Choosing a brokerage firm for opening an account is a crucial step, as you can easily run into a scam that might even falsify information about licenses. Today, we’re reviewing a British broker named Liberty Commercial Finance Limited, which claims to be regulated by the FCA. The company boldly asserts that it manages $1.6 billion, operates in over 100 countries, and employs a staff of more than 600 experts. We suspect that these claims are entirely fake and have no basis in reality. The lack of or scarce online reviews only amplifies our doubts. If you’re interested in uncovering the truth about this company, please join us in our investigation.

Table of Contents

Highlights

| 🏛️ Country | United Kingdom |

| ⚠️ Regulation | – |

| 🖥️ Website | https://www.libertycommercialfinanceltd.com |

| 🎲 Demo Account | No |

| ⏳ Start Time | 2023 |

| 💲 Minimum Deposit | €100 |

| ⚖️ Minimum and Maximum Leverage | 1:20-1:100 |

| ⚙️ Trading Platform | WebTrader |

| support@libertycommercialfinanceltd.net | |

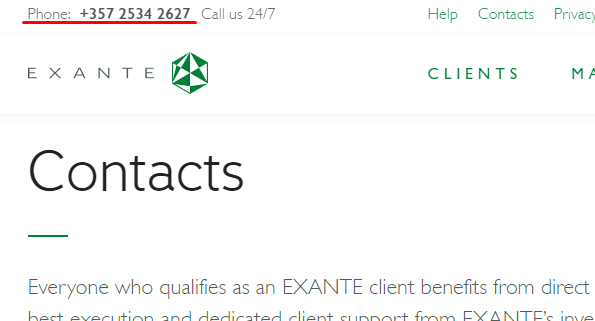

| 📞 Phone | +357 2534 2627 |

First Impression of Libertycommercialfinanceltd.com

The official website doesn’t stand out much from those of other forex brokers, except for its graphic design. The top of the homepage provides essential information about trading conditions, account types, the trading platform, contact details, and the categories of tradable assets. You can also find data regarding Liberty Commercial Finance Limited’s operations. While the text contains a wealth of specific details, it also includes some glaringly empty and meaningless sections.

The homepage of the official website is adorned with visual effects. It features a bird’s-eye view of London’s skyline as the backdrop. Scrolling further down, you’ll encounter images of people, presumably traders and investors, sitting at computers wearing glasses. Towards the bottom, there’s an embedded video showing a trading office where employees seem to be engaged in discussions while staring at monitors displaying charts. Chances are, it isn’t the actual office of Liberty Commercial Finance Limited. It’s more likely, fraudsters lifted the video from YouTube and simply overlaid it with their company’s name.

Overall, the official website comes across as fairly neutral. While the aesthetically pleasing videos add some flair, the resource still remains rather typical and template-like. Besides visual effects, Liberty Commercial Finance Limited hasn’t brought anything unique. Additionally, the site lacks crucial legal documents and financial statements.

Partnership and Bonuses

Liberty Commercial Finance Limited offers a partnership program for clients, consisting of two types: an introducing broker scheme and an affiliate program. Partners are provided with support from the company, marketing materials, and detailed referral statistics. Traders earn rewards based on deposits, trading activity, and overall engagement of their referrals. Further details can be found in the dedicated section within your account or by reaching out to a company representative for clarification.

No information regarding bonus promotions is available. Nevertheless, we suspect that Liberty Commercial Finance Limited likely offers bonuses to traders. The absence of such bonuses would be odd, as they are a common marketing tactic to attract customers, though often one fraught with hidden complexities and pitfalls in the form of inadequate conditions for working off bonuses.

