The online trading market is growing, and with it, new brokerage firms continue to emerge. One such platform is NRDX — a CFD broker from South Africa that claims to offer the best conditions, negative balance protection, and other advantages. In this review, the goal is to examine the firm, identify suspicious and negative aspects, and determine whether the company is a scam or not.

Table of Contents

Highlights

| 🏛️ Country | South Africa |

| ⚠️ Regulation | FSCA |

| 🖥️ Website | https://www.nrdx.com/ |

| 🎲 Demo Account | Yes |

| ⏳ Start Time | 2023 |

| 💲 Minimum Deposit | $50 |

| ⚖️ Minimum and Maximum Leverage | 1:2-1:200 |

| ⚙️ Trading Platform | NRDX Platform, MetaTrader 5 |

| support@nrdx.com | |

| 📞 Phone | +35725775500 |

First Impression of Nrdx.com

We will begin our introduction to the broker with its official website. NRDX strives to appear modern and reliable. A black background, neon green accents, and a minimalist style — all of this creates the impression of a premium service. The website is available in seven languages, with the primary audience being residents of the Asian region, meaning clients from countries where the forex industry is not strictly regulated.

In the website’s footer, the company discloses its legal details, including its license, and provides a risk warning. However, there is no description of the brand’s development history, no information about the business model, the founding date, or the firm’s founders. All reputable brokers have public figures: XTB has Omar Arnaut, while eToro has Yoni Assia.

The top menu of NRDX is standard: available markets, pricing plans, conditions, deposit/withdrawal options, platforms, company information, and the affiliate program. Next to it are buttons for login and registration. Additionally, WhatsApp and Telegram logos are integrated into the homepage for customer support.

Overall, it cannot be said that nrdx.com is just a template-based website, but its design is not well-suited for comfortably reviewing information. The black-and-green color scheme quickly strains the eyes. Moreover, the company is not entirely transparent with its clients, as the disclosed information is only partial.

Partnership and Bonuses

The NRDX affiliate program offers two types of cooperation: CPA (a fixed reward per referred client, up to $5,000) and Introducing Brokers. Unfortunately, no specific details about the partnership have been provided. What percentage is paid for referrals? Can rewards be withdrawn? Are there any restrictions? Nothing is disclosed.

The company does not mention any bonuses. In the user agreement, there is Section 11: Bonus and Award Policy, which simply states that for details on bonus offers, users should visit the official website. However, NRDX has not provided any information about bonuses on its website. This suggests that the broker does offer bonuses but does not disclose the terms under which they are granted.

Account Opening on Nrdx.com

The registration process is simple. The broker asks for a name, email, phone number, and password. Users also need to agree to the legal documents. Additionally, they can create an account using Google.

