Over 578,000 verified users and $0.52 billion in client crypto assets – impressive statistics, aren’t they? Meet Finkea, a broker offering access to a platform for modern-day trading. However, don’t rush to believe these unconfirmed claims, because the firm looks more like a scam than a safe intermediary. Many details are simply missing, for example, the foundation date, legal address, and licenses. Meanwhile, reviews on the internet are quite rare. Let’s try to understand this in more detail.

Table of Contents

Highlights

| 🏛️ Country | – |

| ⚠️ Regulation | – |

| 🖥️ Website | https://finkea.com/ |

| 🎲 Demo Account | No |

| ⏳ Start Time | 2023 |

| 💲 Minimum Deposit | €5,000 |

| ⚖️ Minimum and Maximum Leverage | 1:50 |

| ⚙️ Trading Platform | WebTrader |

| support@f-kea.com | |

| 📞 Phone | – |

First Impression of Finkea.com

The official website is the face of any company. It’s what the user first encounters when getting to know the broker, so the site should not only be well-designed but also contain maximum useful information and a minimum of unnecessary and meaningless text. However, we cannot say this about Finkea’s site.

The broker has filled its resource with meaningless propositions and tons of text that doesn’t provide users with anything useful. For example, the “About us” section should contain information about the company’s founding date, its leadership, licenses, business model, and so on. And what do we see? Nothing. Finkea decided not to add such important details.

Regarding the design, the company chose a combination of dark green and white colors. In the background, you can notice cryptocurrency coins. The site itself is template-based, as we have already encountered similar structures with other companies. The language is only English, with a standard panel at the top with trading conditions, the main page dryly lists Finkea’s advantages, and at the bottom, you can read a warning about the risks of margin trading. No confirmation or proof that this is the safest and most profitable trading. We are simply asked to take their word for it.

Partnership and Bonuses

Finkea offers traders both an affiliate program and bonuses. Unfortunately, the firm does not describe the terms of cooperation for the affiliate program, but a bonus policy is available.

To receive bonuses, you first need to write an email to technical support with consent and a desire to receive bonus funds. These funds cannot be withdrawn until conditions are met: it is necessary to make a turnover of trades equal to the amount of the bonus divided by 4. For example, if a trader received $1,000, then they need to make a turnover of 250 lots, and only after that will Finkea allow withdrawing the bonus and the profit earned with it.

Therefore, we recommend first properly assessing your own strengths before agreeing to such offers.

Account Opening on Finkea.com

Now let’s look at how to create an account and what the personal account interface looks like. This will help us in studying the company, and perhaps we will find some merits or advantages of Finkea.

