This review is dedicated to the Swiss broker YouTrade ECSA, which, according to its official website, has been operating for 5 years. During this period, the company has reportedly achieved some results: 50,000 satisfied clients, a monthly trading turnover of 2 billion, a staff of 100 people, and even received several awards in brokerage services. However, these are just words not backed by substantial evidence. Should we believe this? Considering that there’s scant mention of regulation except for a single mention of the FCA, but without license numbers or links to the registry, probably not, as it resembles a scam. Let’s analyze it further.

Table of Contents

Highlights

| 🏛️ Country | Switzerland |

| ⚠️ Regulation | – |

| 🖥️ Website | https://youtrade-ecsa.com/ |

| 🎲 Demo Account | No |

| ⏳ Start Time | 2023 |

| 💲 Minimum Deposit | $220 |

| ⚖️ Minimum and Maximum Leverage | 1:500 |

| ⚙️ Trading Platform | TRADE Platform |

| support@youtrade-ecsa.com, info@youtrade-ecsa.com | |

| 📞 Phone | +442045939736 |

First Impression of Youtrade-ecsa.com

The official website tells us about the advantages of collaborating with the firm, its merits, and facts about its activities. However, the resource clearly lacks a proof base, although it does provide information about the duration of operation, number of clients, etc. The site’s language can be switched from English to French, Polish, and Russian, suggesting that YouTrade ECSA primarily targets European traders.

The broker uses a typical template where the top part of the page contains standard sections:

- Trading.

- Accounts.

- Terms and services.

- Education.

- About us.

The graphic design, combining white, red, and black colors, includes images of money, rockets, and smartphones. Overall, YouTrade ECSA doesn’t showcase anything unique or interesting.

Partnership and Bonuses

At the time of writing this review, YouTrade ECSA is running a promotion that offers clients a bonus of up to 50% on deposit replenishment. However, one must not forget the restrictions a trader receives when agreeing to bonuses. The user must complete a trading turnover of up to 25 lots before bonus funds are available for withdrawal.

The firm does not mention any affiliate programs. Apparently, they are absent here.

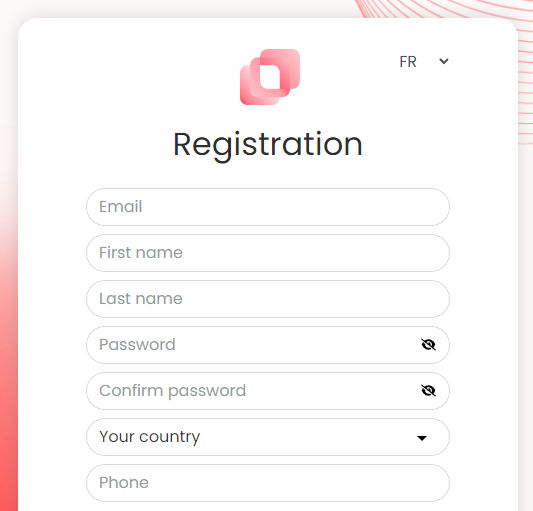

Account Opening on Youtrade-ecsa.com

To start trading, two steps are required:

- Registration.

- Deposit.

Let’s delve more into the first step. The registration process at YouTrade ECSA should not cause difficulties, as it requires providing contact information, name, country, and password.

After successful registration, a personal account is opened, and the system does not even require email and phone number verification. The client portal interface of YouTrade ECSA is easy to understand and explore. Users can perform standard actions:

- Manage finances, including deposit funds, and submit withdrawal requests.

- Open a new account.

- Contact technical support.

- Upload documents for verification and edit personal data.

From the personal account, one can go to WebTrader, or download software for Android or desktop. Despite the mention of a demo account on the official website in the FAQ section, we did not find such an option in the client portal or the trading terminal. So, is there a demo account at YouTrade ECSA?

Verification

A document dedicated to the KYC policy is absent, but the user agreement states that clients cannot withdraw funds without verification. Therefore, it is logical to assume that KYC is mandatory here. However, YouTrade ECSA does not describe what documents are needed, how long the verification will take, or why verification is required.

- None.

- Required documents for KYC are unknown.

- KYC policy is absent.

Trading Software

The trading platform is available not only in a web version but also in desktop and mobile terminals, but without iOS support, so iPhone users are left out. Links to download the software can be found in the YouTrade ECSA personal account.

The platform supports various options:

- Create lists of favorite assets.

- Social trading.

- Signals.

- Technical analysis and indicators.

- Multiscreens and 10 time frames.

- Order panel.

| Features | YouTrade ECSA | BNP Groups | BlackTrade500 |

|---|---|---|---|

| Demo Account | ❌ | ❌ | ❌ |

| Mobile App | ✔️ | ❌ | ❌ |

| Own Development | ❌ | ❌ | ❌ |

How Can I Trade With YouTrade ECSA?

Next, let’s dive into the trading conditions. The broker allows trading stocks, commodities, cryptocurrencies, metals, and indices, with over 1,000 assets available.

All Info About Accounts

Clients have a choice of five different tariff plans at YouTrade ECSA:

- Standard. The minimum deposit is $220. Spreads from 1.5 points, leverage up to 1:500, and zero commissions.

- Silver. From $2,100. Spreads are half lower, and additionally include: assistance from a personal manager, trading signals, and free VPS hosting.

- Gold. Not less than $53,000. VIP services such as market analysis and personal support.

- Platinum. The minimum deposit is not specified, it is individual. Zero spreads, but there is a commission of $7 per lot. On this tariff, YouTrade ECSA promises to route traders’ trades to interbank liquidity with instant order execution.

- Islamic. An account type without swaps, but the required deposit is not less than $100,000.