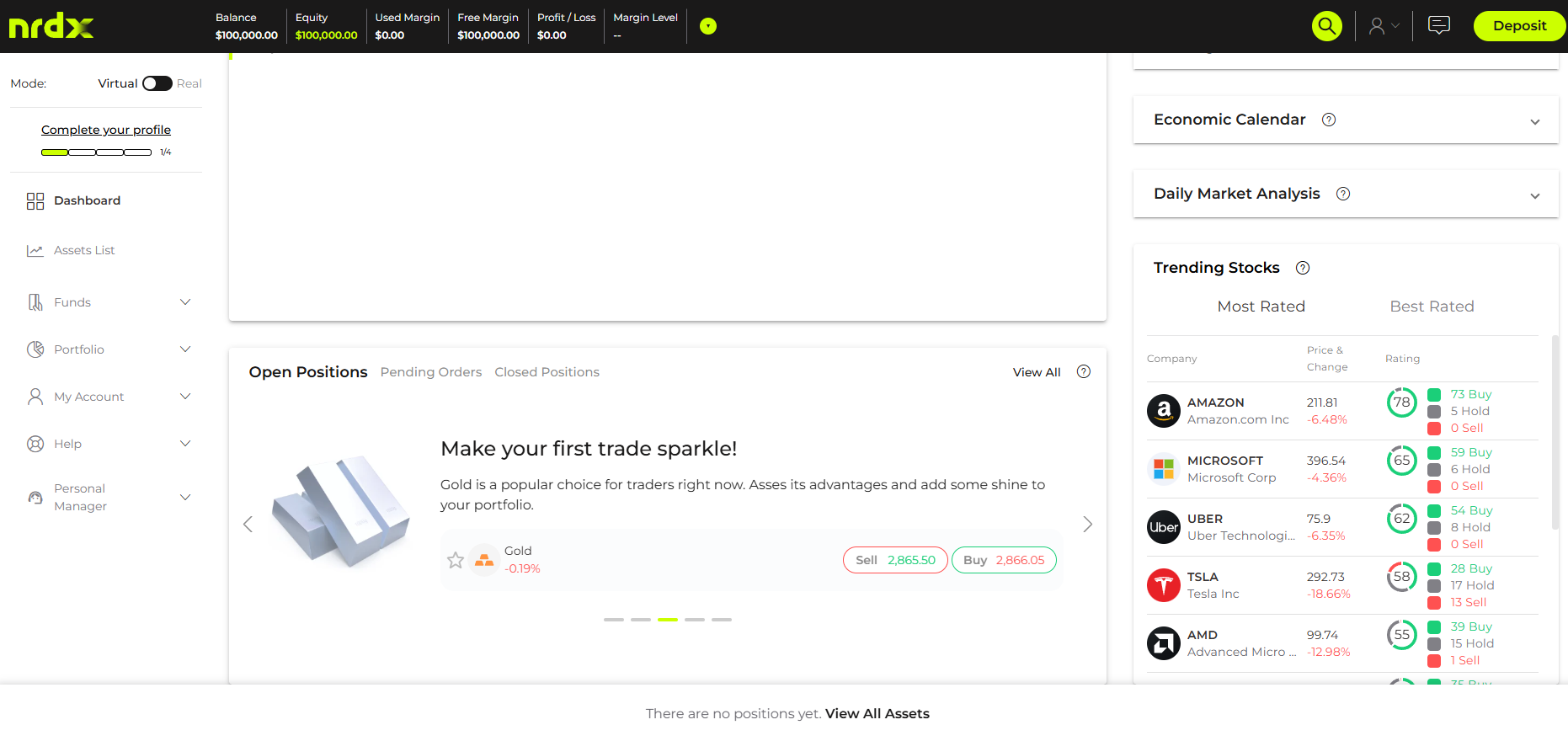

Next, the personal cabinet immediately opens with an option to trade on a real account or a virtual one. This allows clients to first test the service on a demo account instead of risking real money. The NRDX personal cabinet interface is basic: on the left are the main sections (dashboard, assets list, funds, portfolio, account info, help, and personal manager). At the top, the balance is displayed, and on the right, there are supporting widgets: an earnings report calendar, financial events, market analysis, and stock quotes. There is also a search button, a notifications window, and a language switch.

Verification

To complete the registration, users must provide additional personal information, including their address and passport details. Then, they need to upload documents that verify their identity and place of residence. NRDX claims to comply with FSCA regulatory requirements, so the KYC procedure is mandatory.

The document upload process takes place within the personal cabinet, and here’s an interesting point: the verification is conducted for GVT KORIMZA (PTY) LTD, not NRDX.

It appears that the broker uses a third-party legal entity to process documents, a common practice among offshore companies, but one that reduces transparency. The legal entity GVT KORIMZA (PTY) LTD is not mentioned anywhere else, however, Google mentions that this company previously owned the closed broker Tixee.

What is the connection between these companies? If you plan to upload documents for KYC, you should conduct additional research on this firm, as you will be entrusting your sensitive information to it. This looks highly suspicious, and what exactly is behind this scheme remains unknown.

- The verification procedure is mandatory.

- Verification is for GVT KORIMZA (PTY) LTD, not NRDX, and there is no explanation.

- No timeframe for processing of documents is specified.

Trading Software

NRDX clients have two platform options: a web trader or MetaTrader 5. There is no need to comment on the MetaQuotes software, as it is a well-known terminal with many tutorials and videos available online. It is one of the most popular forex trading platforms.

The other option is a basic WebTrader with standard features such as technical analysis and indicators. Additionally, there are mobile apps for Android/iOS, but the app’s rating is low. For example, on Play Market, it has only 10 downloads and a rating of 3 stars. This indicates that NRDX is not popular among traders. If it were a well-known company, the number of downloads would be in the tens or hundreds of thousands.

