The online trading market is flooded with brokers promising “revolutionary” trading conditions, professional support, and secure investments. However, more often than not, behind these grand words and promises lies a plain scam. Welcome to the Groshare Limited review, where we will take a detailed look at this brokerage platform and determine whether it is engaged in fraudulent activities or not.

Table of Contents

Highlights

| 🏛️ Country | UK, Poland |

| ⚠️ Regulation | – |

| 🖥️ Website | https://grosharelimited.com, https://groshareltd.com |

| 🎲 Demo Account | Yes |

| ⏳ Start Time | 2024 |

| 💲 Minimum Deposit | $100 |

| ⚖️ Minimum and Maximum Leverage | 1:200 |

| ⚙️ Trading Platform | – |

| support@grosharelimited.net | |

| 📞 Phone | +48573588507, +48573588508 |

Dark background, minimalist design, and modern graphics — everything looks just like major brokerage firms. At first glance, that is. The images used are stock photos, as if they were the first results from a Google search. For example, these happy people looking at their phone screens — what do they have to do with trading? It would be better if Groshare Limited showcased its real offices and employees.

The website’s content is filled with clichés. “Unleash your potential”, “Trade like a pro”, or “Choose the best” — such phrases have no real value. They do not explain what makes this broker better than others. Look at the websites of top companies like IC Markets, Interactive Brokers, or Saxo Bank. They provide clear, specific details on every aspect: trading conditions, business model, licenses, years in operation, legal information, names of founders, and more. Groshare Limited shares none of this, apart from two addresses in Poland and the UK and a superficial description of trading conditions.

There are also issues with the text. For example, right on the homepage, we see “Etherium” instead of “Ethereum”. It is a classic mistake that a serious financial company would never make. Typos in asset names are a red flag.

The overall website layout is standard: a top menu with main sections, buttons for registration and login, and a language switcher (supporting English, Russian, German, and Polish). The footer lacks a risk warning and legal information, even though serious brokers always warn that margin trading is highly risky and can lead to losses. Groshare Limited has not impressed with its website — spelling mistakes, clichéd phrases, stock images, and minimal necessary information.

Partnership and Bonuses

Groshare Limited offers welcome bonuses to all new clients, but only to those who activate the Silver plan, which requires a deposit of $10,000 or more. The bonus amount ranges from $250 to $1,000. That would be fine, except we could not find a bonus policy anywhere on the official website. If a broker offers such incentives, it should clearly explain the terms and conditions.

Next, we will try to register an account to check what the personal cabinet looks like and what functions are available. To do this, Groshare Limited asks for a name, email, phone number, country of residence, account currency, and password. Overall, nothing unusual — that procedure is standard for every brokerage company.

The personal cabinet interface is quite simple. The main window is located in the center, with a menu on the left, including sections such as personal details, upload documents, change password, trading history, deposit, credit, monetary transactions, withdrawal, and contacts. Despite this abundance of options, we did not find a demo account. However, the homepage of Groshare Limited claims that a demo account is available. Usually, a virtual account can be opened through the personal cabinet after registration to immediately start testing the service.

Verification

The verification process at Groshare Limited is described in an extremely vague manner. The company states that every trader must go through verification but does not specify which documents are required or how long the process takes. The only information provided is a list of possible verification data: name, date of birth, email, phone number, address, and payment method. This is standard information, but reputable brokerage companies supplement it with specific requirements, such as:

- A copy of a passport or driver’s license (identity verification).

- A bank statement or utility bill (proof of address).

- Payment method verification (screenshot of a wallet, bank statement, or card).

Judging by the personal cabinet, the broker does request such documents for verification. However, why are these documents not mentioned anywhere on the official website? Why is there no specific KYC policy? Groshare Limited does not clarify how long the process takes.

- Convenient process of uploading documents through a personal account.

- No KYC policy is available.

- No information on the timeframe for the verification of documents.

- No clear steps for denial of verification.

Trading Software

The trading terminal at Groshare Limited supports only basic features: technical analysis, different types of charts (candlestick, bar, line, and area), timeframes from 1 minute to 1 month, watchlists of favorite assets, notifications, pending orders, and trading history. There are no advanced tools such as an order book, depth of market, or open interest. Moreover, users cannot upload their own indicators or platform setting templates. So, this is a primitive platform suitable only for basic technical analysis, and even then, not every strategy can be implemented with such a limited set of tools.

