Korata is a CFD broker offering margin trading on over 500 assets across various market classes. It’s an offshore company with a small number of reviews online, operating without a license. The firm assures us that it provides impeccable and beneficial conditions, secure and reliable access to trading. However, we don’t believe this, as we suspect it’s just another offshore scam. Why? Let’s delve into it.

Table of Contents

Highlights

| 🏛️ Country | Saint Lucia |

| ⚠️ Regulation | – |

| 🖥️ Website | https://korata.com/ |

| 🎲 Demo Account | No |

| ⏳ Start Time | 2023 |

| 💲 Minimum Deposit | $100 |

| ⚖️ Minimum and Maximum Leverage | 1:500 |

| ⚙️ Trading Platform | WebTrader |

| assistant@korata.com | |

| 📞 Phone | +18007572147 |

First Impression of Korata.com

We’re greeted with a standard and typical broker website, which is neither surprising nor impressive. At the top of the page, you can find information about the company, contacts, types of accounts, platforms, and other conditions. The main page showcases pseudo-advantages, which lack evidence. For instance, they mention segregated accounts, but in which banks are these held? Korata doesn’t provide any names. It is the overall pattern of the website: a lack of evidence, many important documents missing, and specific details not given.

At the bottom of the official site, there’s the generic risk warning. It’s also there that we learn that the legal entity managing the Korata brand is Prosperity Peak Investments LTD. It would be nice to see some licenses or at least a mention of them, as well as documents and other credentials. However, no, none of this information is provided on the site. Most likely, the website was created using some kind of broker website builder. It can’t be called professional or serious.

Partnership and Bonuses

Bonus promotions and affiliate programs are not mentioned on the company’s official website. However, the user agreement mentions bonuses, and when registering an account, one can specify a promo code. It suggests that such opportunities do exist in Korata. Oddly, the broker hides this and doesn’t showcase the conditions when it would be worth doing so. Offshore firms like to offer clients bonuses, as they come with specific conditions that impose restrictions on the deposit. Such conditions are often challenging to meet, so clients lose money faster than working off the bonus money.

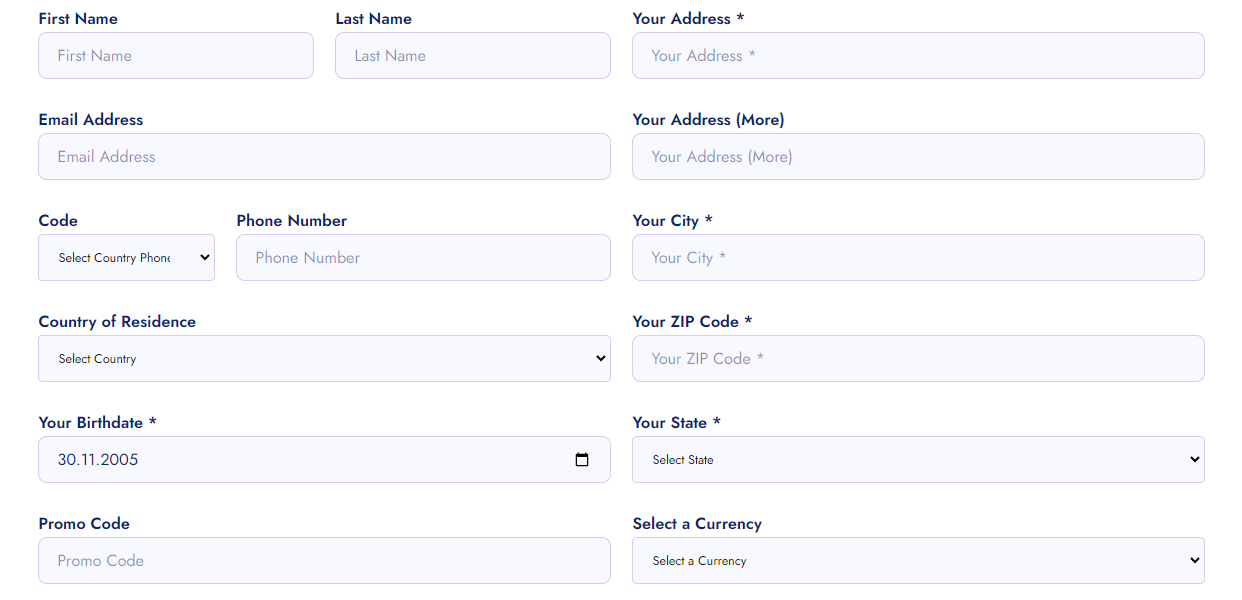

Account Opening on Korata.com

The account creation process requires providing complete personal information, including the residential address and date of birth, as well as agreeing to the terms and confirming that the trader is not a US citizen. At the same time, Korata mandatorily requires ticking the box “I would like to get the latest news and notifications through email”, which is puzzling. What if a client doesn’t want to receive notifications via email? The same applies to SMS notifications.

