Can a broker with two offices in London and one in Dubai turn out to be a scam? It’s quite possible, as these representations still require thorough verification. Integra Asset Management lists the addresses of its offices precisely in these jurisdictions, while the number of active users exceeds 134,000, and the processed orders are over 2 million. This is not our fabrication, but information taken from the official website. There are so few reviews on the internet that it’s quite obvious the figure of 134,000 traders is fictitious. So let’s try to understand what this platform is and whether it can be trusted with money.

Table of Contents

Highlights

| 🏛️ Country | United Kingdom, UAE |

| ⚠️ Regulation | – |

| 🖥️ Website | https://integraassetmanagement.com/ |

| 🎲 Demo Account | No |

| ⏳ Start Time | 2023 |

| 💲 Minimum Deposit | €100 |

| ⚖️ Minimum and Maximum Leverage | 1:50-1:500 |

| ⚙️ Trading Platform | WebTrader |

| support@integraassetmanagement.com | |

| 📞 Phone | +441678250008 |

First Impression of Integraassetmanagement.com

The official website of Integra Asset Management contains statistics on the broker’s activities, information about trading conditions, including the platform, account types, and tradable assets, as well as pseudo-advantages that cannot be called advantages.

Integra Asset Management decided not to waste time and resources, so they took a ready-made template and applied their text, which looks more like fiction and was generated by a neural network. There are many pompous expressions, some meaningless propositions, and other details that have absolutely no significance.

From a design perspective, it’s also bad. Where are the unique designs and beautiful pictures? In general, Integra Asset Management has presented a website made with minimal expenses, so there is no talk of any seriousness and solidity of the broker. Moreover, such an important element as legal documents is missing.

Partnership and Bonuses

Judging by the official website, there is no affiliate program in Integra Asset Management. Although at the time of registration, users can enter some promo code. Perhaps this is the very referral program? Why then does the company hide this, and also does not provide information regarding the conditions? This only speaks of the secrecy and opacity of the broker.

Additionally, Integra Asset Management offers bonuses on deposit replenishment, but only those who can afford to replenish the balance with at least 50,000 euros can receive them. And it is unknown under what conditions these bonuses are given. How much trading turnover is required and within what time frame? Unknown.

Account Opening on Integraassetmanagement.com

To get inside the company and explore its client portal and terminal, one must create an account. Integra Asset Management offers a simplified and fast process, where it’s enough to provide a name, contacts, and a password to register.

By the way, if you want to try a demo account to practice, study the interface, and test the platform, we have bad news for you. The broker does not offer such an opportunity, so you will have to invest and risk real money.

After successful registration, the trading platform opens, which, as it turns out, is integrated into the personal account. It’s a super-inconvenient and maximally unsafe solution. Apparently, Integra Asset Management did not want to spend on creating or connecting a separate trading terminal, so they presented a 2-in-1.

The interface of the personal account is very primitive. Yes, on the one hand, it’s good because beginners can easily figure out where to click and what to press. On the other hand, it again confirms our opinion about Integra Asset Management as a negligent and non-serious broker.

Clients can edit personal data, upload documents for KYC, deposit funds, withdraw money, and view transaction history. In general, usual actions and nothing interesting or unique. We did not find any functionality for an affiliate program; apparently, one must contact managers for details.

Verification

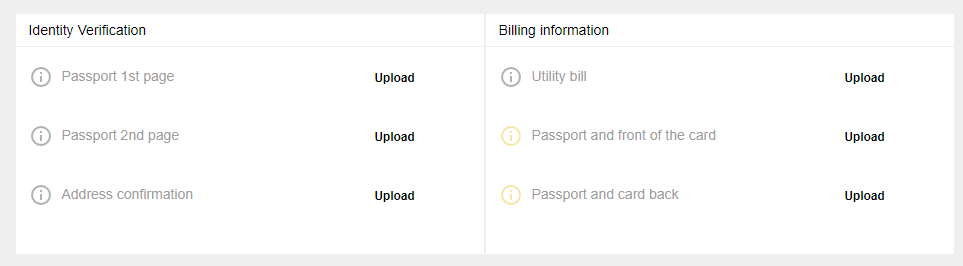

According to the “Profile” section in the personal account, Integra Asset Management requires uploading several types of documents:

- Passport, first and second page.

- Utility bill or another document confirming the address of residence.

- Photo/scan of both sides of the bank card.

The set of required documents is standard, but at the same time, the AML&KYC policy is missing, meaning we do not know whether the verification procedure is mandatory in Integra Asset Management or not. Moreover, the company does not even warn that users need to obscure part of the card number and CVV for security purposes. It’s a careless attitude towards clients, honestly.

- Not found.

- The policy AML&KYC is absent.

