It’s both amusing and surprising to see how a broker with virtually no online reviews claims to have 400,000 active traders on its platform. Introducing RiveGarde – where financial dreams supposedly take flight. Yet, glaring questions remain. Where are the necessary licenses for their brokerage activities? Where are the legal documents confirming their Swiss registration? In short, it’s crucial to conduct a thorough analysis of the company before opening an account or adding funds to your deposit. Most likely, we are dealing with a classic Forex scam, which is engaged in illegal activities, deceiving people for money.

Table of Contents

Highlights

| 🏛️ Country | Switzerland, Japan, United Kingdom, France, Spain, |

| ⚠️ Regulation | – |

| 🖥️ Website | https://rivegarde.com/ |

| 🎲 Demo Account | No |

| ⏳ Start Time | 2023 |

| 💲 Minimum Deposit | $250 |

| ⚖️ Minimum and Maximum Leverage | 1:10-1:50 |

| ⚙️ Trading Platform | WebTrader, MetaTrader 5 |

| support@rivegarde.com | |

| 📞 Phone | +41-21-821-39-21 |

First Impression of Rivegarde.com

The broker’s official website appears to be built using a generic template. It’s highly likely that the firm simply took a pre-designed template and populated it with their own text. The top of the site features the usual suspects: sections on types of accounts, asset classes, resources, company information, and contact details. The homepage is quite banal, listing various advantages and features without the inclusion of any unique graphic elements or special effects. The footer of the RiveGarde site essentially repeats the upper sections and also includes basic policy documents like the KYC policy, user agreement, complaint procedures, and privacy policy.

The website is replete with clichéd phrases and motivational slogans like “navigate the foreign exchange market with ease and precision,” and “unlock the potential of cryptocurrencies.” However, RiveGarde doesn’t back these supposed advantages with any solid evidence. Numerous details are conspicuously absent, including specifics about trading conditions, the company’s founding date, registration documents, and licensing information. It appears to be a typical, hastily assembled template site, seemingly designed to quickly launch a scam. There’s nothing unique, compelling, or aesthetically pleasing about it.

Partnership and Bonuses

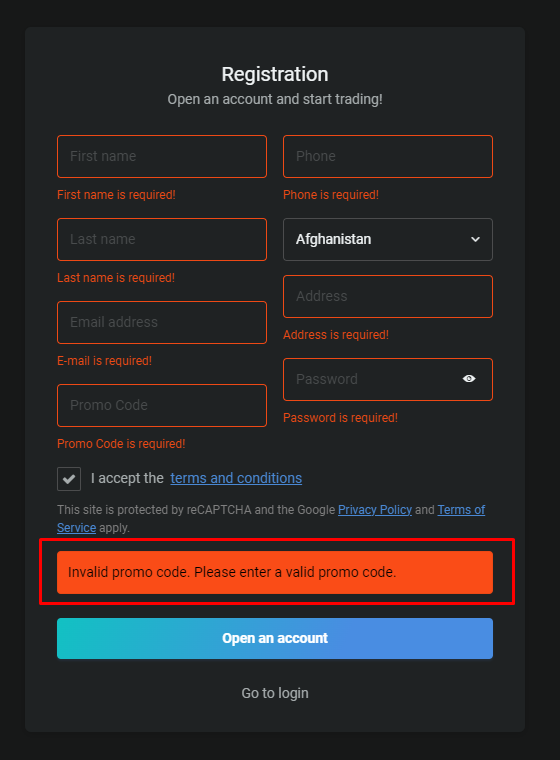

You can learn about the affiliate program during the account creation process, as the system prompts you to enter a promo code, hinting at the program’s existence. However, the terms of the affiliate program are not explicitly stated on the website. Details about RiveGarde’s bonuses can only be gleaned from the user agreement. Furthermore, conditions for each bonus promotion are set on a case-by-case basis. If a trader activates a bonus, neither the bonus itself nor the profits earned from it can be withdrawn. These restrictions remain in place until all specified conditions are met.

Why hasn’t RiveGarde included separate sections on its website for bonuses and affiliate programs, as is standard practice for reputable brokers? It’s a mystery to us. It’s also a mystery under what conditions bonus funds are given. Nonetheless, we can assume: Traders are likely required to achieve a substantial trading volume before they can withdraw any funds. Companies typically offer bonus money under the most unfavorable conditions.

