Discover new financial prospects and secure your future! That’s the bold invitation from Grossfield Limited, calling you to open a brokerage account. Despite boasting decades of experience, there’s a startling scarcity of online reviews, as if it were a brand-new brokerage platform. Moreover, there’s no mention of a license from the FCA or any other regulator on their website, even though the broker claims to be based in the UK. Frankly, it reeks of a scam. Thus, our task is to scrutinize the firm, its policies, and its platform, to identify any red flags and negative aspects.

Table of Contents

Highlights

| 🏛️ Country | United Kingdom |

| ⚠️ Regulation | – |

| 🖥️ Website | https://www.grossfieldltd.com/, https://www.grossfieldltd.vip/ |

| 🎲 Demo Account | No |

| ⏳ Start Time | 2023 |

| 💲 Minimum Deposit | €2,000 |

| ⚖️ Minimum and Maximum Leverage | 1:200 |

| ⚙️ Trading Platform | WebTrader |

| support@grossfieldltd.net | |

| 📞 Phone | +441888785306 |

First Impression of Grossfieldltd.vip

This broker’s website is the most typical and templated resource one can encounter for a brokerage company. We’ve come across similar sites more than once, and they’ve always turned out to be fraudulent organizations. It’s unlikely that Grossfield Limited will be an exception.

The site is created from a standard template: main information sections at the top, a small disclaimer about the risks of margin trading at the bottom, and the homepage is just a boring list of pseudo-advantages and merits of the broker.

The focus on gray and dark colors is somewhat depressing. The design uses overused stock images of skyscrapers and groups of people actively discussing something over laptops. The photos are undoubtedly stock, although for uniqueness, the broker could have done something unique, which would have increased interest and customer loyalty. Moreover, Grossfield Limited offers little specificity and detail about its operations. In general, it’s dull, with a lot of meaningless text and zero useful information.

Partnership and Bonuses

Grossfield Limited has an affiliate program, but no bonuses were found, although such firms are very fond of foisting supposedly advantageous 100% bonus promotions on traders. The affiliate program is divided into two categories: affiliate and introducing. The company provides marketing materials and support to partners.

Account Opening on Grossfieldltd.vip

The account creation process is quick and takes about a minute. The client needs to provide personal details, and contact information, and agree to the terms of service. However, after entering all the data and registering a personal account, Grossfield Limited does not send a confirmation email. It is a serious drawback in the security system.

