Have you ever heard of Monexis? This broker promises personalized trading strategies, advanced analytical tools, and top-tier customer support. The company claims to be registered in the U.S., but something does not add up. For example, there is no information on the website about licenses from regulators such as the SEC, FINRA, or CFTC. Additionally, there are very few online reviews. Why has almost no one heard of this platform? Can they be trusted, or is this just another scam that will disappear with clients’ money?

Table of Contents

Highlights

| 🏛️ Country | USA |

| ⚠️ Regulation | – |

| 🖥️ Website | https://monexis.org |

| 🎲 Demo Account | No |

| ⏳ Start Time | 2024 |

| 💲 Minimum Deposit | €250 |

| ⚖️ Minimum and Maximum Leverage | 1:400 |

| ⚙️ Trading Platform | – |

| support@monexis.org | |

| 📞 Phone | +1 (800) 441-7760 |

First Impression of Monexis.org

The broker’s official website looks modern and minimalist, which is its only advantage. The company lists operational statistics, such as 45,000 clients and $750 million in assets under management, but these are just numbers with no verification. There are no links to independent sources, financial reports, or regulatory audits.

At the top of the page, there is a main menu, where users can access sections like “About Us,” “Tools,” “Education,” and “Analysis,” alongside a language switch button. On the homepage, Monexis claims to be a “technological leader” with “deep market analysis” and a “personalized approach,” but provides no evidence to support these claims. These are just generic marketing phrases commonly used by questionable brokers.

The website features a map showing countries where Monexis supposedly operates, including the U.S., UK, Germany, China, and Australia. However, the broker provides no information about its licenses in these countries. For example, to legally operate in the U.S., a broker must be registered with the CFTC and NFA; in the UK, it must be licensed by the FCA; in Australia, it must be regulated by ASIC.

Visually, the website looks stylish and well-designed, but the quality is lacking. There are many vague statements and unverified facts, making it seem more like self-promotion to attract clients rather than a legitimate financial service.

Partnership and Bonuses

Judging by the description of the tariff plans, Monexis offers deposit bonuses, but they are not available to all clients — only to those who can afford to invest $2,500 or more. The bonus amount depends on the tariff, ranging from 50% to 150%, which is quite substantial. However, it is important to keep the conditions in mind.

Bonus funds can only be withdrawn after meeting the required trading turnover, which is calculated as the bonus amount multiplied by the leverage (35 or 40, depending on the deposit). Trades with zero profit are not counted toward turnover. The bonus may be canceled if no trading activity occurs after it has been credited. Once the bonus expires, the credited funds may be deducted from the client’s trading account.

There is no mention of a partnership program. There are not even any hints that such a program exists at Monexis.

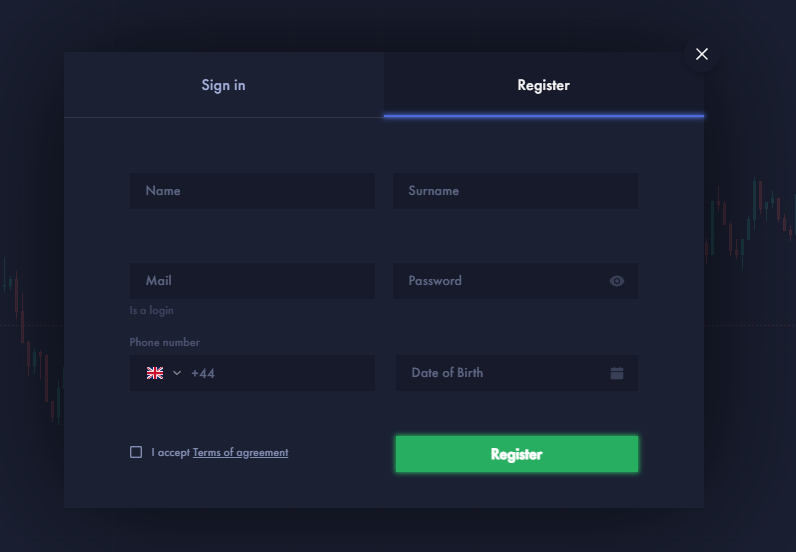

Account Opening on Monexis.org

To register an account, you need to provide your first name, last name, email address, phone number, password, and date of birth.

