The CFD broker Fundiza has an average rating of 3.5 in reviews, which is neither good nor bad. It is known that the company is registered offshore in Saint Vincent and the Grenadines, and operates without a license, as it is not even mentioned on the website. The duration of the operation is unknown, which is something we still need to find out. Clients have access to 500 assets and leverage. Overall, the organization requires thorough verification because it can easily turn out to be a scam.

Table of Contents

Highlights

| 🏛️ Country | St. Vincent & Grenadines |

| ⚠️ Regulation | – |

| 🖥️ Website | https://fundiza.com/ |

| 🎲 Demo Account | No |

| ⏳ Start Time | 2020 |

| 💲 Minimum Deposit | $5,000 |

| ⚖️ Minimum and Maximum Leverage | 1:400 |

| ⚙️ Trading Platform | WebTrader |

| services@fundiza.com | |

| 📞 Phone | +1-(888)-964-7227 |

First Impression of Fundiza.com

Upon entering the website, we are greeted with images of buyers and sellers in the form of a bull and a bear. We are immediately offered to make the right choice and start trading with Fundiza. The main page essentially consists of a banal and boring enumeration of opportunities and conditions. Nothing special.

The top panel is quite standard, but an important “About us” section is missing:

- Markets.

- Platform.

- Trading info. Account types, conditions, contacts, and FAQs.

At the bottom, one can find legal documents, Fundiza’s address, and a classic warning about the risks of margin CFD trading.

Fundiza does not tell anything about itself. Licenses, duration of operation, and business model remain a mystery to us. At least the legal address is indicated, and that’s something to be thankful for. The site supports 6 languages, including Arabic, Russian, and Azerbaijani. In fact, nothing particularly special or interesting. A standard and boring website, although not made from a ready-made template, but with mistakes and clearly unfinished parts. For example, the section with information about the platform, where the text merges with the terminal picture, and you have to highlight it to read.

Partnership and Bonuses

From time to time, the broker may offer bonuses and other promotions. However, Fundiza offers these bonuses under certain conditions. First, there is a time limit. Second, the client is required to perform a certain volume of trades before the possibility of withdrawing bonuses opens up. Alas, the details are not disclosed by the company.

On the official Fundiza website, we found no information about an affiliate program. However, at the moment of registration, the firm offers to enter a referral code. What is this, if not a referral program?

Account Opening on Fundiza.com

Without an account, you cannot start trading, so let’s look at how to register, what the personal account looks like, and what opportunities are available to users. Thus, registration at Fundiza begins with providing personal information:

- Date of birth.

- Name.

- Phone number and email.

- Referral code (if any).

- Base currency (USD/EUR).

- Address.

In addition, it is necessary to check the box agreeing to all the conditions described in the legal documents and stating that the trader is not a resident of the USA.

The registration process is quite tedious. Why enter residential address data if this can be done later when the trader undergoes identity verification?

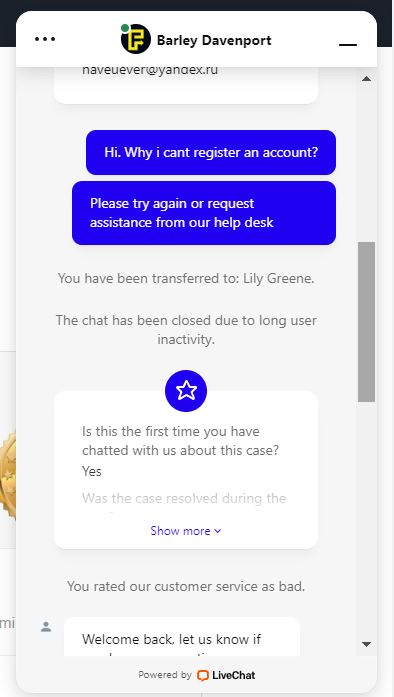

We were unable to create an account. Fundiza displayed the message “Please try again or request assistance from our help desk”. We tried different data, but it did not help. It turns out that registration cannot be completed without contacting technical support. Even a demo account cannot be tried, as such an option is absent.

Verification

On the official website, you can find a document dedicated to the AML & KYC policy. It describes what it is, why it is needed, and who requires it. We will briefly describe that Fundiza requires its clients to undergo identity verification. This is a standard process that includes uploading documents verifying identity and confirming the place of residence. It is also necessary to upload a photo/scan of a bank card if it is used for depositing.