Unfortunately, registering an account was unsuccessful. After entering all the details, an error appears: “Your request did not go through. Please try again or ask for assistance from our support desk.” We tried to reach out through the live chat on the website, hoping that Korata’s managers might help resolve this issue quickly, but we received no response. Notably, the broker doesn’t offer a demo account.

Verification

On the official website, the verification procedure is placed between the account registration and the deposit replenishment, which means KYC in Korata is a mandatory process. The broker requires uploading documents to verify identity and place of residence. However, it isn’t described comprehensively. The AML&KYC policy is superficial, with many details overlooked.

- None.

- Requires you to take a picture of your bank card.

- The KYC procedure is described superficially.

Trading Software

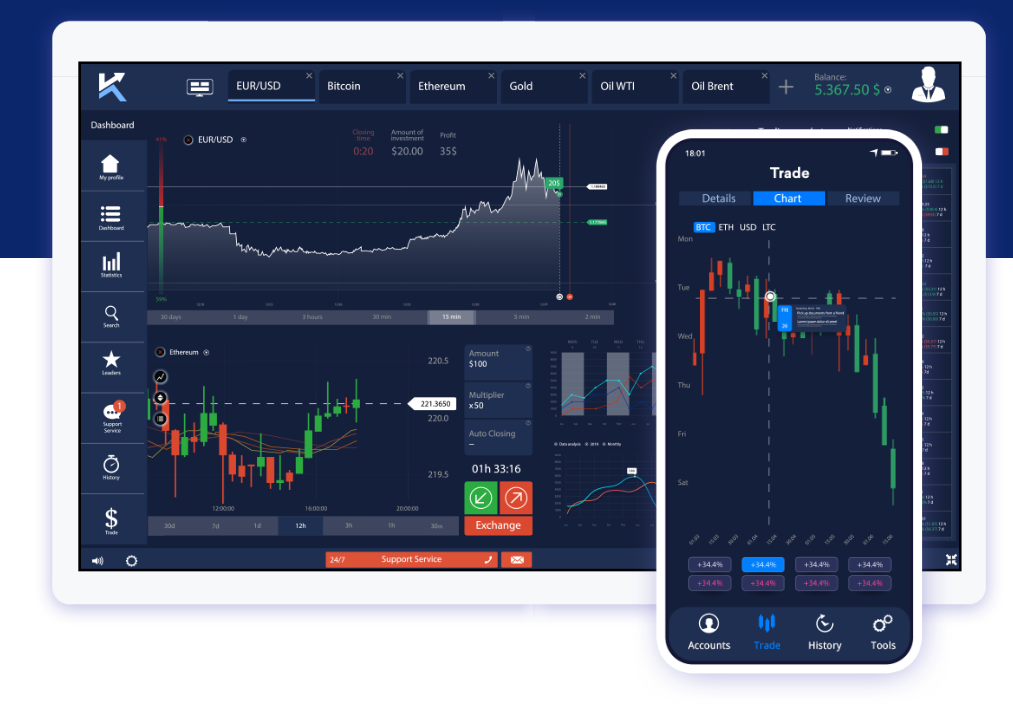

We couldn’t explore and try out the trading platform in practice because an error appears when creating a personal cabinet. Well, we’ll have to rely on what the broker writes about the terminal on its website. Though, in reality, it seems pointless because anyone can write anything. One shouldn’t trust the words of brokerage companies, as they tend to exaggerate and deceive. However, we have no other choice but to believe in Korata.

The platform is claimed to be user-friendly and high-performance. Korata offers a terminal that is accessible not only through a browser but also for Windows, Linux, Mac OS, and smartphones iOS/Android. The firm promises a broad and advanced set of tools for analyzing charts and executing trades, as well as real-time quotes and quick order execution.

Judging by the screenshots, the terminal at Korata is unlikely to be professional and multifunctional. It’s probably a primitive web trader with basic functions. Such software is hardly suitable for serious and full-fledged trading.

| Features | Korata | TradeVtech | RannForex |

|---|---|---|---|

| Demo Account | ❌ | ❌ | ✔️ |

| Mobile App | ✔️ | ❌ | ✔️ |

| Own Development | ❌ | ❌ | ❌ |

How Can I Trade With Korata?