The Monexis personal account is integrated into the trading platform, which is highly inconvenient and unsafe. If a malicious actor gains access to the terminal, they will also gain access to the account. The functionality of the personal account is quite basic: it includes personal information, verification documents, and transaction and trading history.

In separate windows, users can fund their deposit, request a withdrawal, and contact customer support via live chat. These are all standard actions, but we did not find an option to open a demo account.

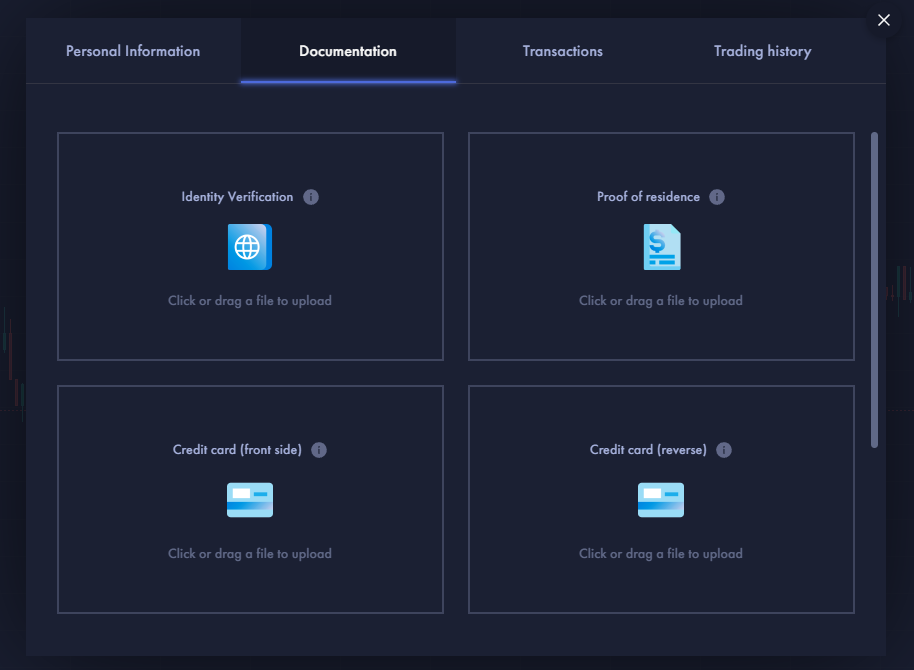

Verification

Verification at Monexis is mandatory. Without completing verification, a client cannot open an account or trade. If a client refuses to provide the requested documents, their account will be closed.

The KYC process includes the following steps:

- Identity verification — the client must provide a passport, an identity card, or a driver’s license.

- Address verification — a utility bill, tax document, or bank statement (no older than three months) is required.

- Additional information — the company requires the client to provide their phone number, email, date of birth, nationality, profession, job title, and employer.

- Financial check — if the broker suspects illegal sources of funds, it may request proof of their legitimacy (e.g., bank statements).

- Payment method verification — when making a deposit, the account holder’s name must match the name in the KYC profile. Withdrawals can only be made to the same account used for the deposit.

Monexis promises to review the data and documents within a few business days, but no exact timeframe is specified. Additionally, we do not recommend rushing to upload documents until the company has been thoroughly checked for signs of fraud.

- KYC procedure is mandatory.

- Convenient process of uploading documents in my personal office.

- There is no exact timeframe for processing documents.

- Monexis may request proof of the legitimacy of the origin of funds.

Trading Software

The platform at Monexis is a web trader with an interface borrowed from the popular TradingView service. The terminal supports timeframes ranging from 1 minute to 1 month, as well as different types of charts (Japanese candlesticks, bars, lines, area, and others). However, where is the technical analysis? Where are the levels, trend lines, harmonic elements, and indicators? Does their platform not even support basic technical analysis? These features should be included in every trading terminal; otherwise, what is the point? Just to open and close trading positions?

There is no alternative. Monexis does not offer other platform options, even though they could have acquired a MetaTrader license, which covers most traders’ needs. It is also important to note that there are no mobile or desktop applications.

| Features | Monexis | FXRoad | Groshare Limited |

|---|---|---|---|

| Demo Account | ❌ | ✔️ | ❌ |

| Mobile App | ❌ | ✔️ | ❌ |

| Own Development | ❌ | ❌ | ❌ |

How Can I Trade With Monexis?

