Starting in 2020, The Investment Center has offered traders the chance to trade on financial markets, catering to both beginners and seasoned clients alike. The platform boasts over 200 CFDs, a cutting-edge terminal, and the advantage of leverage. Yet, all these features fall short if the company engages in fraudulent activities. Reviews are a mixed bag, presenting conflicting views. The pressing question remains: Is this a scam or a reliable entity to establish a brokerage account? We’ll delve deeper to find out.

Table of Contents

Highlights

| 🏛️ Country | United Kingdom, Australia |

| ⚠️ Regulation | – |

| 🖥️ Website | https://investmentcenter.online/ |

| 🎲 Demo Account | No |

| ⏳ Start Time | 2020 |

| 💲 Minimum Deposit | $250 |

| ⚖️ Minimum and Maximum Leverage | 1:100-1:400 |

| ⚙️ Trading Platform | WebTrader |

| support@investmentcenter.online | |

| 📞 Phone | +61383999132, +442039123746 |

First Impression of Investmentcenter.online

How do you react when greeted by columns of an ancient-looking structure upon entering The Investment Center’s official website? Seriously, what was the designer thinking when they chose a mere image of building columns for the site’s layout? It’s baffling, to say the least, seeing the designs concocted by various forex fraudsters – and that’s putting it mildly.

Setting architecture aside, we’re presented with a generic, templated site. It showcases standard sections, covering aspects like the trading platform, account types, company operations, FAQs, and documents, including AML&KYC and user agreements. The Investment Center is all about self-praise, trying to enhance its image for potential users. To be frank, their effort feels both feeble and comical.

Partnership and Bonuses

The Investment Center’s website is silent on any affiliate program, and we couldn’t find any indications of one. Bonuses are reserved for those opting for the “Gold” plan, starting at a minimum deposit of $10,000, though the precise bonus size remains undisclosed. It’s crucial to recognize that bonuses aren’t given without strings attached. They’re a marketing tactic with potential underlying issues.

To be eligible to withdraw the received bonus, it has to be traded 20,000 times its value. Additionally, the activation of the bonus program comes with withdrawal constraints for the main sum. Clients can withdraw up to 20% of their deposit; however, if withdrawals exceed this limit, the bonus and any following profits are canceled. The Investment Center appears to be exploiting this scheme. One should realistically assess their trading proficiency before opting for such bonus funds.

Account Opening on Investmentcenter.online

Opening an account with The Investment Center is a standard and understandable procedure. The broker asks you to specify your first and last name, country, phone number, and e-mail, and then come up with a password and agree to the terms and conditions.

After registration, the firm does not require the user to confirm the email and phone number entered. It is a serious security hole in The Investment Center’s security system.

The user dashboard is quite standard. You can toggle between a light and dark theme, and adjust the language setting (only English is available though). Additionally, you can update personal information, provide verification documents, enable notifications, input your BTC crypto address, access company documents, and reach out to technical support. Lastly, The Investment Center doesn’t provide a demo account option.

Verification

At The Investment Center, users are required to undergo verification before starting to trade. They need to provide documents that confirm their identity and residency. Moreover, the company might also ask for video or audio verification.

- None.

- Video or audio verification may be required.

- No trading is possible without KYC.

Trading Software

The trading platform of The Investment Center is integrated into the trader’s dashboard. The firm pledges the best execution, but this can’t be confirmed without depositing actual funds, especially since they don’t offer a demo account. Their “about us” section mentions compatibility with Android/iOS devices, but we couldn’t locate any dedicated app. They might be referring to browser adaptability for mobiles.

Regarding the trading terminal’s capabilities, the software is far from impressive. If we compare it with popular platforms like MetaTrader, a long-time dominated in the forex market, they’re simply not in the same league. The Investment Center’s terminal severely lags in functionality and features. You can’t upload personal indicators or set templates; there’s no provision for automated or copy trading; auto-testing strategies based on historical data is also not feasible, and the selection of indicators and technical analysis tools is very sparse.

| Features | The Investment Center | Odyssey Investment Group | Kiplar |

|---|---|---|---|

| Demo Account | ✔️ | ❌ | ❌ |

| Mobile App | ❌ | ❌ | ✔️ |

| Own Development | ❌ | ✔️ | ✔️ |

How Can I Trade With The Investment Center?