In the company, clients can trade currency pairs, metals, stock indices, commodities, stocks, and cryptocurrencies. All assets are represented only as CFDs. Traders also have access to leverage up to 1:500 and micro-lots from 0.01. Let’s look at the types of accounts available in Korata, as this determines the availability of additional services and features.

All Info About Accounts

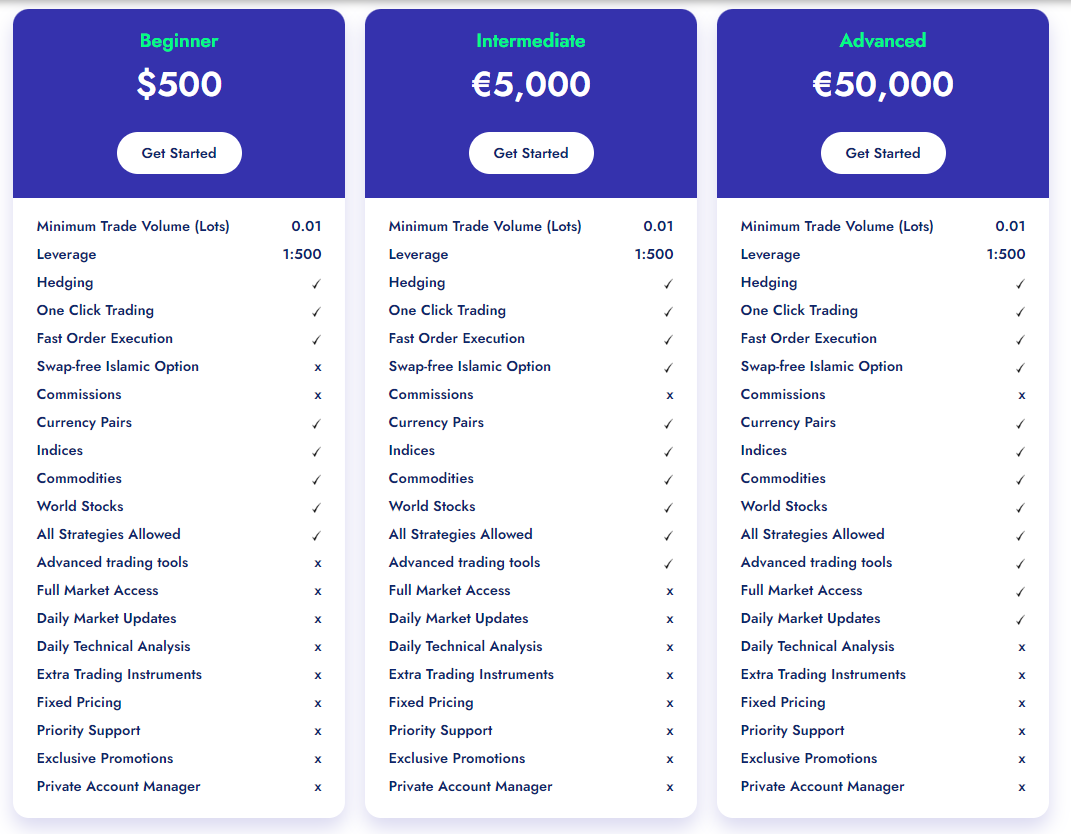

The broker offers six types of accounts: Beginner (from $500), Intermediate (from $5,000), Advanced (from $50,000), Premium (from $100,000), Platinum ($250,000), and VIP ($500,000). Korata requires a significant minimum deposit, which is an unpopular practice among similar organizations where you can start trading even with $10. However, beginners, who can only afford the first type of account, have the opportunity to trade all assets, use one-click trading options, and hedging. Essentially, there are no additional services, even though they are most needed at this rate.

Additional services are only available on the Advanced tariffs and above. And that’s a minimum deposit of $50,000. Such a requirement from the broker seems outrageous. Who would agree to invest such amounts in a lesser-known and offshore firm? Why aren’t options like daily market updates and daily technical analysis available to all users? Why is the Islamic account in Korata only available with a deposit of $5,000, when this option should be available to all traders? In short, the organization offers very peculiar and outrageous trading conditions. It’s evident that it operates on a money extraction principle. To get more favorable conditions and a broader set of features, one needs to invest more money.

Meanwhile, under the “commissions” section, there’s a cross everywhere. So, Korata doesn’t take commissions for trades? At the same time, spreads remain an unknown factor. It immediately raises the question: “How does the firm earn?”. For a broker to generate revenue, they need to charge a commission, but it’s set at zero here. Either there are high spreads, which one will only learn about when opening a first trade, or the company’s earnings depend on the client’s success. That is, if a client loses money, the broker profits. And it is the business model of a dealing desk, a significant and crucial drawback.