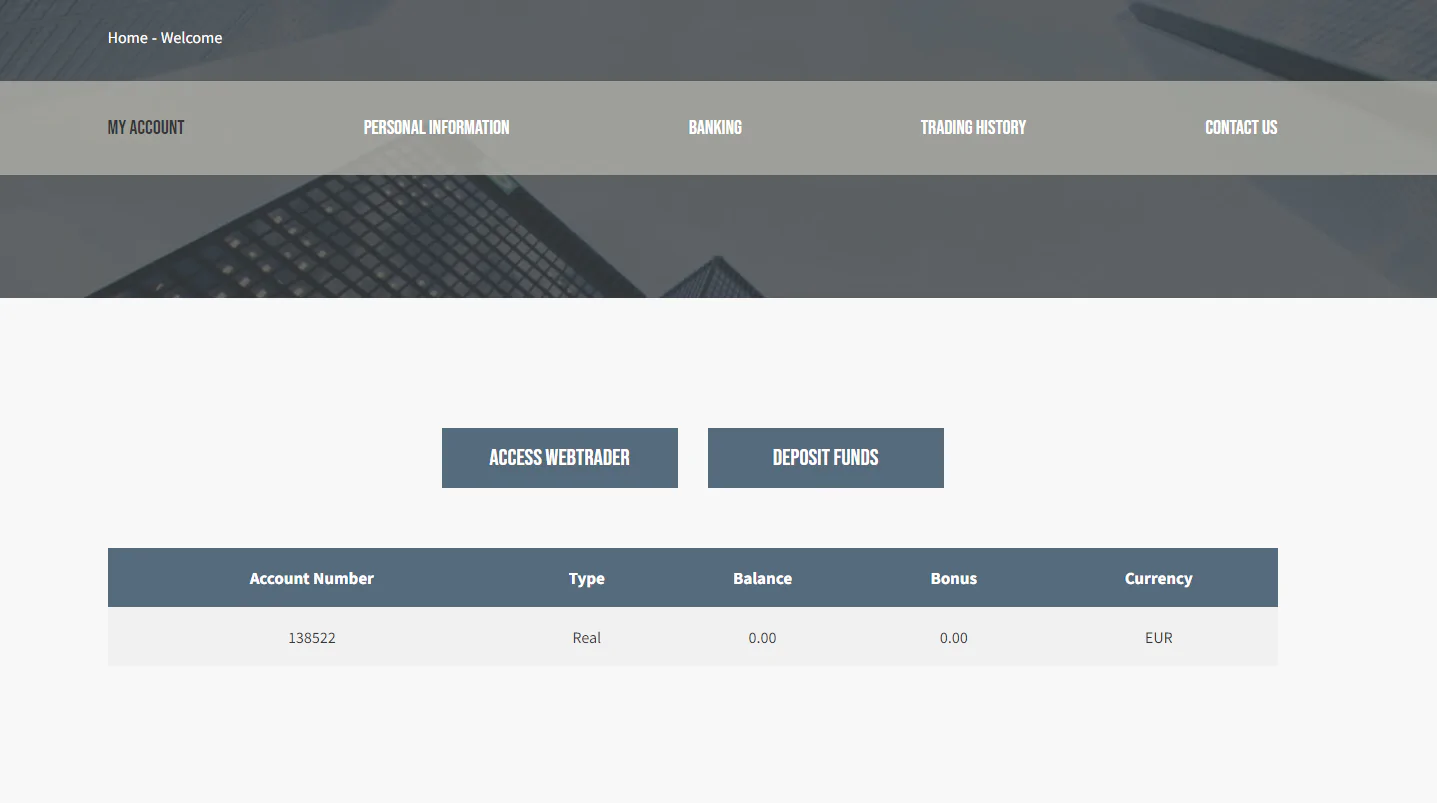

The dashboard interface is standard. We are used to seeing sections located on the left side of the window with similar brokers, but here they are at the top. Clients can change data, upload documents for KYC, deposit funds, and perform other operations. Grossfield Limited has not provided anything new, unique, or interesting, not even a demo account.

Verification

The broker does not disclose details regarding verification. A separate AML & KYC policy document is completely absent. It’s unclear whether verification is mandatory at Grossfield Limited, what specific documents are required, and how long the check will take. In fact, there seems to be some secrecy on the part of the firm.

- None.

- AML & KYC policies are missing.

- Uncertain if verification is a mandatory process.

Trading Software

Grossfield Limited’s platform is quite primitive. The terminal only supports basic features, such as pending orders, 80 indicators, the main types of execution, technical analysis, netting, and hedging. While the broker claims that its platform supports auto-trading and the ability to test strategies in automatic mode, we did not find such functionality. Traders can also create their own lists of favorite assets, change the language from English to many others, switch timeframes and chart types, set notifications, and change the color theme.

There is no mobile application for Android/iOS, although the main page of the website mentions a mobile trader. Apparently, this refers to a version adapted for mobile browsers, which is not equivalent to smartphone applications. Using such a platform is still inconvenient and impractical. In short, Grossfield Limited’s platform lags behind popular alternatives and cannot be called professional.

| Features | Grossfield Limited | The Investment Center | Lincoln Financial Service LTD |

|---|---|---|---|

| Demo Account | ❌ | ✔️ | ❌ |

| Mobile App | ❌ | ❌ | ❌ |

| Own Development | ❌ | ❌ | ❌ |

How Can I Trade With Grossfield Limited?

Only CFDs are available for trading: forex, metals, indices, commodities, stocks, and cryptocurrencies. Clients can open trades with volumes from 0.01 lot and leverage up to 1:100-1:200 depending on the tariff. Next, let’s look at the types of accounts available at Grossfield Limited.

All Info About Accounts

The broker offers just 4 tariffs:

- Bronze. Minimum deposit €2,000. Leverage up to 1:100, spreads from 0.8 pips, personal manager, and low commission fee.

- Silver. No less than €5,000. More favorable conditions, and additionally access to the collective webinar.

- Gold. From €20,000. At this tariff, Grossfield Limited offers assistance from a personal analyst, while there is no commission on trades.

- VIP. From €100,000. The most favorable spreads, signals, and leverage up to 1:200.

A high minimum deposit, huge leverage, a personal manager, and signals are all obvious signs of an illegal broker. Leverage of 1:100-1:200 is an excessive luxury for a firm under regulation, so it’s logical to assume that Grossfield Limited is unlicensed. Remember, there is no demo offered, and the minimum deposit of €2,000 is quite significant. You can’t even try the service with small amounts that you wouldn’t miss.