The Investment Center provides multiple account types to choose from. Based on the chosen package, customers get extra features and benefits. There are over 200 assets available for trading, encompassing forex, stocks, indices, metals, and cryptocurrencies. These assets are exclusively represented as CFDs. Leverage can be utilized to amplify trade volumes.

All Info About Accounts

Traders can select from four plans: “Silver” beginning at $250, “Gold” at $10,000, “Platinum” at $50,000, and “VIP” which is by invitation only. The notable disparity, particularly the vast $9,750 difference between “Silver” and “Gold”, stands out. The Investment Center may be pressuring clients to part with larger sums, enticing them with an expansive set of additional features for deposits of $10,000, and above. To clarify, here’s a comparison of the “Silver” and “Gold” plans:

- Silver – market review, over 200 tradable assets, leverage up to 1:100.

- Gold – dedicated senior account manager, bonuses, more favorable spreads, leverage up to 1:200, trade room analysis, financial planning, risk management planning, monthly webinars, prioritized withdrawal process.

The Investment Center seems to significantly sideline users of the first tariff. For traders, especially those new to the scene, who can’t spare $10,000 for trading, there’s minimal on offer. A majority of the perks and tools only kick in with the second account type and the following.

- None.

- No benefits or perks for minimum tariff holders.

- High minimum deposit.

- No demo account, Islamic account, cent tariff, ECN.

Market Analysis and Education With Investmentcenter.online

The Investment Center Education Center includes e-books, an asset index, and a glossary. In addition, there is a small section with FAQs. However, there are no online quotations, widgets, or auxiliary tools, such as stock exchange opening hours, interest rates of central banks, or calendar of economic events.

Deposit, Withdrawal, and Fees

You can deposit funds into The Investment Center using a credit/debit card, bank transfers, or electronic wallets. While cryptocurrencies aren’t explicitly listed, the website does offer an option to store a Bitcoin address. It hints at the possibility of conducting transactions with digital currency. Withdrawals are facilitated using the same method employed for the deposit. Unfortunately, there’s no mention of associated fees.

| Features | The Investment Center | Signet Capital | IC Markets |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ✔️ |

| Electronic Payments | ✔️ | ✔️ | ❌ |

| Crypto Transfers | ❌ | ✔️ | ❌ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ❌ | ❌ | ✔️ |

How Can I Contact It?

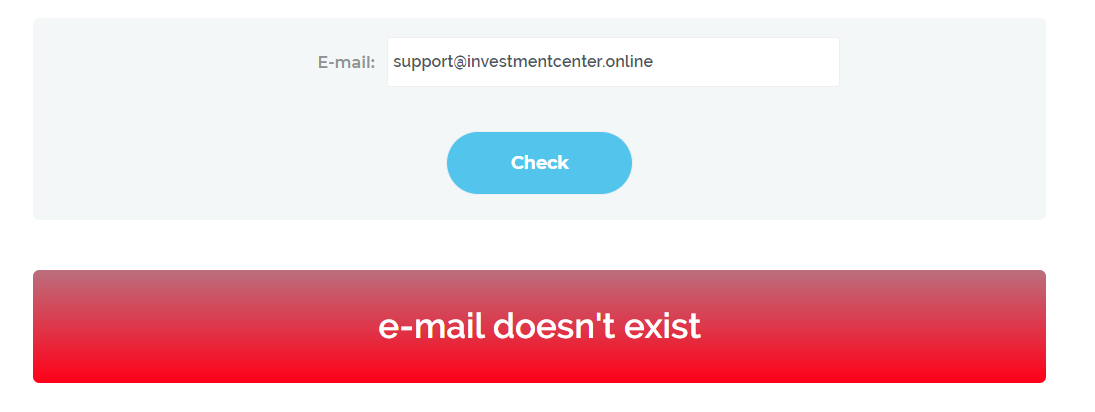

The Investment Center offers two contact phone numbers (for Australia and the United Kingdom) and an email for correspondence. Our attempts to verify these phone numbers showed that both were associated with this broker, with no reports of spam or fraud. However, a closer look at the email address unveiled a surprise: it doesn’t exist. How trustworthy can a company be if it lists a non-existent email address?