Trading Software

We already mentioned that the platform at Integra Asset Management is integrated into the personal account, so traders can forget about comfort and convenience. Besides, the terminal lacks applications for Android/iOS smartphones. Although likely, the trading terminal is adapted for mobile browsers, it still cannot fully replace a mobile application, which has better optimization, performance, and security.

The chart and tools are taken from the popular service Tradingview, but without the ability to upload own indicators and setting templates, as well as connect indicators created by other traders. Therefore, users can perform technical analysis, overlay indicators, graphical elements, and switch timeframes. Also, the platform interface is translated into Russian and German languages, and light and dark color themes are available.

Integra Asset Management has presented its clients with a low-quality terminal. Many advanced options are not available, and separate applications for smartphones and computers are not developed. The platform is clearly inferior to other, more popular and well-known alternatives.

| Features | Integra Asset Management | Ixxen | RichPointCapital |

|---|---|---|---|

| Demo Account | ❌ | ❌ | ❌ |

| Mobile App | ❌ | ✔️ | ❌ |

| Own Development | ❌ | ❌ | ❌ |

How Can I Trade With Integra Asset Management?

Now we’ll examine whether trading here is profitable and what services are available to clients. Essentially, we need to study the tariff plans at Integra Asset Management, as the choice of account type determines everything else.

All Info About Accounts

Integra Asset Management offers traders several types of accounts:

- Classic. Requires a minimum deposit of €100. In return, the client gets leverage up to 1:50, immediate execution, personal support, and some kind of 7-day trial period without an explanation of what it entails. Notably, this tariff likely allows trading only in currency pairs, as other asset classes become available in the following account types.

- Silver. The minimum deposit is €2,500. It differs from “Classic” in that the leverage is 1:100, cryptocurrencies and metals are available, as well as deposit protection.

- Gold. From €10,000. A broader leverage of 1:200. And what’s the point of this tariff?

- Platinum. From €50,000. Bonuses appear, and the leverage is 1:400.

- VIP. At least €100,000. More favorable conditions, including the presence of signals.

Why would traders, who can afford a deposit of €50,000 or more, need such high leverage? Wouldn’t it have been wiser to offer 1:400-1:500 to those who do not have such substantial amounts? Apparently, the management of Integra Asset Management did not consider this, or they deliberately offered such leverage ratios to those with a lot of money, as using leverage also increases risks.

Overall, there is a noticeable use of the principle “if you want more services – pay more money”. Notably, this principle is most often followed by fraudulent firms. Moreover, Integra Asset Management does not disclose the size of commissions and spreads, calling them simply profitable and tight. So, this once again shows the broker’s secrecy.

There is no demo account – we have already mentioned this. There is also no Islamic tariff, ECN, or cent account type. In general, trading conditions cannot be called favorable or interesting.

- A low minimum deposit.

- No demo and no Islamic account.

- Hidden fees and spreads.

Market Analysis and Education With Integraassetmanagement.com

There are no fresh analyses and educational resources, including trading courses, available here. Integra Asset Management offers only a brief description of tradable assets, guides on cryptocurrencies, an online table, exchange operation hours, and links for downloading remote desktop connection software like Anydesk and TeamViewer. Even useful widgets such as an economic event calendar, a financial news feed, or calculators are missing.

Deposit, Withdrawal, and Fees

According to the description from the official website, Integra Asset Management offers to use all major methods for money transfers: credit/debit cards, bank wire transfers, crypto, and Skrill/Neteller/Sofort. The processing time for withdrawal requests is not specified, but the company noted that it depends on the transfer method. Meanwhile, the firm has no mention of commissions either.

We want to add about cryptocurrency transactions. The fact is that the technology of digital currency implies the impossibility of getting a chargeback. If you’ve sent funds, only the recipient can return them to you. Moreover, using cryptocurrency allows the recipient to remain anonymous, as only a wallet address is needed for the transaction.

| Features | Integra Asset Management | Wiolin | FinBitPro |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ✔️ |

| Electronic Payments | ✔️ | ❌ | ✔️ |

| Crypto Transfers | ✔️ | ✔️ | ❌ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ❌ | ❌ | ✔️ |

How Can I Contact It?