The Groshare Limited platform is available in web format, but in the personal cabinet, there is an option to download a program called “Help Desk 2.0”. It is likely software for computers, but we will not download it and do not recommend that you do so either. It is unclear what this program is — it could contain malicious software, so it is better to download files to your devices only from trusted sources. By the way, there are no links to mobile versions.

| Features | Groshare Limited | Orbonex Capital | RGN Financial Planning Ltd |

|---|---|---|---|

| Demo Account | ❌ | ❌ | ❌ |

| Mobile App | ❌ | ❌ | ❌ |

| Own Development | ❌ | ❌ | ❌ |

The official website and trading platform offer the following asset classes for trading: Forex, stocks, metals, cryptocurrencies, commodities, and indices. All of these are CFDs, meaning they operate with artificial liquidity. There are no spot markets or futures available. Next, we need to examine the account plans to assess the broker’s conditions.

All Info About Accounts

Groshare Limited offers customers four trading tariffs:

- Bronze. Need $2,500 to activate that account. Over 50 assets and no bonus.

- Silver. From $10,000 — bonus funds up to $250; over 200 trading instruments available.

- Gold. From $25,000 — even more favorable conditions.

- Diamond. Over $50,000 — over 1000 assets and bonus funds of $1,000.

The broker states on its homepage that the minimum deposit is $100, but activating the first-tier account requires $2,500. It raises the question: what is the actual entry threshold at Groshare Limited? If a $100 deposit is not even enough for the basic account, then what is the point of mentioning it?

Additionally, the website states that the commission ranges from 1% to 5%, but in the account descriptions, the range changes to 1% to 7%. This inconsistency creates confusion. It is also unclear what exactly the commission applies to — trades, fund transfers, or other transactions? Groshare Limited does not provide clear explanations.

Spreads start from 0.7 pips, and leverage goes up to 1:200 — these are standard conditions for Forex brokers. However, the website lacks an online specification where traders can check the current spreads and swap rates.

Apart from trading accounts, Groshare Limited offers an investment plan with a return of 9% to 18%, but the firm does not specify the period for these returns. Profit is credited monthly, and the investment amount is supposedly insured. Yet, no further details are provided: what is the minimum investment amount, where does such a high return come from, and how does the insurance work? This strongly resembles a financial pyramid scheme, as it promises guaranteed returns on investments — something that HYIPs are known for and are banned by law.

- None.

- Conflicting data: in one place the starting deposit is $100, in another $2,500.

- High commission up to 7%.

- No demo account and no cent tariff.

Groshare Limited claims to provide educational materials, daily analytics, and a trading academy. All this information is located in the “Tools & Education” section on the official website. However, some tools do not work. For example, the trading academy section is empty, and the available educational materials are overly basic — this kind of information can be found in open sources within minutes. As a result, the promised educational service raises doubts about its quality and usefulness.

Deposit, Withdrawal, and Fees

According to the personal cabinet, deposits can be made via bank cards, bank transfers, P2P, and cryptocurrencies. Groshare Limited claims that there are no fees for deposits or withdrawals. However, there is a contradiction in the payment processing terms: on the one hand, the broker promises processing within one business day; on the other, it states that funds may take 3 to 7 business days to reach the client.

This raises another question: if a client withdraws funds via cryptocurrency, why would it take up to 7 days when such transactions typically take just minutes? Even bank card transfers are usually processed faster.

| Features | Groshare Limited | Equaledge | QuantumWins |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ✔️ |

| Electronic Payments | ❌ | ❌ | ✔️ |

| Crypto Transfers | ✔️ | ✔️ | ❌ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ❌ | ✔️ | ❌ |

How Can I Contact It?

The broker’s contact information is extremely poor. Groshare Limited provides an email address and two phone numbers. However, there are no online chat or social media accounts. And the main issue is not even that. We checked the email address — it does not exist. The broker is providing a fake email.

- None.

- Fake email.

- No online chat.

Unfavorable conditions, a low-quality website, and fake contact details — are these the signs of a trustworthy company where you can safely invest your money? Of course not. We have serious doubts about the reliability of this firm, but to make a full conclusion, we need to check licenses and other aspects of its operations.