We recommend not rushing with identity verification, but first thoroughly checking the company. It is better not to send your personal data to unclear and little-known firms, as it is unclear where they will end up in the end.

- Clients can look into AML&KYC’s policy.

- The firm requires a photo of a bank card.

Trading Software

Fundiza describes its trading terminal very pompously and in detail: 21 timeframes, technical indicators, drawing tools, market depth, and all types of orders. Moreover, the company claims that its platform is available on Mac, Windows, and Linux, as well as on Android/iOS smartphones. However, no links are provided.

How the terminal actually looks and what capabilities it has, we do not know. Believing how Fundiza describes the software is also foolish, as in practice we have noticed that brokers often overpraise their platforms.

| Features | Fundiza | Kiexo | AU Venture |

|---|---|---|---|

| Demo Account | ✔️ | ❌ | ❌ |

| Mobile App | ✔️ | ✔️ | ✔️ |

| Own Development | ✔️ | ✔️ | ❌ |

How Can I Trade With Fundiza?

To understand how profitable trading can be, it is necessary to consider the types of accounts, as the conditions depend on the chosen tariff.

All Info About Accounts

Fundiza has developed five types of accounts for its clients. The logic behind such a lineup of tariffs is very simple – if a client wants more services, they need to have a larger deposit. This approach is most often used by fraudulent and illegal organizations.

Here is a brief description of the tariffs:

- Rookie. The minimum deposit is $5,000. Floating spreads and assistance from a personal manager are included. It is worth noting that such a size of the initial deposit is excessively high, and there are not so many additional services, while the specific size of the spreads is not disclosed. A table with contract specifications is not presented.

- Basic. The requirements for the minimum deposit are even higher – at least $25,000. Premium signals are added, but their profitability and examples of past trades are not shown.

- Elite. From $100,000 and more. The requirements go beyond what is reasonable. The client receives a 10% discount on commissions, daily signals, a private 1-on-1 trading academy, and private sessions.

- Elite Plus. From $250,000. Access to the event room and a trial period for VIP services.

- VIP. The last tariff is for those who can afford a deposit of 1 million dollars. The difference from the previous account types is the availability of video courses and webinars. Also, a 50% commission discount is available.

Regarding the important trading conditions, only leverage and the type of spreads are known. The size of spreads and commissions is not indicated, making it impossible to determine whether trading with Fundiza is profitable or not.

- Not found.

- No demo.

- $5,000 is a very high minimum deposit.

- Hidden fees and spreads.

Market Analysis and Education With Fundiza.com

On the main page, the broker has embedded its YouTube videos, which discuss financial markets and various economic events. However, Fundiza does not provide anything else. For example, useful tools such as an economic calendar, news feed, fresh analytics, or a calculator for calculating position parameters are missing.

Deposit, Withdrawal, and Fees

According to the FAQ on the official website, clients can deposit and withdraw money using credit/debit cards (Mastercard or Visa) and e-wallets (Skrill or Neteller). Withdrawals at Fundiza take from 3 to 5 business days.

| Features | Fundiza | Exton Global | FiatVisions |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ✔️ |

| Electronic Payments | ✔️ | ✔️ | ❌ |

| Crypto Transfers | ❌ | ✔️ | ❌ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ❌ | ❌ | ❌ |

How Can I Contact It?

Firstly, clients can seek help through online chat. We did so when we were unable to register an account. However, the managers simply ignored us and did not even respond.

Secondly, Fundiza provides a phone number and an email address. Checking these contacts showed us nothing. The email is real, and the phone number is not listed anywhere else, only on the broker’s website.

Thirdly, the broker has accounts on social networks Twitter, Instagram, and Facebook. However, there are almost no followers, and the activity is low. It is unlikely that Fundiza is a well-known and popular firm.

- All methods of communication are available.

- Online chat is not answered.

- Few followers on social media.

Is Fundiza Dangerous?

As practice shows, if there are problems with account registration, this indicates potential fraud. Often, with illegal brokers, one cannot freely create an account for unknown reasons, and it’s necessary to contact technical support. Therefore, Fundiza looks more like a dangerous rather than a reliable platform. One should not forget about the trading conditions, which also resemble those we constantly see with dishonest organizations.

Next, we will examine how long the firm has been operating, what licenses it has, and draw a conclusion.