The broker adheres to the standard fraudulent policy of “deposit more to get more services and better conditions.” Additionally, the absence of specific commission sizes is noteworthy, as this is one of the most critical parameters that traders look at first. However, the most important thing is the “no commission fee” on the Gold tariff and above. How does Grossfield Limited earn then? It’s simple, the firm operates on a dealing desk business model, so its earnings are the losses of its clients.

- None.

- Business model with a conflict of interest.

- Unreasonably high minimum deposit requirements.

- No swap-free or demo account is available.

Market Analysis and Education With Grossfieldltd.vip

Additional services such as analytics and training are not offered by Grossfield Limited. They provide only a brief summary of financial news and basic information about asset classes. Despite the industry norm, there’s no economic calendar, calculators, or fresh analytics.

Deposit, Withdrawal, and Fees

The section dedicated to deposit and withdrawal operations is inaccessible; attempting to open it results in a “page not found” error. Based on the website footer, Grossfield Limited supports transfers via Visa/Mastercard, Neteller, Skrill, and Bitcoin. Fees, processing times, and other details are not disclosed.

| Features | Grossfield Limited | Stone Bridge Ventures | FXChoice |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ✔️ |

| Electronic Payments | ✔️ | ❌ | ✔️ |

| Crypto Transfers | ✔️ | ✔️ | ✔️ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ❌ | ✔️ | ❌ |

How Can I Contact It?

To contact Grossfield Limited managers, email or phone calls are the only options; no instant online chat support is provided. Furthermore, there are no social media accounts, which is a significant omission for any online business. The office address is listed in the UK, but this is yet to be verified.

- None.

- No online chat or social media presence.

Is Grossfield Limited Dangerous?

The broker is more likely dangerous than not. We’ve encountered similar resources before; such companies usually turn out to be fraudulent. We suspect that Grossfield Limited is a scam broker. We just need to check how long the company has existed and what licenses it holds, if any.

How Long Does The Broker Work?

The firm does not disclose its exact founding date, only mentioning decades of operation. However, the absence of online reviews is contradictory. The domain for the website was registered only in October 2023. It all adds up – Grossfield Limited appeared just in October 2023.

Please note that https://www.grossfieldltd.vip/ is active as of June 2024.

How Is Grossfield Limited Regulated?

Legally based in the UK, the broker must obtain a license from the Financial Conduct Authority, which regulates financial firms in that jurisdiction. Searches revealed two companies with similar names; neither is authorized by the FCA. One was regulated at some point, the other is a fake organization altogether. Our review subject has not obtained a license. Grossfield Limited operates illegally.

The website lists the registration number 01611036, which leads to Grossfield Limited, founded back in 1982. Now, it is clear where the scammers claim decades of experience. The company associated with this registration number has nothing to do with the website grossfieldltd.com. It should be obvious. Furthermore, our investigation’s subject isn’t even registered in the UK. No doubt remains about the fraudulent nature of this pseudo-broker.

| Features | Grossfield Limited | Exallt | Mitrade |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ❌ | ✔️ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ❌ | ❌ | ✔️ |

Frequently Asked Questions (FAQ)

How to Trade With Grossfield Limited?

Is Grossfield Limited Legit?

How Risky Is It?

Kevin Berry

Kevin Berry It’s almost amusing to watch blatant scammers trying to swindle people. It’s doubtful anyone would believe their claims and deposit at least €2,000. Even if the deposit threshold is set to high, that should be a deterrent. Experienced traders will immediately recognize Grossfield Limited as a scam. The scam is likely targeted at forex novices rather than seasoned users. The absence of a license, fabricated operational history, lack of guarantees, no legal documentation, and extremely unreasonable trading conditions are all glaring red flags. Stay away from such companies; their template websites make them easy to spot.

Grossfield Limited rating

2 reviews about Grossfield Limited

My brother got into trouble… he invested in this company €2,500, and now, when he really needs the money, he can’t withdraw it… the scammers don’t respond, they ignore, don’t give the money back… some kind of internet criminals… what can be done? how to get the funds back from a fraud trap?

I immediately guessed that Grossfield Limited is some murky, shady, and suspicious brokerage firm. Well, agree, a minimum deposit of €2,000, isn’t that a bit much? Moreover, there’s no mention of a demo account on the site. It’s a nonsensical condition; you can’t try on a demo while you have to invest 2k euros.

Besides, no licenses are found, although any British broker must be regulated by the FCA. It’s not even up for discussion and every trader knows it. It also bothered me that there are no proper legal documents, the site is not fully finished, and a lot of information is simply not indicated.

So, if even I could recognize Grossfield Limited as a usual scam, fake, fraud platform, then other traders can too. I have been studying Forex for only three weeks, and I already understand that there is nothing to do here. It’s another fraud trap for gullible people.