Greendax, a broker offering trading in digital pairs, has caught our attention. However, whether it is a scam or a reliable platform remains to be determined. In this independent review, we will delve into the details and present our findings. Stay tuned for the results.

Table of Contents

Highlights

| 🏛️ Country | Hong Kong |

| ⚠️ Regulation | — |

| 🖥️ Website | https://greendax.com/ |

| 🎲 Demo Account | No |

| ⏳ Start Time | 2022 |

| 💲 Minimum Deposit | $2,500 |

| ⚖️ Minimum and Maximum Leverage | 1:1-1:400 |

| ⚙️ Trading Platform | Unknown |

| info@greendax.com | |

| 📞 Phone | +18008316765 |

First Impression of Greendax.com

The Greendax website exhibits a generic and uninspiring design, lacking any distinguishing features. It is flooded with excessive self-promotion, giving the impression of a desperate attempt to attract attention.

On the positive side, Greendax does provide some legal information, including relevant disclaimers and terms of service. The presence of contact details, such as phone numbers and email addresses, is commendable.

Partnership and Bonuses

We noticed the absence of information on the website about a partnership program or bonuses. However, it is worth mentioning that during the registration process, clients are prompted to enter a promotional code. This suggests the possibility of a referral program or other incentives offered by the broker upon registration.

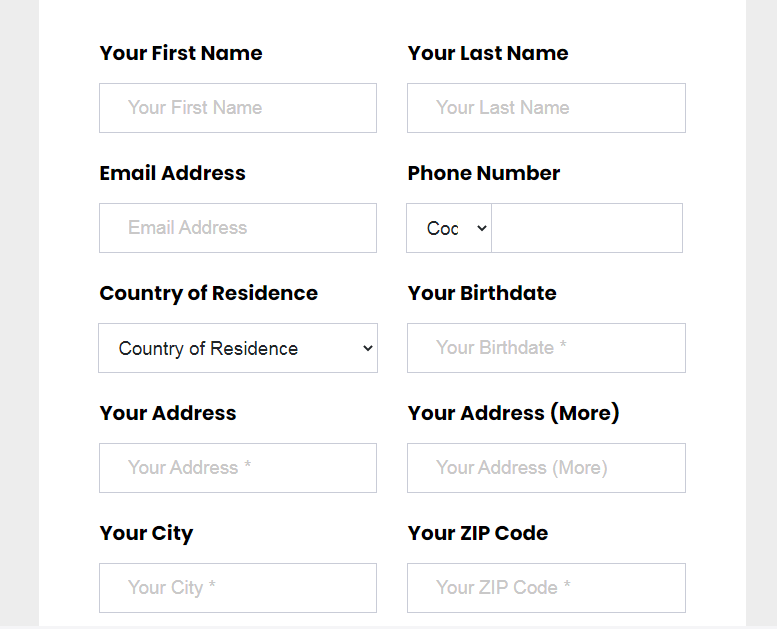

Account Opening on Greendax.com

The registration process with Greendax is notably complex and time-consuming. Prospective clients are required to complete an extensive questionnaire that demands detailed personal information, including address details. This intrusive approach to registration may deter some users who value their privacy and prefer a more streamlined process.

As for the Client Portal, it offers standard functions expected from a broker, such as account management, deposit and withdrawal options, and access to trading platforms. However, there are no standout features or innovative tools that would differentiate it from other brokers in the industry. It is a functional but unremarkable Client Portal.

Verification

Greendax requires mandatory verification for all clients. To complete the verification process, users need to provide certain documents and information. Here is an outline of the typical requirements.

- Identity Verification. Clients are required to submit a clear and valid copy of their government-issued identification document, such as a passport or driver’s license. The document should display the client’s full name, date of birth, and a clear photograph.

- Address Verification. Clients need to provide proof of their residential address. This can be done by submitting a recent utility bill, bank statement, or any official document that clearly displays the client’s name and address.

- Financial Information. Clients may be asked to provide additional financial information, such as bank statements or proof of income, to comply with anti-money laundering (AML) regulations and ensure the legitimate source of funds.

- Verification is mandatory.

- The broker asks for a lot of documents.

Trading Software

Greendax uses a relatively unknown trading platform that is not available for download from the official app stores. Instead, it can only be accessed through the broker’s personal cabinet. The platform offers both a mobile version and a desktop version, but it is worth noting that the web trader option tends to provide the best performance.

However, it is important to acknowledge that this choice of platform is somewhat controversial and may not have the same level of recognition and reputation as more established trading platforms.

| Features | Greendax | Crypto Comeback Pro | Genesis Exchange |

|---|---|---|---|

| Demo Account | ❌️ | ❌ | ❌ |

| Mobile App | ✔️ | ❌ | ❌ |

| Own Development | ✔️ | ❌ | ✔️ |

How Can I Trade With Greendax?