Account Opening on Rivegarde.com

The broker follows a typical and standard registration process. They request basic information like your first and last name, phone number, country of residence, email address, and a chosen password. Additionally, there’s an option to enter a promo code if you have one.

Nevertheless, we were unable to complete the registration because the system mandates the input of a promo code. While we initially thought this would be optional, it turns out that an invitation code is actually required. Without one, you can’t create an account with RiveGarde, indicating that their registration process is private. It is a serious drawback of the firm. Additionally, there’s no mention of a demo account, suggesting that one is not available.

Verification

RiveGarde claims to adhere to AML and KYC policies, making verification mandatory for all users. The verification procedure aligns with standard practices and is detailed in the KYC document available on the company’s website. Essentially, the broker requires traders to validate their identity and residential address. However, it remains unclear how this document submission process unfolds, as we couldn’t access the user dashboard due to the mandatory promo code requirement.

- Specifies the documents and why KYC is required.

- None.

Trading Software

RiveGarde describes its trading platform as professional, user-friendly, multifaceted, and advanced. The broker claims that the platform caters to both seasoned traders and novices, boasting lightning-fast order execution and comprehensive analysis tools. The software can be downloaded onto iOS/Android smartphones. The firm even features software from MetaQuotes, specifically MetaTrader 5, along with a download link.

Due to the impossibility of registering an account without an invitation, we couldn’t verify what the platform truly offers. As a result, we’re left to rely on what RiveGarde’s website claims, which is risky. Brokers, particularly unlicensed ones, are known to exaggerate the features of their platforms, painting them as professional-grade services. However, often traders are presented with a primitive terminal without iOS/Android applications and a limited set of tools.

| Features | RiveGarde | FXStone Financial | Fusion Markets |

|---|---|---|---|

| Demo Account | ❌ | ❌ | ✔️ |

| Mobile App | ✔️ | ❌ | ✔️ |

| Own Development | ❌ | ❌ | ❌ |

How Can I Trade With RiveGarde?

We’re looking at a typical CFD broker, which means traders have access only to contracts for difference; actual assets like spots or futures are not available. RiveGarde allows trading in forex, commodities, cryptocurrencies, stocks, indices, and metals. Interestingly, they also claim to offer NFTs, which was quite surprising to us. The platform doesn’t specify how NFT trading is facilitated, whether they offer derivatives of popular NFT collections or have their own NFT marketplace. It seems likely that the mention of this asset class is primarily for marketing purposes.

Next, we’ll examine the types of accounts available to clients, as the type of account you choose will dictate the range of additional services and features you can access.