- None.

- Email doesn’t exist.

- There is no social media or online chat.

Is The Investment Center Dangerous?

What do you reckon: a fake email, a generic website layout, and unreasonable trading conditions – are these hallmarks of a scam broker or a trustworthy forex associate? The question is, of course, rhetorical. Currently, our confidence in The Investment Center’s legitimacy is severely shaken. As we delve deeper, we’ll definitively conclude if it’s a scam or not.

How Long Does The Broker Work?

A broker’s operational duration is something undeniable. The Investment Center confidently states it commenced operations in 2020. Yet, the domain’s registration date reflects December 2021, with no existing registration papers to validate their claim. Furthermore, reviews trace back to 2021 at the earliest. That scenario hints that the company might have overstated its age. Either way, this is a young firm, and there’s a clear instance of misleading information.

Interestingly, many online reviews of the company indicate that the management formerly claimed 2001 as its founding year. It appears they’ve recently switched from 2001 to 2020, possibly to make this inconsistency less conspicuous.

How Is The Investment Center Regulated?

The company lists Australian and British phone numbers, suggesting their offices are situated in Australia and the UK, which typically would mean they hold licenses from ASIC and the FCA. However, the ASIC registry doesn’t list any such organization by that name. The FCA does have a record, but it’s a warning about an unregulated entity named The Investment Center, albeit with different contact details and a .com domain instead of .online. It is visible in the screenshot provided. It’s possible that these scammers previously operated through different sites. In any case, the FCA hasn’t licensed that particular broker, indicating their operations are illegal.

| Features | The Investment Center | Buy Crypto Market | TheFinancialCentre |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ❌ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ❌ | ❌ | ❌ |

Frequently Asked Questions (FAQ)

Kevin Berry

Kevin Berry Everything indicates that traders should avoid The Investment Center. The FCA even cautions that this entity is deceptive and dangerous. It’s foreseeable these con artists might soon change their domain to exploit naive clients anew. Everywhere one looks, there’s a red flag, from the astronomical minimum deposit, and the Dealing Desk business model, to a deeply tarnished reputation and more.

The Investment Center rating

3 reviews about The Investment Center

I was considering trying out The Investment Center for trading. However, the absence of a demo account was a turn-off. The minimum deposit is steep at $250, especially when other well-known firms allow you to start with just $10. The reviews about The Investment Center aren’t particularly flattering either. I opted to play it safe and not make a deposit. I’d recommend you tread carefully as well.

The Investment Center has numerous drawbacks that scream scambroker. First off, their lack of licensing is telling. Without regulatory authorization, they operate on the fringes of legality. Their claimed operational history since 2020 is hardly convincing. Such a brief tenure doesn’t exude credibility or rich experience. Another red flag is the inherent conflict of interest. They function as a Dealing Desk, meaning they don’t route trade orders to ECN or liquidity providers; everything is internally managed. That model is problematic since the broker’s gain coincides with a trader’s loss. Expecting unbiased trading charts in this scenario is naive. Of course, it will be fake charts. Lastly, the stark absence of essential documents – registration papers, company details, financial reports, and leadership names – further undermines their legitimacy. It’s wise to keep a distance from this fraud.

I’d like to caution all traders: The Investment Center is nothing but a scam and fraud. I was ensnared by them half a year ago. Their cunning managers lured me with promises of trading signals, guidance, and courses, but only after depositing at least $3,000. Regrettably, I borrowed from friends and kin. I thought it was a savvy move, a chance to master remote earnings. I didn’t understand then, that these anonymous scammers were merely extorting money from me. They promised one thing, but the reality was entirely different.

In the end, The Investment Center swindled me. Half of my balance vanished due to unprofitable signals and flawed advice from these so-called analysts. The other half remains trapped in their wretched system. The withdrawal function doesn’t work. I tried, but they ignored me, and they no longer communicate with me.

It has been a harrowing experience, and a costly lesson. I’m still trying to repay those loans. My advice? Never trade on borrowed money, be wary online, and steer clear of The Investment Center. They’re nothing but charlatans and scammers