The trading platform integrated into the personal cabinet is not the company’s proprietary software. We have seen similar software from several offshore brokers. A proprietary trading terminal increases trust in a firm, but in this case, NRDX does not have one.

| Features | NRDX | Capitalis Sa | Gainful Markets |

|---|---|---|---|

| Demo Account | ✔️ | ❌ | ❌ |

| Mobile App | ✔️ | ❌ | ❌ |

| Own Development | ❌ | ❌ | ❌ |

How Can I Trade With NRDX?

The company offers over 200 U.S. stocks and more than 350 CFDs on forex, metals, commodities, cryptocurrencies, and other market classes. However, it is suspicious that the firm claims to provide real stocks. Does this mean clients have access to investing in Facebook, Tesla, Microsoft, and other American companies while also receiving dividends? We highly doubt it. Many questionable brokers refer to CFDs on stocks as “real stocks” to create a false sense of ownership for clients. In reality, you do not become a shareholder but simply trade on price movements.

All Info About Accounts

NRDX has developed two types of accounts: for real stocks and for CFDs. In the first category, accounts are divided into three tiers:

- Basic — minimum deposit of $500. Commission per ticket is $1.75, per share $0.01, and there is a market data fee of $4.5/month. Leverage: 1:2.

- Intermediate — minimum deposit of $2,500, with better conditions, including leverage of 1:3.

- Premium — from $10,000+. Fees per ticket are $1.25, per share $0.006, and the market data fee is $1.25.

For CFDs, there are only two account tariffs:

- Basic — minimum deposit of $50. Traders can choose zero-commission trading, where the EUR/USD spread starts from 0.8 pips, or a commission-based model, where spreads start at 0 pips. The commission is $3 per forex trade and 0.3% for cryptocurrency trades, with a maximum leverage of 1:200. Additional services include calculators and automated trading with expert advisors.

- Premium — $500 and more, offering better conditions: tighter spreads and lower trading fees. It also includes weekly outlooks, an investor package, meetings in the Dubai office, and chief market analysis. However, NRDX does not disclose its Dubai office address, only listing South Africa on the website.

We have serious doubts that NRDX actually provides access to investing in real U.S. stocks. A broker offering real stocks must have direct access to stock exchanges such as the NYSE or NASDAQ. However, NRDX does not mention this anywhere on its website. Brokers dealing with real stocks use stock trading platforms like Thinkorswim, TWS, or Active Trader Pro. Meanwhile, MetaTrader is exclusively a CFD trading platform. Many other aspects can only be verified through practical use or by speaking with company representatives, but there are clear signs of deception regarding “real stocks”.

- Low starting deposit of $50.

- Demo account.

- There is no cent tariff.

- The broker does not specify the stock exchanges to which it is connected or intermediaries.

Market Analysis and Education With Nrdx.com

Clients can use economic calendars, a news feed, and calculators. Depending on the selected plan, market analysis, and a personal analyst are also available. However, there is no mention of educational courses. Additionally, NRDX has a YouTube channel, but it is completely empty.

Deposit, Withdrawal, and Fees

The broker supports three payment methods for deposits and withdrawals: credit/debit cards, e-wallets, and bank transfers. Notably, cryptocurrency transactions are not available, despite their massive popularity among traders. Withdrawal processing times vary depending on the method:

- E-wallets — up to 24 hours.

- Credit/debit cards — 1-3 business days.

- Bank transfers — 2-5 business days.

NRDX claims not to charge any fees for deposits and withdrawals. However, the fee structure contradicts this. The account descriptions mention a $5 withdrawal fee, but one free withdrawal per month is allowed. So, is there a withdrawal fee or not? The company contradicts itself.

| Features | NRDX | Market Haven | CauvoCapital |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ✔️ |

| Electronic Payments | ✔️ | ✔️ | ❌ |

| Crypto Transfers | ❌ | ✔️ | ✔️ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ✔️ | ✔️ | ❌ |

How Can I Contact It?

There are several ways to contact NRDX managers:

- Email.

- Phone.

- Online chat.

- Messengers WhatsApp and Telegram.

However, there are also problems. For example, online chat doesn’t work. When you click on “start live chat” nothing happens. Messengers are only available for registered users.

- Basic ways to get in touch are available.

- Online chat doesn’t work.