All Info About Accounts

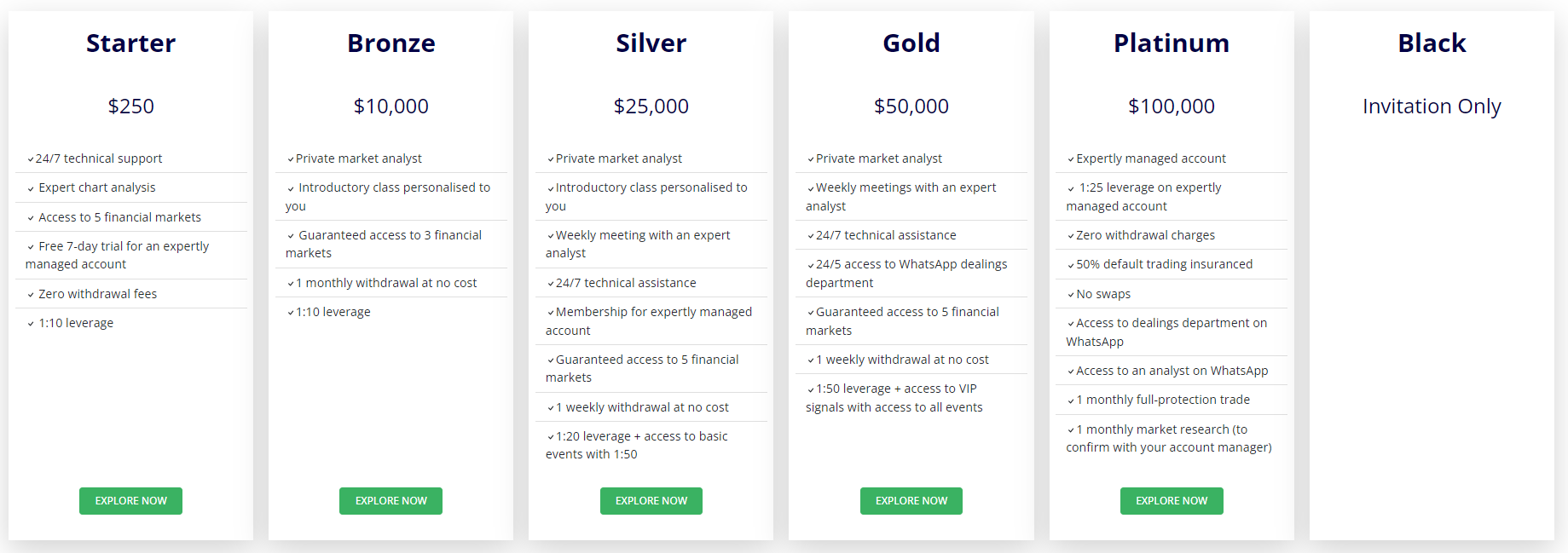

There are 6 rates available at RiveGarde:

- Starter. Minimum deposit from $250, the client receives technical support 24/7, expert chart analysis, 5 financial markets, a free 7-day trial for an expertly managed account, zero withdrawal fees, and leverage up to 1:10.

- Bronze. From $10,000, differs from the first tariff by the following services: private market analyst, introductory class personalized to you, guaranteed access to 3 financial markets, and 1 monthly withdrawal at no cost.

- Silver. From $25,000. RiveGarde additionally provides 24/7 technical assistance, weekly meeting with an expert analyst, membership for expertly managed account, and 1:20 leverage and access to basic events with 1:50.

- Gold. From $50,000. Differences from previous tariffs: 24/5 access to WhatsApp dealings department, 1:50 leverage, and access to VIP signals with access to all events.

- Platinum. From $100,000. Expertly managed account, zero withdrawal charges, 50% default trading insurance, no swaps, 1 monthly full-protection trade, and 1 monthly market research.

- Black. Invitation only.

There are many questions about RiveGarde’s trading conditions. First, the high minimum deposit of $250. For comparison, many honest and popular brokers offer access to trading with just $10. The second type of account even has a colossal starting deposit of $10,000. Second, why are there no withdrawal fees on the first tariff, and then they appear? Why does the same first account type offer 5 market assets, while those who can afford “Bronze” only get 3 asset classes? Who came up with such ridiculous conditions? Third, why is leverage so low at 1:10? On such small amounts, traders need more leverage, especially in the forex market. Fourth, there are big questions about the competence of RiveGarde’s analysts and signals. How can analysts and experts confirm their professionalism? And where are the past results of signals and recommendations so that their quality can be assessed?

RiveGarde operates under the “pay more, get more privileges” principle, a hallmark of fraudulent organizations. The platform further raises suspicions by lacking basic features often offered by reputable brokers, such as demo accounts, Islamic accounts, or low-entry accounts for those who wish to start with smaller sums. Even essential trading terms like commissions and spreads are conspicuously absent, leaving us to wonder what hidden fees the platform might contain. Only the scammers themselves know what commissions are on their scam

- None.

- The broker requires a high amount for the initial deposit.

- Important options, such as a demo account and an Islamic tariff, are missing.

- Most of the trading conditions are hidden.

Market Analysis and Education With Rivegarde.com

The company suggests downloading Anydesk for remote desktop access, hinting at the presence of a personal manager or analyst who could join your desktop remotely. We strongly caution against granting anyone such access, given its inherent risks. Firstly, it is a popular tactic among fraudulent brokers where an analyst initiates losing trades on the client’s behalf. Secondly, the manager could potentially steal sensitive information stored on your computer, including cryptocurrency wallet passwords. It is not a new scam, but it’s an effective one that RiveGarde appears to employ actively.

On the other hand, clients can access asset classes, utilize an economic calendar, and reach out to technical support at no cost. The news feed is missing, but there is a table with online quotes for popular assets.

Deposit, Withdrawal, and Fees

Money transfers in RiveGarde are available via credit/debit cards, bank wire transfers, and other unspecified methods. While the commission for deposits remains undisclosed, withdrawal fees are vaguely mentioned in the account types, without any specific numbers. The broker is very secretive, because such an important aspect as commissions should be described in detail.

| Features | RiveGarde | StockHome | Signet Capital |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ✔️ |

| Electronic Payments | ❌ | ❌ | ✔️ |

| Crypto Transfers | ❌ | ✔️ | ✔️ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ✔️ | ❌ | ❌ |

How Can I Contact It?

