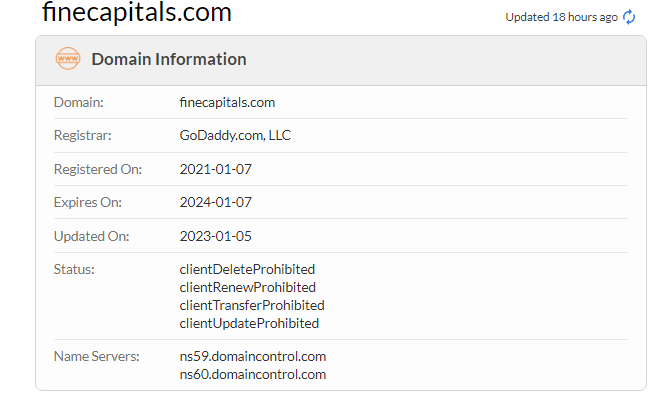

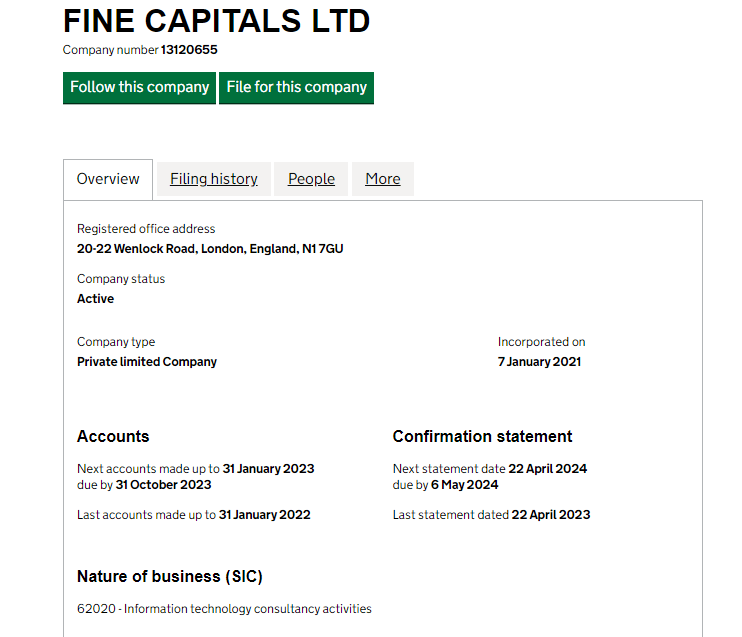

Firstly, let’s consider the broker’s tenure in the industry. Fine Capitals may not be widely recognized. A domain verification indicates that the website was created in 2021. Furthermore, the company, Fine Capitals Ltd, was also incorporated in the same year. Based on this information, it can be concluded that the broker has been operating for a relatively short period of time. It is not an extensive duration. However, it is worth noting that the broker’s performance and reputation should be evaluated based on more factors as well.

How Is Fine Capitals Regulated?

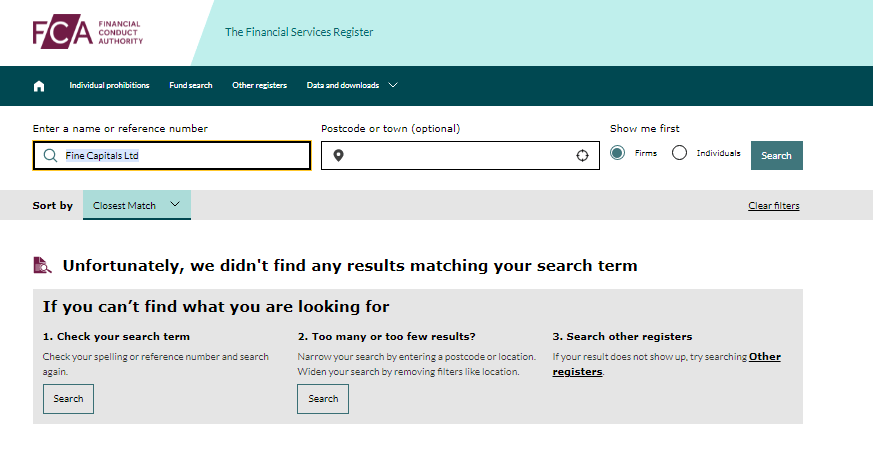

We were surprised by the regulatory information concerning Fine Capitals. It is evident that the broker offers retail traders leverage of up to 1:500, indicating that it is not regulated by European regulators. The company’s official activities are listed as “Information technology consultancy activities.”

Furthermore, the British regulator, the FCA, does not have any records of Fine Capitals in its registry. In other words, although Fine Capitals is a legally registered company, it has chosen not to obtain a license for brokerage services and operates without any supervision. This lack of regulation is indeed concerning and can be considered a significant drawback.

| Features | Fine Capitals | Mitrade | Spotinvest |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ✔️ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ❌ | ✔️ | ❌ |

Frequently Asked Questions (FAQ)

How to Trade With Fine Capitals?

Is Fine Capitals Legit?

How Risky Is It?

Kevin Berry

Kevin Berry You know, it’s quite strange how some brokers seem to think that if they don’t intend to offer their services in a particular jurisdiction, they don’t need to bother obtaining a license from the local regulatory body. Well, let me tell you, there are no real obstacles to becoming licensed, regardless of their target market. It all boils down to the broker’s willingness and ambition. If they’re not willing to ensure full safety and protection for their clients, well, the writing’s on the wall, isn’t it? It’s a matter of priorities, mate. So, traders, make sure you choose a broker who goes the extra mile to ensure your security and peace of mind.

Fine Capitals rating

3 reviews about Fine Capitals

It’s like having two different brokers altogether. I couldn’t make any profits on a real account, although everything seemed easy on the demo. Clearly, the issue lies with Fine Capitals itself. Judging by the reviews I’ve found online, I’m not the only one who thinks this way. I came across a story that mirrored my experience exactly. I won’t be making any further deposits with Fine Capitals; I sense some kind of deception going on.

Before registering, I always search for real people who have traded with the broker, not just read reviews. It’s quite easy to find them on forums and social media. I managed to speak with three individuals who traded here at different times, and all three had a negative experience and left without their money. They all shared similar stories. I have no intention of opening an account here; it’s better to stay away from these troubles.

I’ve tried it numerous times, but to no avail. I decided to withdraw because I experience frequent slippage on the platform, and sometimes the charts go completely haywire. Just to be sure, I checked the same asset with another broker, and such issues were nonexistent. So, I thought it best to withdraw my funds and keep them with me. But it seems they’ve misled me, and now I’m left with nothing, as they’ll likely continue stalling. I strongly advise against Fine Capitals.