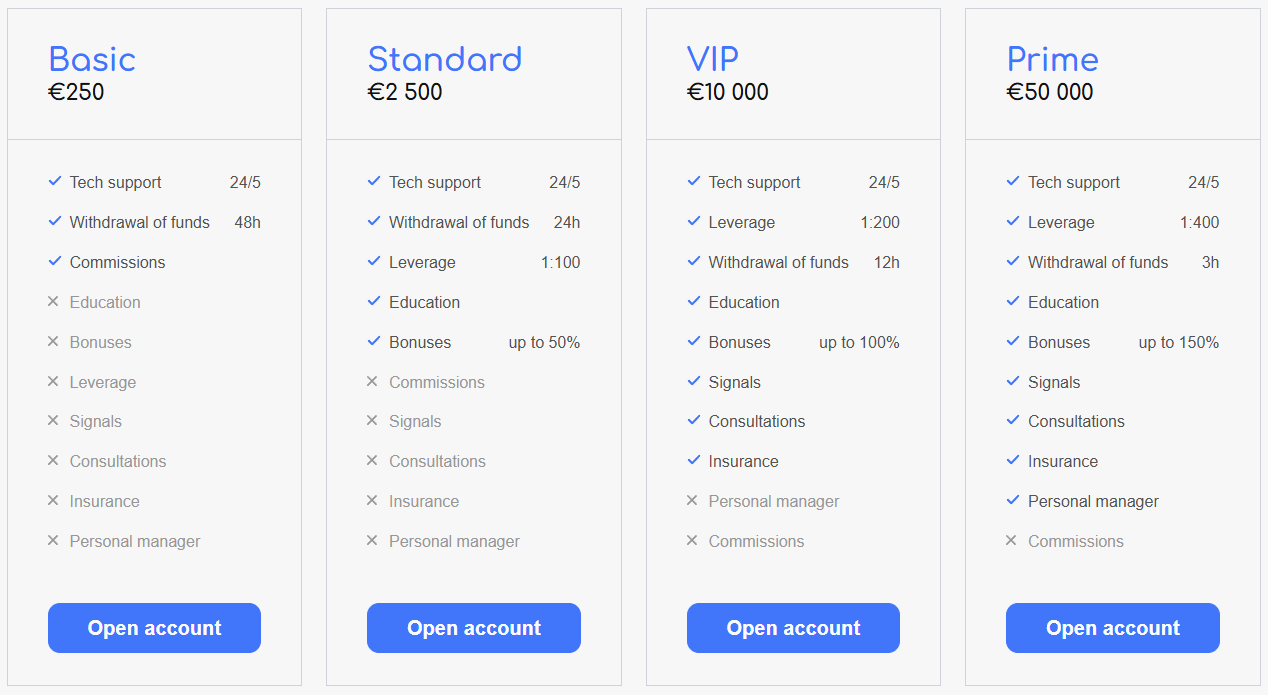

The company provides access to cryptocurrencies, commodities, metals, indices, stocks, and forex. To fully understand the conditions, we need to examine the tariff plans, as they significantly impact trading.

All Info About Accounts

Monexis offers 4 types of accounts:

- Basic. The minimum deposit is €250. There is a commission, but it is not specified what kind. Besides, the client receives nothing, only technical support, and withdrawal of funds for up to 48 hours.

- Standard. The minimum deposit is €2,500. Training, leverage 1:100, bonuses up to 50%, and withdrawal of funds up to 24 hours.

- VIP. The minimum deposit is €10,000. Owners of this package can trade with leverage of 1:200, and also receive signals, advice, and insurance. However, these services are not disclosed in any way; there are no examples, or detailed terms and conditions.

- Prime. From €50,000. Leverage 1:400, personal manager, bonuses up to 150%, and withdrawals up to 3 hours.

Specific commission rates are not disclosed, nor are the spreads, making it impossible to determine whether trading here is profitable. The website states: “Competitive trading conditions” — but where is the proof, or are traders expected to take their word for it? Monexis offers an extremely high leverage of up to 1:400, which is highly suspicious. Why? Because it does not align with the company’s stated U.S. address, where such high leverage is banned by regulators. Furthermore, why is the account’s currency in EUR when the U.S. uses dollars?