Is NRDX Dangerous?

At this point, there is no concrete proof that NRDX is a scam. The website, trading conditions, and platforms appear standard and do not immediately raise red flags. However, we will now examine the company’s licenses and legal details.

How Long Does The Broker Work?

It is essential to understand how long the firm has been in business. NRDX does not disclose its founding date, even though all legitimate brokers do. For example, Interactive Brokers states it has been operating since 1978, while Saxo Bank has been around since 1992.

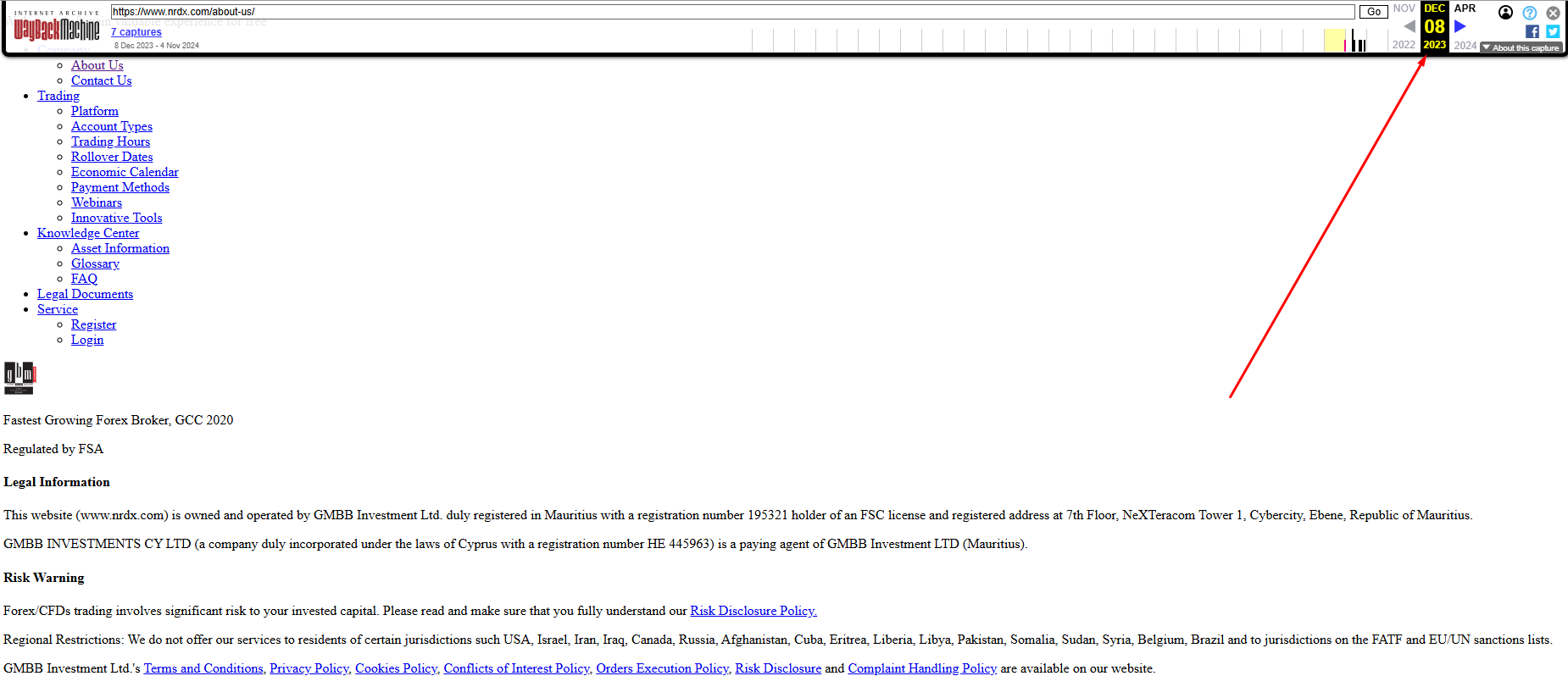

Let’s try to verify the domain. The domain was registered in 2011, but this does not mean the company has existed for 14 years. The last update was in 2023. Looking at WebArchive snapshots, the platform was inactive in 2021. However, by 2023, it had transformed into a brokerage website. During that period, NRDX belonged to GMBB Investment Ltd, a company registered in Mauritius. Moreover, this company is still listed as a liquidity provider for CFDs in the Terms and Conditions.