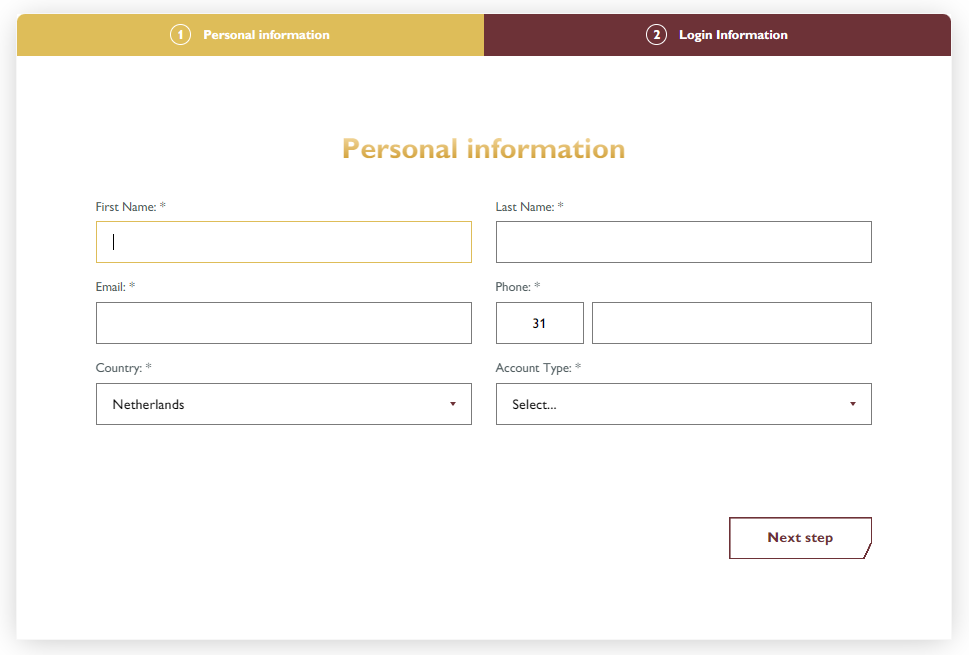

Account Opening on Libertycommercialfinanceltd.com

The registration process with this broker consists of two steps. Initially, clients are required to input their name, email, and phone number, in addition to selecting their account type and country of residence. The second stage involves setting up a password and agreeing to the terms and conditions.

The provided phone number and email do not require verification. In other words, Liberty Commercial Finance Limited does not send a verification code to the specified data, which creates potential security threats for the trader’s account.

The interface of the dashboard is primitive and unattractive. Users can change their personal data, view trading and transaction history, change their password, upload documents for KYC, deposit funds, request withdrawals, and write to technical support. From the dashboard, you can also directly go to the trading terminal. The Dashboard at Liberty Commercial Finance Limited is as templated as the website. Apparently, the founders did it in the same builder.

Liberty Commercial Finance Limited doesn’t offer the option to choose the type of account or open a new trading account. Additionally, we couldn’t find a demo account. It appears that one must immediately fund the account with real money to gain practical experience with the trading terminal. Reputable and transparent brokers typically offer a demo account feature, which is conspicuously absent in this case.

Verification

The verification process at Liberty Commercial Finance Limited is conducted via a designated section in the user’s account. You need to choose the type of document and specify the path on the computer to the file. The company mandates verification, and accounts will not be activated without completing the KYС requirements. Therefore, after registration, it is necessary to upload documents for KYC.

- It’s convenient to upload documents.

- Do not disclose information without pre-registration.

Trading Software

Now, let’s delve into one of the most crucial aspects – the trading platform. Liberty Commercial Finance Limited offers two types of trading terminals: WebTrader and a downloadable PC program. However, we advise against downloading unfamiliar software to your computer due to the potential risk of catching a virus that could infect your operating system. Additionally, the broker falls short by not offering mobile versions of the platform available for download from official stores like the App Store or Play Market.

The Liberty Commercial Finance Limited website portrays its trading platform as the best terminal filled with endless capabilities and a diverse set of tools. However, it is far from reality. The platform lacks numerous features, making it less versatile than advertised. For instance, traders cannot upload customized terminal settings or proprietary indicators. Essential advanced tools like open interest, order book, market depth, clusters, and horizontal volume are conspicuously missing. Additionally, the platform doesn’t support automated trading bots or offer the ability to copy trades. Even the creation of custom instruments, such as analyzing the correlation coefficient between two assets, is not possible.

The trading platform provided by Liberty Commercial Finance Limited is severely restricted. While such a terminal may be suitable for beginners at first, experienced traders are unlikely to appreciate its functionality. One wonders why the company doesn’t offer a more sophisticated alternative, such as MetaTrader, which would be far more capable.

| Features | Liberty Commercial Finance Limited | LumineTrade | All Capital Trade |

|---|---|---|---|

| Demo Account | ❌ | ❌ | ❌ |

| Mobile App | ❌ | ❌ | ❌ |

| Own Development | ❌ | ❌ | ❌ |

How Can I Trade With Liberty Commercial Finance Limited?