How Long Does The Broker Work?

The specific founding date is not mentioned on the website, and it’s unclear why. We’ll try other means to determine when the company approximately began its operations. Social media accounts were created in 2020, and some online reviews are also dated this year. The domain of the official website was registered in 2014, but it requires further verification.

WebArchive contains many snapshots, but only one from 2018. All the others are from 2020 and later. In 2018 the website was not operational, and in 2020 we already see the broker offering services. Therefore, it can be concluded that Fundiza began offering its services in 2020, i.e., 4 years ago.

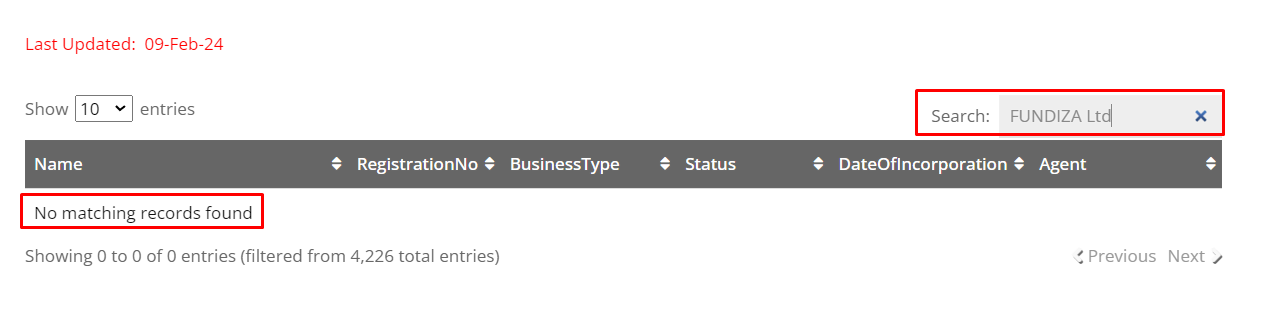

How Is Fundiza Regulated?

This is an offshore firm, as its legal address is in Saint Vincent and the Grenadines. Notably, FUNDIZA Ltd was not found by us in the SVGFSA registry.

So how does the firm operate? Illegally. Its official registration is also in question.

| Features | Fundiza | National Trade Center | CryptoLogicIQ |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ❌ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ❌ | ✔️ | ❌ |

Frequently Asked Questions (FAQ)

Kevin Berry

Kevin Berry It’s astonishing that such an organization still exists, given that it appeared in 2020. However, there’s no doubt about its illegal activities, so there’s no point in trying to register an account and then deposit funds, as you will lose all your money. Fundiza promotes itself through fake positive reviews, which is a very serious and important red flag. And let’s not forget other significant downsides: lack of a license, an offshore legal address provided, and a dealing desk.

Fundiza rating

4 reviews about Fundiza

I traded here a bit, but I didn’t like it. fundiza.com offers unfavorable conditions. Large spreads plus the need to pay commissions – in the end, trading turns into a losing business. I have nothing against the company, but it needs to reduce commissions or spreads. Perhaps they have already lowered them, as the last time I traded here was in 2021. I don’t know.

I still can’t get my $8,000 back. I traded with Fundiza back in 2022, and now it’s 2024. I sometimes write to scammers, but they don’t even respond. They didn’t respond even before.

It turned out to be a fake and fraudulent company that took my money. For me, it was a serious blow to my wallet, unpleasant and sad.

Any positive reviews about this trash – scam and fake. Don’t even read them. These shameless fraudsters have gone mad, operating for several years, engaging in fraud, and continue to write fake reviews about themselves. Many people have lost their deposits here, but the fraudsters continue their fraudulent activities. PEOPLE! You can’t withdraw money from here! Don’t even try! Look, the swindlers even closed registration, A SIGN THAT YOU SHOULDN’T GET INVOLVED!

I recently read reviews about Fundiza. There are many negative reviews where people were simply deceived and had their money taken. Some were scammed out of tens of thousands of dollars by their mother, some were duped themselves and gave their money to these swindlers and fraudsters. In fact, it’s quite obvious that this brokerage firm is involved in a scam. Why? Because there’s no license, the conditions are inadequate, and looking at the website, nothing good can be said. Fellow traders, learn from other’s mistakes, not your own. Here you see that people lose money here, please do not invest here.