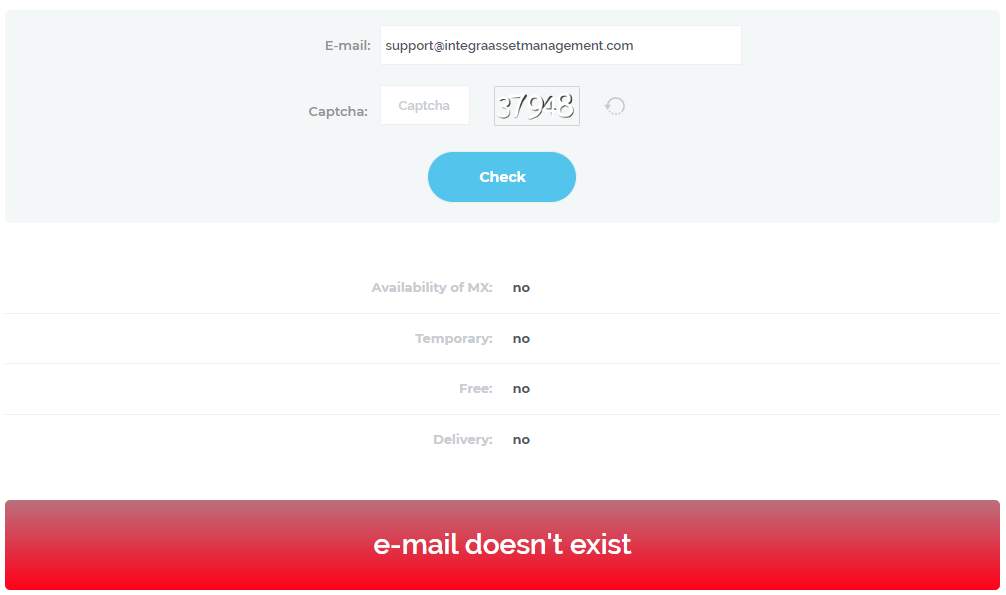

Integra Asset Management has provided only one phone number and one email address for contact with managers, which certainly does not characterize it as a major and global brokerage firm. Moreover, one should not even expect a response by email, meaning it’s not worth writing there because the address is fake.

No other ways to communicate. Social networks are absent, as is an online chat on the website. There are also serious suspicions that the phone number at Integra Asset Management is fake too.

- Not found.

- Fake email.

- No online chat.

Is Integra Asset Management Dangerous?

One can’t say that we are dealing with some safe and profitable broker that can definitely be trusted. Quite the contrary, the firm already raises serious concerns and negative thoughts. There are many red flags, and we haven’t even looked at the legal address, duration of operation, and other data from the activities of Integra Asset Management. So, let’s do that now.

How Long Does The Broker Work?

Judging by the small number of reviews on the internet, it’s unlikely that Integra Asset Management has been operating in the brokerage service market for a long time. Although it is stated that the number of clients exceeds 134,000, we suspect this information to be false. Moreover, the short period of operation is confirmed by the young domain of the official website, which appeared just a few months ago – on December 22, 2023.

How Is Integra Asset Management Regulated?

Regarding the legal registration of the company, it is located in two jurisdictions: the United Kingdom and the UAE. At least, that is where the broker’s offices are based. So let’s find out whether this is true or not, and whether Integra Asset Management is regulated.

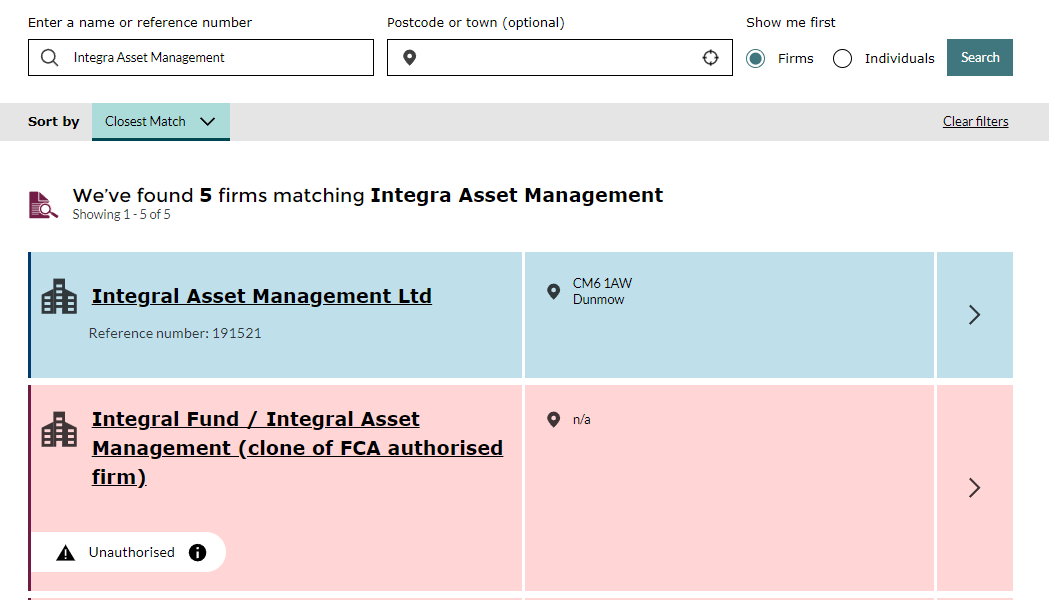

A check with the FCA, which regulates the activities of British organizations, showed nothing. There are firms with similar names found, but Integra Asset Management is specifically absent among them.