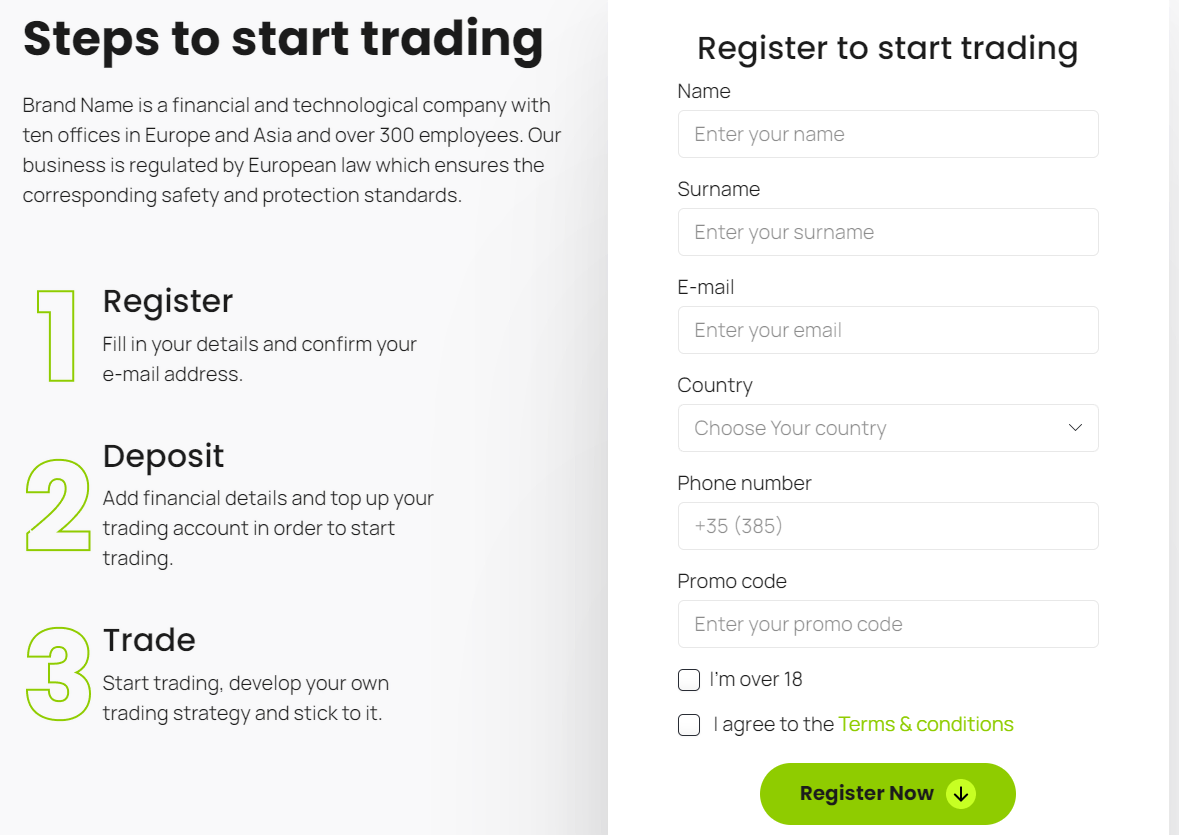

At the moment of registering a personal account, you can see instructions on how to start cooperating with the firm: first registration, then deposit replenishment. The account creation process in Finkea should not cause any difficulties. The firm asks for standard information, including a referral code, if any. The trader must be 18 years of age or older.

Then the personal account opens. By the way, it’s very strange that the system did not require confirming the email address specified during registration. Although this is a common action when creating an account, it’s even described in the instructions, which you can see in the screenshot above.

Finkea offers to use a primitive client portal. Moreover, upon logging in, we are immediately warned that the account is not activated and we need to contact the managers. And what about the step-by-step instructions? Why do we have to deposit money right after signing up?

The demo account is absent. Such an option was not found in the personal account. Moreover, through the client portal, users can submit documents for KYC, perform deposit/withdrawal operations, and view trading history. In general, Finkea does not offer anything interesting.

Verification

Before considering the KYC procedure, we want to remind you not to rush to upload documents to unknown brokerage companies. First, you need to make sure that the broker is legal and verified, as it’s unclear into whose hands your personal data will fall, and what will be done with them later.

Finkea requires clients to provide certain documents. The list of documents includes proof of identity and residence, as well as a copy of the bank card used to replenish the balance. Documents can be uploaded in the personal account, or sent to the technical support email.

- None.

- The firm requires a scan of a bank card.

Trading Software

If we are to believe the official website, the Finkea platform is available in several versions: webtrader, desktop, and mobile trader. Additionally, the terminal supports advisors for auto-trading, pending orders, indicators, various timeframes, and real-time news. The mobile version of the terminal can be downloaded from the site, but only for Android. Is it safe to install unknown software downloaded not from the official AppStore/Play Market but directly from the site? We don’t think so, and therefore we do not recommend doing this.

We encountered problems with further exploring the terminal. It’s unclear how to access the web version of the terminal, and we are not inclined to download and install unknown software. There is no button in the personal account for transitioning to WebTrader, and attempts to access the terminal from the section describing the platform were met with difficulties in entering the login and password. The data from the personal account does not match, and Finkea has not sent anything to the email.

We are left to believe what the broker says about its platform. This is quite foolish, as companies often praise their terminal, but in reality, it often turns out to be primitive software with minimal capabilities.

| Features | Finkea | FxPro | Oanda |

|---|---|---|---|

| Demo Account | ❌ | ✔️ | ✔️ |

| Mobile App | ✔️ | ✔️ | ✔️ |

| Own Development | ❌ | ✔️ | ✔️ |

How Can I Trade With Finkea?

Many brokers use the approach of several account types. That is, the company offers a choice of various tariff plans that differ in minimum deposit and set of additional services. Next, we will examine in more detail what types of accounts are available in Finkea.

All Info About Accounts

The broker offers five types of accounts. It’s worth noting that there is no Islamic tariff. And we have already mentioned the absence of a demo account.

Essentially, the tariff plans in Finkea differ only in the required amount for the deposit and the leverage. For example, the first type of account requires 5,000 euros, and the leverage is limited to 1:10. The second type of account starts from 10,000 euros, with a leverage of 1:20. Meanwhile, the maximum available leverage is 1:50. The logic behind such trading conditions is missing.

Why do traders with a large deposit of 100,000 euros need leverage of 1:50 when it’s not needed for such volumes? And clients with fewer funds precisely need additional leverage to increase volumes.