- None.

- Unfavorable conditions.

- High minimum deposit.

Market Analysis and Education With Korata.com

All clients, regardless of their tariff plan, can use the economic calendar, a market news feed, an expiry dates calendar, and trading hours. Analytics, education, and other options in Korata are only available when depositing huge sums of money.

Deposit, Withdrawal, and Fees

Deposits and withdrawals in Korata can be made using credit/debit cards, bank transfers, Bitcoin, and electronic payment systems. The firm assures that there are no commissions.

| Features | Korata | VastWealth | Xeodis |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ✔️ |

| Electronic Payments | ✔️ | ✔️ | ✔️ |

| Crypto Transfers | ✔️ | ✔️ | ❌ |

| Deposit Fee | ❌ | ✔️ | ❌ |

| Withdrawal Fee | ❌ | ✔️ | ❌ |

How Can I Contact It?

You can contact the managers in several ways: email, phone number, and online chat. However, there are no social media accounts.

- There’s an online chat and primary methods to connect with Korata representatives.

- There is no social media.

Is Korata Dangerous?

The firm raises more suspicions than trust. For unknown reasons, registration is unavailable; one needs to contact the managers, but we received no response. The trading conditions seem more like those in any fraudulent organization. In short, one needs to investigate the legitimacy status of a firm and its operation period.

How Long Does The Broker Work?

The duration of a brokerage firm’s operation is a crucial aspect that shouldn’t be overlooked. Korata, like any suspicious broker, conceals its founding date. Meanwhile, the website’s domain was only registered in 2020. However, what has happened to it up to the present day? Unfortunately, this is also unknown, as snapshots are missing. The site’s last update was in August of 2023. Even if we consider 2020 as the founding year, it’s a relatively short operational period.

How Is Korata Regulated?

The broker identifies the legal entity as Prosperity Peak Investments LTD, which is registered offshore in Saint Lucia. In this jurisdiction, the activities of brokerage firms are overseen by the Financial Services Regulatory Authority (FSRA). However, Prosperity Peak Investments LTD was not found in the regulator’s registry. So, Korata operates without a license, which is illegal. Moreover, regulation isn’t even mentioned on the organization’s website.

| Features | Korata | Forexeze | Fusion Markets |

|---|---|---|---|

| European Zone | ❌ | ❌ | ✔️ |

| Asian Zone | ❌ | ❌ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ❌ | ❌ | ✔️ |

Frequently Asked Questions (FAQ)

How to Trade With Korata?

Is Korata Legit?

How Risky Is It?

Kevin Berry

Kevin Berry Another offshore broker scam. Not surprising at all. Investing in companies like Korata is a no-go, because you won’t be able to withdraw your money. I don’t recommend partnering with offshore brokerage firms, as they often turn out to be fraudulent and fake. It’s better to play it safe and open an account in a reputable place with plenty of licenses, a long operational history, and transparency, where legal documents are available, and there are many online reviews from satisfied customers. As for Korata, let them continue with their illicit activities. I hope no trader has fallen for this fraud scheme and hasn’t handed over their money to these swindlers.

Korata rating

4 reviews about Korata

These are scammers!!! Do not think of investing money here!!! They deceitfully lure money out of gullible traders and then don’t return it. All their advantages and offers are false and fake!!!

There are very few reviews online about korata, so it’s an unpopular and little-known firm. Depositing money into an unknown firm where no one trades, and nobody knows anything about, is a foolish idea. There’s no doubt that it is a scam and that people are being deceived here. Just a typical fake platform, nothing more.

The trading conditions here are pure nonsense. First, there’s a huge minimum deposit. Even though their website states it’s $100, in reality, it’s higher. You can see for yourself how much you need to open a basic account. Who do they think they are? Secondly, they don’t even offer a demo account. They have an Islamic account, but you need to invest a minimum of $5000, which is a significant amount.

In short, the conditions at Korata are very bad and terrible. There are much more favorable brokers out there than this fraudulent and scamming firm.

I don’t trust offshore brokers, and I advise you not to either. I once tried trading with such firms and it didn’t end well. The company manipulated charts, making the entire trading process essentially fake. In the end, they didn’t even return my money. Trust me, the same will happen with Korata. You’ll encounter fake charts, and fake liquidity, and you won’t get your money back. What’s the point in trading with such a scambroker? Absolutely no point. Korata is based in Saint Lucia, has no licenses, and lacks any pertinent documentation. That’s all you need to know about this scam. The rest is up to you to decide.