The broker claims that hundreds of thousands of financial products are available on its platform, not only forex, metals, indices, stocks, commodities and cryptocurrencies, but also bonds, options, funds, and futures. However, for some reason we didn’t see this, but only classical CFDs for 6 asset groups. Terms and conditions vary depending on the tariff plan. We’ll look at them further.

All Info About Accounts

The company offers to start trading with a minimum of 100 euros. It is the minimum threshold for a deposit on the first type of account called “Test”. The account features leverage up to 1:10, spreads from 0.8 pips, a minimum trade volume of 0.01 lots, only forex is available, and low commissions. Additionally, there is assistance from a personal account manager. A leverage of 1:10 is clearly insufficient for forex trading. Have those who drafted these trading conditions ever traded in this market class? The minimum trade volume starts at $100,000. How can a trader with 100 euros and a leverage of 1:10 trade in Forex? It seems that Liberty Commercial Finance Limited doesn’t even understand such an obvious point. And why such restrictions? Why not offer clients access to all available market classes? For example, one could trade cryptocurrencies with 100 euros and leverage of 1:10, but not forex.

The second type of account at Liberty Commercial Finance Limited starts at a 2,000-euro investment. This level adds indices to the asset classes available for trading, along with a slightly improved leverage of 1:30, and spreads are slightly lower. Beyond that, there are no notable benefits. Intriguingly, the next type jumps significantly, requiring a minimum deposit of 50,000 euros, a considerable leap from 2,000 euros. One might expect that those willing to invest such an amount under the “Standard” plan would receive some extraordinary benefits. Surprisingly, this is not the case; not at all, as commodities are added, leverage is a bit higher, and spreads are a bit lower. It’s nonsense, to be honest.

The fourth and fifth tariffs set the bar incredibly high, with their minimum deposit starting at a staggering 150,000 euros. It makes it improbable that anyone would commit such a hefty sum to a relatively obscure company like Liberty Commercial Finance Limited. That said, these tiers do introduce some unique features not found in the lower levels, including access to a personal manager, an analyst, trading signals, a corporate department, no fees, and contracts with a hedge fund.

Liberty Commercial Finance Limited lacks both Islamic and demo accounts. Commission details are unspecified, and the available leverage is super low. Interestingly, leverage increases with higher-tier plans, contrary to what one would expect. Why would a trader with a €100,000 capital need high leverage? For them, a maximum of 1:5 might suffice, but not 1:50. On the other hand, traders with only a few hundred euros could really benefit from leverage ratios of 1:50 to 1:100. These are glaring downsides, suggesting that Liberty Commercial Finance Limited operates on a money-extraction model. Clients must deposit substantial amounts to unlock even the most basic of additional features.

- None.

- No Islamic account and demo account.

- Inadequate trading conditions.

- The principle of “pay more and get more” is followed.

Market Analysis and Education With Libertycommercialfinanceltd.com

Liberty Commercial Finance Limited falls short in offering supplementary services. The platform lacks key features like an economic calendar, real-time quote tables, a news feed, interest rates from major central banks, or even a trading calculator for assessing trade parameters. Furthermore, beginners have no access to free educational articles or videos; the platform only provides rudimentary information on different asset classes.

Deposit, Withdrawal, and Fees

Liberty Commercial Finance Limited offers multiple methods for depositing and withdrawing funds, including credit/debit cards, bank wire transfers, peer-to-peer transactions, and cryptocurrency. However, the company does not disclose details about commissions on transfers, making cooperation less transparent. Any reputable and transparent firm would disclose this information upfront.

| Features | Liberty Commercial Finance Limited | Mitrade | IC Markets |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ✔️ |

| Electronic Payments | ❌ | ✔️ | ❌ |

| Crypto Transfers | ✔️ | ❌ | ❌ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ❌ | ✔️ | ✔️ |

How Can I Contact It?

For communication with the managers, Liberty Commercial Finance Limited has provided an email and phone number. Moreover, the fraudsters forgot to edit the phone number in the “contacts” section from “111111111” to +357 2534 2627. By the way, it is the phone number of another broker named Exante. Why is the number of different company listed on the site?