The other conditions for all users are the same: free VPS, full support 24/5, a dedicated manager, and a minimum trade size of 0.01 lots. Only owners of Expert accounts, starting from 25,000 euros, receive signals and an unlimited number of open positions. Although Finkea tries to extract more money from traders, it can be said that it does so poorly and unsuccessfully. Because there is no sense in opening a more expensive tariff, except for the presence of higher leverage.

The official site mentions spreads from 0 points, but the size of the commission is not specified. The transparency level of Finkea is at rock bottom. The most important detail is hidden.

- None.

- It’s impossible to test the service with a demo.

- Huge minimum deposit.

- Commissions are not disclosed.

Market Analysis and Education With Finkea.com

Finkea offers a section on its website called “Analytics”. What does it include? Exchange tickers, technical analysis, crypto market, market quotes, and trading hours. Small but useful widgets, but for some reason, an economic calendar and financial news are missing. However, clients can use an online converter for cryptocurrencies. For example, you can estimate how much Bitcoin is worth not only in dollars but also in euros, pounds, and even Serbian dinars.

Deposit, Withdrawal, and Fees

Information on deposit/withdrawal methods is scattered throughout the site. Moreover, it’s impossible to check which methods are supported in the personal account without account confirmation. Finkea mentions credit/debit cards, e-wallets, and cryptocurrency. No commission is charged.

We want to remind you that using cryptocurrency for payments allows the recipient to remain anonymous. Moreover, it’s impossible to cancel a transaction or receive a chargeback.

| Features | Finkea | NPBFX | Odyssey Investment Group |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ✔️ |

| Electronic Payments | ✔️ | ✔️ | ✔️ |

| Crypto Transfers | ✔️ | ❌ | ✔️ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ❌ | ❌ | ❌ |

How Can I Contact It?

Users can contact managers via email, while a phone number and online chat are absent. You can also try your luck and submit a request for feedback; perhaps the staff will respond. Finkea does not have social media accounts and does not disclose the exact address of its headquarters. These are important details that show how open and transparent a firm is to its clients.

- None.

- Phone, online chat, and social media accounts are not available.

Is Finkea Dangerous?

This broker is more dangerous and suspicious than reliable and verified. The trading conditions only cause bewilderment, especially the requirements for the minimum deposit. Meanwhile, the firm behaves very secretly, as many details are simply unknown. Well, let’s check if Finkea has any licenses and when the platform was launched.

How Long Does The Broker Work?

In the personal account, at the very bottom, you can see the date 2013, which hints at the founding date of the company. However, we believe that this is just a number that has no relation to the actual operation period of the firm. The domain of the official Finkea website was registered on November 21, 2022. At the same time, we do not rush to conclude that the broker started working in 2022.

To get the exact launch date of the platform, we sought help from the WebArchive service and found their snapshots, which showed us that on January 8, 2024, the domain was for sale. This tells us that Finkea actually started operating quite recently.

How Is Finkea Regulated?

The fact that the broker does not specify licenses and its legal address already says a lot about the company. Verified firms usually do not engage in such practices. They detail all the addresses of headquarters and branches, as well as licenses, their numbers, and links to registries. Finkea, however, hides all these important details.

Although in the client portal, you can notice a mention of the European Economic Area, it is unlikely that such an organization is really registered in this zone. Most likely, it is the same fake information as the year 2013.

| Features | Finkea | Graystone Venture Capital | Clark Financial |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ❌ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ❌ | ❌ | ❌ |

Frequently Asked Questions (FAQ)

Kevin Berry

Kevin Berry Here is an example of a fresh brokerage scam that steals money from all its clients. So don’t even think about transferring funds to these fraudsters, or you’ll lose them entirely. There’s no doubt about Finkea’s fraudulent activity. No license, the operation period is just a couple of weeks as seen from webarchive snapshots, no legal address is provided, and the business model also involves a conflict of interest since it’s a dealing desk. Is there anything positive? No. Even the minimum deposit is huge – 5,000 euros. What are these fraudsters thinking? They can’t even offer a demo account. In short, it’s a scam, period.

Finkea rating

1 review about Finkea

If you’ve made a deposit with Finkea, congratulations, you’ve fallen for a scam. Yes, that’s the sad news for those who decided to trust blatant fraudsters and swindlers. Such a company does not exist, it is not registered anywhere, meaning its activity is fake. And moreover, the broker cannot have a license. A typical scam platform with fake liquidity. Nothing new, really. A typical scheme that deceives thousands and tens of thousands of traders every day. Please, don’t fall for this fraud.