Regarding the trading conditions at YouTrade ECSA, there are aspects to comment on. Firstly, the high minimum deposit of $220 is significant compared to other firms where trading can start at $10. Additionally, there’s no cent account option. Secondly, the swap-free option is essentially absent, as activating an Islamic account requires $100,000. Thirdly, despite claims of routing trades to interbank liquidity, we suspect this is 100% a B-book, especially considering the leverage of 1:500.

There’s also contradictory information from YouTrade ECSA. The types of accounts clearly indicate a minimum deposit of $220, but elsewhere it’s mentioned as $250. Moreover, the broker calls its platform MT, which is clearly not MetaTrader. We have already discussed the demo account, which is mentioned several times on the site but was never found.

Ultimately, the broker employs a standard marketing tactic favored by fraudulent firms. If a trader wants more services and better conditions, they need to invest more money.

- Spreads and commissions are indicated.

- YouTrade ECSA employs a fraudulent tactic of extracting money from clients.

- High minimum deposit.

- A demo account was not found.

Market Analysis and Education With Youtrade-ecsa.com

Beginners can receive educational resources from the broker: webinars, articles, and tutorials. The personal account provides access to an economic calendar, market quotes of stocks, indices, and other popular financial instruments. YouTrade ECSA also provides ready-made technical analysis.

Deposit, Withdrawal, and Fees

The company supports several methods for depositing and withdrawing funds: Visa/Mastercard, YooMoney, Qiwi, and cryptocurrency. These payment systems are visible in the personal account when attempting to deposit. However, on its website, YouTrade ECSA also lists Neteller, Skrill, and bank wire transfers.

There is no commission for depositing or withdrawing funds. However, the processing time for withdrawal requests is not disclosed. Thus, the conditions regarding financial transfers appear contradictory, which is typical for YouTrade ECSA.

It was also surprising that a supposedly Swiss organization supports Russian payment systems, Qiwi and YooMoney.

| Features | YouTrade ECSA | Orbonex | Arbitrage Genius |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ✔️ |

| Electronic Payments | ✔️ | ✔️ | ✔️ |

| Crypto Transfers | ✔️ | ❌ | ✔️ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ❌ | ✔️ | ❌ |

How Can I Contact It?

Despite an indicated office in Switzerland, the phone number is British for some reason. Traders can also contact managers by email, with two options provided. However, it’s unlikely that YouTrade ECSA will respond, as both emails turned out to be fake.

Additionally, clients can create a feedback request through a special form. It would be great if the broker created an online chat for promptly solving issues, but no such option exists here. Even social media accounts are absent. In general, it would be miraculous if a user manages to contact YouTrade ECSA.

- None.

- Fake email addresses are presented.

- No online chat.

- Social media accounts are not created.

Is YouTrade ECSA Dangerous?

The company has many shortcomings and potentially negative aspects. For example, contradictory information about the minimum deposit and demo account. Additionally, there are almost no mentions or reviews of YouTrade ECSA on the internet, leading to suspicions about a fabricated founding date of 2017. Well, let’s check if the firm is regulated and whether it really has the claimed experience.

How Long Does The Broker Work?

The organization appeared in 2017 and since then has allegedly gained the trust of 50,000 clients. However, there are no confirmations of this, and conversely, there are refutations. The number of reviews on the internet is too small for such many clients, and the domain of the official website was only registered on November 16, 2023. Therefore, it is very likely that YouTrade ECSA is deceiving about its launch date. Not only regarding its years of experience but also the number of users and other facts.

How Is YouTrade ECSA Regulated?

A Swiss broker should obtain a license from FINMA, which monitors the activities of brokerage companies in that country. However, a search in the registry of regulated organizations yielded nothing. YouTrade ECSA is not listed there.

On its official website, the firm boasts of having a license from the Market Securities Insurance Commission, which also includes a compensation fund. If you try to search for information about MSI, you are unlikely to find anything, as it is an unknown regulator. Notably, the domain of the MSI website was registered on November 22, 2023. Most likely, YouTrade ECSA invented the financial commission and issued themselves a non-existent license.

Lastly, it’s necessary to debunk information about regulation by the FCA and the headquarters in Switzerland. If you try to find YouTrade ECSA in the registry of legal entities in Switzerland, you will not succeed, as such a firm is not listed there. Our subject is also absent in the FCA registry. Therefore, there is no regulation here, besides, the company indicates a fake address in Switzerland.

| Features | YouTrade ECSA | Virgobanc | Nour Trade |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ❌ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ❌ | ❌ | ❌ |

Frequently Asked Questions (FAQ)

How to Trade With YouTrade ECSA?

Is YouTrade ECSA Legit?

How Risky Is It?

Kevin Berry

Kevin Berry At first, it might be hard to discern the fraudulent nature of this platform, but as it turns out, it is an outright fake broker, swindling people out of their money. The headquarters are fictional, and licenses are absent. Moreover, the fraudsters hide behind a non-existent regulator, which is also important to consider. Many beginners might believe in the reality of the Market Securities Insurance Commission, but it does not exist. YouTrade ECSA should have obtained a license from FINMA and FCA, but there’s nothing in the registries. So, there’s no need to risk money, as the risk is 100%.

YouTrade ECSA rating

1 review about YouTrade ECSA

I thought I would be collaborating with a safe and verified company, but Youtrade ECSA turned out to be a scam firm refusing to withdraw my funds. I believed their falsehood about a long duration of operation, tens of thousands of clients, full security, and an office in Switzerland. But in reality, all of it is a mirage and fake. It is not a broker but a classic internet fraud.

This mistake cost me $2,500. The deposit was made using cryptocurrency, so there’s no chance of getting it back. I want to warn all traders, especially beginners, about the danger from this scam broker. Always check the intermediary for red flags, and if they are present, don’t invest, find a more reliable brokerage partner. All I can do now is accept the loss…