We also discovered several suspicious details when analyzing the domain:

- The domain owner is hidden behind a proxy service (Domains By Proxy, LLC). This practice is typical for anonymous offshore companies and is often used by brokers that do not want to disclose ownership details.

- The database does not mention NRDX Pty Ltd or GVT KORIMZA (PTY) LTD. Legitimate companies always register domains under their legal name (for example, Interactive Brokers registers its domain under “Interactive Brokers LLC”).

These are not direct signs of fraud, but they raise concerns about the company’s honesty and transparency.

How Is NRDX Regulated?

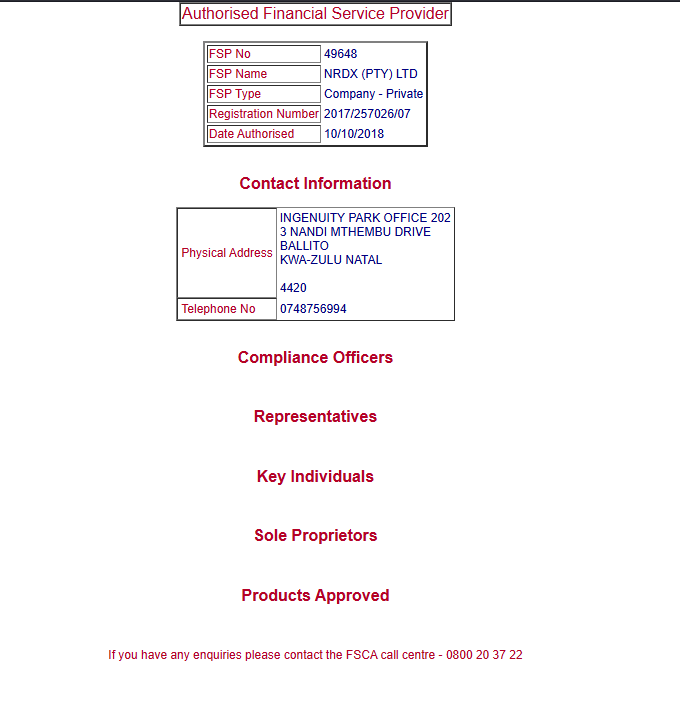

We found NRDX listed in the FSCA registry, with an authorization date of 2018. Interestingly, it has been five years since the company received its FSCA license, but how has the company been operating during this time?

The FSCA license (South Africa) does not provide sufficient client protection. It does not strictly regulate market makers, does not require segregated accounts, does not insure client funds, and does not protect traders outside of South Africa.

If a broker holds only an FSCA license but operates globally, it is a high-risk option because, in case of disputes, clients will receive no protection. NRDX does not hold licenses from CySEC, FCA, ASIC, or other stronger regulators, making its reliability questionable.

| Features | NRDX | Korata | Weinsteincorp |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ❌ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ✔️ | ❌ | ❌ |

| Offshore | ❌ | ❌ | ❌ |

If I am a European resident, will the FSCA regulator help me in the event of an NRDX scam?

Is NRDX Legit?

How Risky Is It?

Kevin Berry

Kevin Berry If a broker considers itself safe and profitable, then why does it need fake positive reviews? If you try to find comments about NRDX, you will see a flood of positive feedback that lacks any specifics — no details on how much traders earned, how withdrawals were processed, proof of the company’s solvency, or other crucial information. These reviews immediately stand out as paid content. It seems that things are not as perfect as the company wants us to believe.

NRDX rating

2 reviews about NRDX

I could not make money with NRDX. The spreads are significantly higher than what is listed in their pricing tables. I tried both MetaTrader and the web platform, and both had terrible lag and poor connection stability. Additionally, their customer support is awful. I never received a response regarding long withdrawal delays. No replies via email, WhatsApp, or Telegram. I also heard from other traders that the company can block accounts for any reason and take a very long time to return funds.

It is better not to risk your money – I completely agree with that. A broker like nrdx.com could scam you at any moment. And what will you do then? There is nowhere to turn, as there are no serious licenses. If you are a South African citizen, then yes, you can trade here. But if you are not, this broker is not for you. That is just my opinion.