Demo accounts, cent accounts, Islamic accounts, and ECN accounts — Monexis is clearly unaware of these types of accounts, as it does not offer them. So, we found nothing beneficial or competitive about Monexis.

- None.

- Commissions and spreads are not specified.

- Huge bonuses and leverage.

- No demo account, Islamic account, cent rate, and ECN.

Market Analysis and Education With Monexis.org

On the official website of the broker, there are three sections with additional options:

- Tools — informers, calculators, calendars, and signals.

- Education — text and video lessons for beginners and advanced traders.

- Analytics — news, technical and fundamental analysis, and determining trends.

Deposit, Withdrawal, and Fees

Judging by the personal account interface, clients have access to USDT (TRC-20), BTC, credit/debit cards, and bank wire transfers. Other important conditions are not specified. Monexis provides no information about commissions.

| Features | Monexis | Gainful Markets | AtlasLC |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ✔️ |

| Electronic Payments | ❌ | ❌ | ❌ |

| Crypto Transfers | ✔️ | ❌ | ✔️ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ❌ | ❌ | ✔️ |

How Can I Contact It?

Earlier, we mentioned that there is an online chat feature in the personal account for contacting customer support. This option is also available on the official website. Additionally, Monexis provides a phone number and an email address. Upon checking these details, nothing suspicious was initially found.

However, response times in the online chat are extremely slow, and sometimes inquiries go completely unanswered. Furthermore, the company does not have accounts on social media or messaging platforms, which would have been convenient for users to communicate with company representatives.

- Online chat, phone, and email are available.

- No social media accounts.

- Long answers in online chat.

Is Monexis Dangerous?

There are many suspicions regarding the honesty and legality of this company, so it is necessary to verify its legal address, licenses, and other aspects of its operations. Once this is done, it will become clear whether Monexis is a scam, although there is already little doubt that it is.

How Long Does The Broker Work?

Monexis tells a story about its development, claiming that it began back in 2010. In 2014, they allegedly started opening offices in different countries, yet not a single address is listed. Moreover, their domain was registered only on September 12, 2024, and for just one year — hardly a sign that the platform’s creators plan to develop the business long-term. In reality, the company has not been operating for 15 years, but only for six months.

Additionally, when checking the domain monexis.org, we found other suspicious details. For instance, the real owner’s information is hidden behind the Privacy Protect, LLC service. The registrar is Hostinger (Lithuania) — one of the cheapest hosting providers. At the same time, Monexis claims to have an address in the U.S., which is highly unlikely.

How Is Monexis Regulated?

There is no longer any doubt that the supposed New York office is a fake. Even without checking legal registries, there is already plenty of evidence:

- Monexis does not mention any license, even though it is required to be regulated by the SEC or other U.S. financial authorities.

- Leverage of up to 1:400 is prohibited in this jurisdiction, as are bonuses of up to 150%.

- The domain is registered to a hidden owner, rather than a legitimate U.S.-based organization.

- The listed office in New York is not supported by any official documents.

- There are no registration details, such as license numbers or links to official registries.

This means the company is operating illegally. Moreover, it provides a large amount of fake information, further damaging its already questionable reputation.

| Features | Monexis | Goldman Markets | London Partners Ltd |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ❌ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ❌ | ❌ | ❌ |

Is it possible for a US broker to be unlicensed?

Is Monexis Legit?

How Risky Is It?

Kevin Berry

Kevin Berry This scam targets beginners in trading and investing. Any trader with even minimal experience would immediately recognize the deception: how can a U.S.-based broker offer margin CFD trading with 1:400 leverage and 150% bonuses? This is completely against U.S. regulations. Many forex companies avoid working with U.S. residents due to strict oversight, but not Monexis. They thought listing a fake New York office and pretending to follow U.S. laws would be a good idea. In reality, there is nothing here but a scam.

Monexis rating

1 review about Monexis

Never trade with platforms like Monexis. They are outright fraudsters. They even publish fake positive reviews to lure in naïve traders and investors. As an experienced trader, I am 100% certain that this is a scam. And I am telling you with absolute confidence – your deposit will be stolen. These are anonymous scammers preying on inexperienced users. I want you to spread the word about these fraudsters to help others avoid falling into their trap!