How Long Does The Broker Work?

If a company hides its founding date, it raises suspicion. How can we find out when the platform was launched? This can be done by checking the domain registration. Groshare Limited actually has two domains, so both need to be checked: grosharelimited.com and groshareltd.com. Both were registered on November 27, 2024, and they were purchased for only one year, expiring on November 27, 2025.

The second alarming detail is the domain registrar. It is registered through Dominet (HK) Limited, but the contact email belongs to Aliyun (Alibaba Cloud), a service widely known for hiding website owner data. This means that the broker’s real ownership cannot be traced. If Groshare Limited were a legitimate company, its domain would be registered under actual legal entities, not anonymous services.

The cherry on top — the domain servers. They operate through Cloudflare, which can be used to mask the IP address of the real server. While this is not always a sign of fraud, in combination with all the other red flags, it raises concerns about the true intentions of this company.

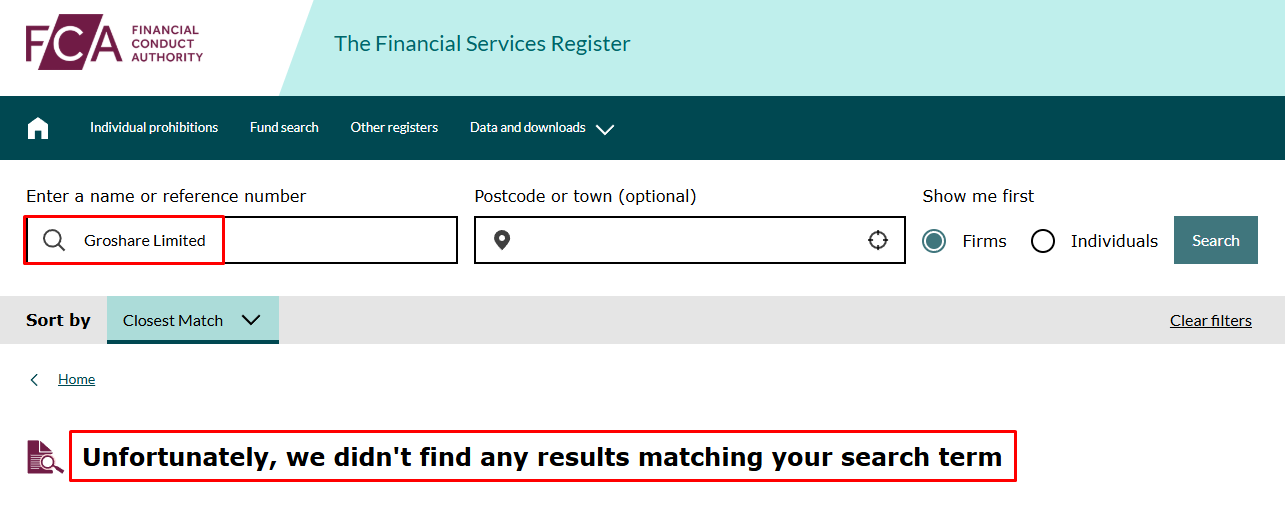

The contact section lists two office addresses — one in the UK and another in Poland. We checked the UK address through Companies House. It turns out there is indeed a firm with this name in the UK, but here’s the catch — it was founded in 1962. That is clearly not the company we are investigating. We also searched the FCA registry, as this company should have a license from the UK financial regulator. However, no such license exists. This confirms that the broker is operating illegally.

| Features | Groshare Limited | SmartMarket26 | FinBitPro |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ❌ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ❌ | ❌ | ❌ |

How Risky Is It?

Kevin Berry

Kevin Berry A typical scam tactic is to take the name and legal address of an already existing organization from the UK or another reputable jurisdiction and then launch a fake brokerage platform, collecting money from unsuspecting traders. This is why it is essential to verify all the information a company publishes on its website. Basic fact-checking can help you avoid falling into the hands of fraudsters like Groshare Limited.

Groshare Limited rating

1 review about Groshare Limited

I deposited $300. Then I realized that a minimum of $2,500 was required to activate the lowest-tier account. I don’t have that kind of money. I requested a withdrawal, but the company did nothing. The scammers refuse to return my money and are ignoring me. I literally gave away $300 to fraudsters from a fake company. Beware of groshare limited — do not invest your funds here!