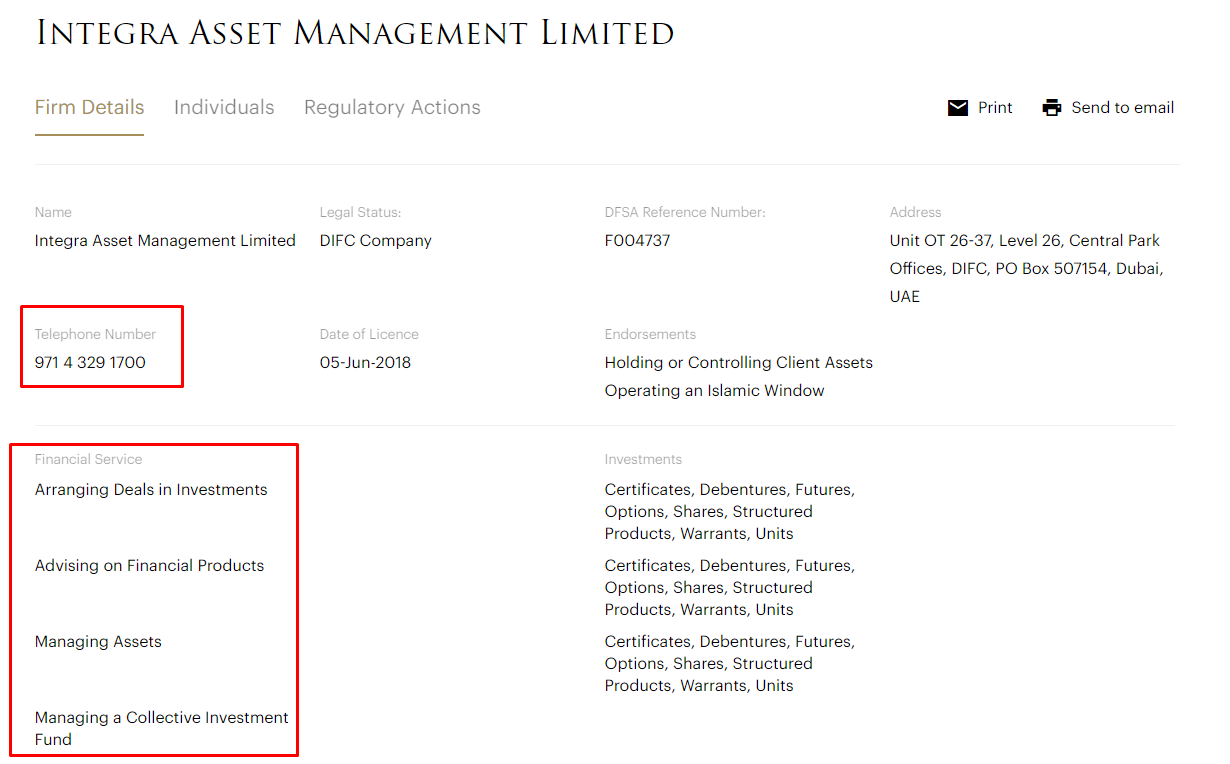

In the Dubai registry, the DFSA, an organization with that name was found, registered on June 5, 2018. However, don’t rush to think that this is the same firm we are discussing. The fact is that the DFSA registry is home to an entirely different company that does not engage in brokerage services in the Forex/CFD market; its activities include asset management, financial product consulting, and arranging deals in investments. We also found its website: integra.am. So, our Integra Asset Management is using another company’s license.

| Features | Integra Asset Management | Arbitrage Markets | FxRevenues |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ❌ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ❌ | ❌ | ❌ |

Frequently Asked Questions (FAQ)

Kevin Berry

Kevin Berry That’s unexpected! Although I suspected there would be some catch, and here it is. The license mentioned on the site belongs to an entirely different company. This is a typical scammer’s trick, as is lying about having more than 100,000 traders. Integra Asset Management tries to create the impression of an experienced and safe broker, but it is not. We are facing a classic fraudulent firm operating as a dealing desk, meaning it steals money from all its clients.

Integra Asset Management rating

1 review about Integra Asset Management

I’m such a fool 🙁 I believed the scammers from Integra Asset Management, so I transferred them 500 euros. I didn’t know it was a fraud. Nobody advised me, and I couldn’t find any decent reviews on the internet. I believed they had a license, but it’s actually fake, belonging to a completely different organization. I realized this five days after submitting a withdrawal request. The money has still not been withdrawn. The scammers are not responding and don’t even plan to return the deposit.