Liberty Commercial Finance Limited also provides a special feedback form, but lacks features like online chat and a social media presence. It’s surprising, given that brokerage is inherently an online business, and social media is usually considered a crucial component of any fully online operation.

- None.

- The phone number of another brokerage firm is given.

- Accounts in social networks have not been created.

- There is no online chat for prompt communication.

Is Liberty Commercial Finance Limited Dangerous?

There are already signs suggesting a potential scam. A false phone number, irrational and unrealistic trading conditions, and the lack of a demo account already raise red flags about Liberty Commercial Finance Limited. We suspect that even the claim of having a headquarters in the United Kingdom and a license from the FCA could be fake. We intend to investigate this matter further to reach a definitive conclusion.

How Long Does The Broker Work?

While the website vaguely mentions that the firm was founded in 2011, we checked the domain for Liberty Commercial Finance Limited was only registered on September 1, 2023. The website lacks any registration documents, and there are no online reviews to be found. Therefore, it’s safe to conclude that the broker is new.

How Is Liberty Commercial Finance Limited Regulated?

We are examining a British brokerage that claims to have an FCA license and a London office. Although a firm named Liberty Commercial Finance Limited does appear in the Companies House and FCA registries, discrepancies arise when looking at contact information and website domains.

The domain listed in the registry is libertycommercialfinance.com, while our subject of scrutiny operates under libertycommercialfinanceltd.com. Evidently, these are two different websites. It turns out that the broker indicated the license and registration of another firm with a similar name.

Did the hero of our review get a license? No. Liberty Commercial Finance Limited operates without a license. And this is not even worse than indicating the license of another firm. Scammers have created a website with a similar name and are pretending to be a completely different organization.

| Features | Liberty Commercial Finance Limited | Geetle | Stockoza |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ❌ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ❌ | ❌ | ❌ |

Frequently Asked Questions (FAQ)

How to Trade With Liberty Commercial Finance Limited?

Is Liberty Commercial Finance Limited Legit?

How Risky Is It?

Kevin Berry

Kevin Berry Seriously, do the scammers at Liberty Commercial Finance Limited actually believe they can swindle people into such blatant and glaring fraud? From using Exante’s phone number to lacking a proper license, operating for less than a month, and even listing a fake legal address, the red flags are numerous. Claims of over 600 professionals, 1.6 billion dollars in client capital, and operations in more than 100 countries are nothing but fake statistics and fabricated numbers. Unmasking this scam was all too easy. It seems like fraudsters are becoming increasingly blatant in creating fake platforms. I sincerely hope no one has fallen for this and handed over their money.

Liberty Commercial Finance Limited rating

4 reviews about Liberty Commercial Finance Limited

Please do not invest money in Liberty Commercial Finance Limited, as it is a fraudulent organization that steals money from people. Why? Let me explain. First of all, the claimed FCA license is not present. Secondly, there is indeed a financial company in the UK with the name Liberty Commercial Finance Limited, but it is an entirely different organization that has nothing to do with this fraud. Scammers have taken an already existing organization, created a phishing site, and started offering brokerage services. They even have the audacity to claim years of operation and speak about regulation. Thirdly, there are no legal documents on the site. Liberty Commercial Finance Limited cannot prove that it is officially registered in the UK. And the domain of the site was registered in September of this year. So it’s logical to assume a short period of operation. In short, scambrokers have devised a fraud scheme to collect money from inexperienced clients. It is precisely such inexperienced clients who believe in such scambrokers and transfer money. I recommend always checking the brokerage intermediary you want to trade with. Otherwise, you will end up with such a black brokerage firm, and then you won’t even be able to withdraw money.

Something about liberty commercial finance limited is not on the Internet… I thought it was some kind of well-known brokerage organization, but it turned out to be a complete scam… there are almost no reviews, mentions either, only just now they are starting to appear… I looked at when their site was created, it happened quite recently… now the picture has become completely clear and understandable, now it is clear what the scambroker represents… a fresh scam aimed at stealing money from gullible people… there can definitely be no license here… charts are fake, the platform is also fake, activity is similarly fake… Well, liberty commercial finance limited is engaged in illegal activity…

Unfortunately my husband was scammed and I am too disgusted to type the amount. I have contacted UK police and two newspapers, hoping to blow this up. If anyone can provide assistance, would be appreciated.

Sorry to hear that. My wife fall for this company aswell. Did you get any money back?