The broker claims that one account is never enough, offering multiple options to cater to different traders.

All Info About Accounts

In total, Greendax provides 6 types of accounts, although the VIP account, which requires a minimum deposit of at least $250,000, can be considered out of reach for most. Even for beginners, the minimum deposit for their account is $2,500, without the availability of a demo or cent account. Additionally, traders with initial accounts will face limited access to trading assets, with full access only granted on the Advanced account. Guess how much is required for that account? You’re right, a staggering $50,000.

Interestingly, instead of providing a detailed description of their trading conditions, the broker vaguely mentions near-market services. It is only in the FAQ section where we can find information about leverage.

- None.

- High minimum deposit.

- Conditions are not described in detail.

- High leverage.

Market Analysis and Education With Greendax.com

While the broker offers market analysis and educational resources, these services appear to be better and more accessible with higher payment commitments. Essentially, newcomers, who would seemingly benefit from these services the most, are not provided with adequate support. It becomes evident that Greendax is primarily focused on catering to clients with substantial deposits.

Deposit, Withdrawal, and Fees

You can fund your account on the broker’s platform using various methods. These include credit and debit cards from Visa and Mastercard, as well as cryptocurrencies. However, no information is provided regarding the associated fees. Similarly, details regarding withdrawal options and processing times are not specified.

| Features | Greendax | Crypto Comeback Pro | AI Global Group |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ❌ | ❌ |

| Electronic Payments | ❌ | ❌ | ❌ |

| Crypto Transfers | ✔️ | ❌ | ❌ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ❌ | ❌ | ❌ |

How Can I Contact It?

To contact Greendax, you have multiple options available. The broker provides a telephone number, an email address, and even a live chat feature. However, we have doubts about the provided address. It is unlikely that the physical office of the broker is located there; it is more likely to be a legal address.

- Full contacts.

- No real office.

Is Greendax Dangerous?

Having examined the trading conditions, it is now time to delve into other important aspects, such as the legitimacy of Greendax.

How Long Does The Broker Work?

Strangely enough, the broker’s website does not mention anything about its industry experience. Therefore, we decided to investigate the status of its domain. The investigation revealed that the domain was relatively old. However, prior to 2022, it did not belong to Greendax but was available for sale. This raises concerns as to the broker’s credibility, as a significant track record is lacking.

How Is Greendax Regulated?

Furthermore, Greendax claims that its managing company is registered in Hong Kong. With due diligence, we were able to verify this information by consulting the relevant registry. And guess what? We could not find any entity named Greendax Limited registered in Hong Kong. Moreover, it is worth noting that the broker lacks any licenses whatsoever, not even one from offshore. It operates entirely illegally, offering its services without proper authorization.

| Features | Greendax | Vortexyl | Ai Global Group |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ❌ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ❌ | ❌ | ❌ |

Frequently Asked Questions (FAQ)

How to Trade With Greendax?

Is Greendax Legit?

How Risky Is It?

Kevin Berry

Kevin Berry Alright, let me drop some expert knowledge on you. When I dug into Greendax’s user agreement, I couldn’t help but chuckle. Guess what? It doesn’t mention any specific jurisdiction. Talk about being vague! But that’s not all. Greendax reserves the right to block your access to the platform if they suspect your actions are unlawful or if they simply think you’ve provided them with false information. Imagine being Anna and they’re like, “Nah, we don’t believe you.” Boom, blocked! Gotta admit, it’s quite the move. So, my friends, keep your eyes peeled and avoid such shenanigans.

Greendax rating

3 reviews about Greendax

Welcome, newcomers! Greendax was created to take your money and leave you empty-handed. They lure you in with education, favorable conditions, a plethora of tools, analytics, and so on. They’re incredibly cunning and resourceful! I wouldn’t advise you to go anywhere near them. For some reason, people think they can outsmart a system that has already deceived thousands of individuals. The main scenario is that money simply disappears from your account or vanishes during a withdrawal. It’s gone, and it never arrives in your hands.

Personal managers, trading signals, ready-made strategies – they have all these tricks up their sleeve. The managers are focused on squeezing every penny out of the client. They advise taking out loans, borrowing money, and finding ways to come up with funds because trading through their platform will supposedly bring clients multimillion-dollar earnings. When asked why they themselves aren’t millionaires lounging in Miami, they respond with, “Oh, we’re just here to help people become wealthier.” It’s all nonsense, don’t believe a single word, whether it’s on their website or from the mouths of their sales managers and representatives of this shady company. They can’t even provide accurate company information. These scammers are hiding, and they’re hiding because they have something to hide.

They lie about work experience and other data. I thought they were a top-notch broker, a real professional, up until a certain point. That was until I discovered that the company simply bought this domain a few months ago. The same reviews confirm my conclusion that the broker started its operations quite recently.