RiveGarde generously lists five contact numbers from different countries, suggesting that it has international branches. There’s also an email address that does exist, as well as a form for requesting a callback from the company.

We took the initiative to verify each of these phone numbers for authenticity. The British number turned out to be inaccessible, as did the French, Spanish, and Swiss numbers. The Japanese number was even incorrectly listed. It appears that RiveGarde is sharing fake contact information with its visitors.

- There is an email.

- Phone numbers are fake.

- Social networks are unavailable.

Is RiveGarde Dangerous?

Do you also find the broker to be exceedingly odd and suspicious? The trading conditions are completely insane, the contact details are fake, and registration without an invitation is impossible. That’s a lot of red flags, and we haven’t even delved into the company’s operating history, registration details, or licensing yet. Time to investigate further.

How Long Does The Broker Work?

The company vaguely mentions that it has been operating for several years. However, it does not specify an exact founding date. Interestingly, RiveGarde’s website domain was only registered in July 2023, making it a very recent entrant in the market.

Registration documents are missing, and they could be very useful in establishing the operating period. However, considering the lack of numerous mentions on the Internet, the documents are not needed. It’s obvious that the company started operating only in the summer of this year.

How Is RiveGarde Regulated?

A Swiss brokerage firm is required to secure a license from the local regulatory body, FINMA. Has RiveGarde obtained such a license? We’re about to find out.

A search within FINMA’s database produced no results, indicating the broker is operating unlawfully. We additionally cross-referenced the FCA registry, as a British phone number was provided. There too, RiveGarde was absent. Further checks with other registries are pointless at this stage, as it’s abundantly clear we are facing an illegal organization.

| Features | RiveGarde | InternationalReserve | Stone Bridge Ventures |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ❌ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ❌ | ❌ | ✔️ |

Frequently Asked Questions (FAQ)

How to Trade With RiveGarde?

Is RiveGarde Legit?

How Risky Is It?

Kevin Berry

Kevin Berry So, another scam broker has been dissected down to the bones. The fact that all 5 listed phone numbers are unavailable hardly speaks to the company’s seriousness and reputation. RiveGarde indicated an address in Switzerland, but forgot to attach legal documents. They stated on the website their activity is regulated, but could not provide links to the regulators. All the advantages and merits described by the fraudsters are purely enticing and promotional. None of the offers that you can read and study on the website are true. Please do not give your money to the scammers from RiveGarde; this is all they are waiting for.

RiveGarde rating

3 reviews about RiveGarde

Very suspicious broker! Better not to take risks and avoid it! I didn’t see any licenses or founding date for it. And there’s almost no talk about it on the Internet. These are hardly signs of a verified and safe company. It’s better not to take the risk, really.

I can’t say anything good or positive about rivegarde. The broker engages in illegal activities and lies a lot. The company lies about having several years of experience, lies about being regulated, lies about having addresses in multiple countries and a headquarters in Switzerland. All of this is easily verifiable. You can check the business registries of any country mentioned on their website, as well as the registries of regulators in all jurisdictions. Then you’ll see and understand that rivegarde is a company of swindlers, scammers, and criminals.

As an experienced trader, I’m telling you, there’s no point in trading here. Trading makes no sense because the charts are fake, the liquidity is fake, the platform is also fake. Moreover, you won’t even be able to try it out on a demo account, as that option isn’t available here. You need to invest real money right away just to minimally try out the platform’s functionality. I think this is utter absurdity. It should not be happening. Yes, normal and verified firms don’t have this, but scammers do. And this is precisely a scam broker.

I highly advise against engaging with RiveGarde for any trading activities. Trying to register an account by seeking promo codes or asking their managers for assistance is futile. What we have here is a typical scambroker, designed to initially attract victims and subsequently defraud them.

They employ a variety of deceptive tactics and means of theft, including using Anydesk program for remote desktop access to a trader’s computer. Do you actually believe that their so-called analyst intends to assist you in trading via Anydesk? It is absurd. Their aim is to deplete your funds when you’re not looking, and to steal your passwords for banking, e-wallets, and social media accounts.

RiveGarde is indistinguishable from the slew of other scam brokerage firms out there. It lacks proper licensing, has a questionable operational history, and keeps the identities of its founders well-hidden. Additionally, the absence of legal documentation is a glaring red flag. Don’t get ensnared in this fraud; you’ll inevitably lose money. RiveGarde is nothing but a scam, far removed from being a legitimate or genuine broker.