“Maximize Each Trade NOW” – this is how the brokerage company Quant Finance Limited invites us to start cooperation. One could even say it compels rather than invites. What does the platform represent, could it be a scam? We are yet to find out. For now, it appears as a CFD broker supposedly based in the United Kingdom, although there is no confirmation of this. Furthermore, the firm is not regulated by the FCA, as it should be. However, the official website does mention regulation by CySEC and the presence of a compensation fund of up to 20,000 euros. There aren’t many reviews on the internet, so we begin our investigation.

Table of Contents

Highlights

| 🏛️ Country | United Kingdom |

| ⚠️ Regulation | – |

| 🖥️ Website | https://www.quantfinanceltd.com/, https://quantfinanceltd.vip/ |

| 🎲 Demo Account | No |

| ⏳ Start Time | 2023 |

| 💲 Minimum Deposit | £100 |

| ⚖️ Minimum and Maximum Leverage | 1:200 |

| ⚙️ Trading Platform | WebTrader |

| support@quantfinanceltd.net | |

| 📞 Phone | +442081576590 |

First Impression of Quantfinanceltd.vip

Upon entering the website, we are greeted with an astonishing and mesmerizing mountain landscape, and in the center stands a person who apparently has conquered the summit and is now observing. It seems the owners symbolize trading and achieving success as reaching the mountain peak in this image.

However, apart from this beautiful picture, a template and typical resource is noticeable. We have encountered such a design several times with other brokers, which, unfortunately, turned out to be fraudulent and illegal. It is unlikely that Quant Finance Limited will be an exception.

The site is translated into Polish in addition to English. At the top, you can navigate to specific sections to learn more about the conditions. The footer contains a standard risk warning, and the main page includes the usual listing of advantages and merits. Quant Finance Limited used a ready-made template, but did not invent anything new themselves.

Partnership and Bonuses

For attracting new clients, traders can receive rewards. This is an affiliate program, available to all registered users. Quant Finance Limited provides clients with competitive commission structures, clear payments, reports, detailed statistics, and support.

Nothing is known about bonuses and similar promotions. The broker does not mention such opportunities.

Account Opening on Quantfinanceltd.vip

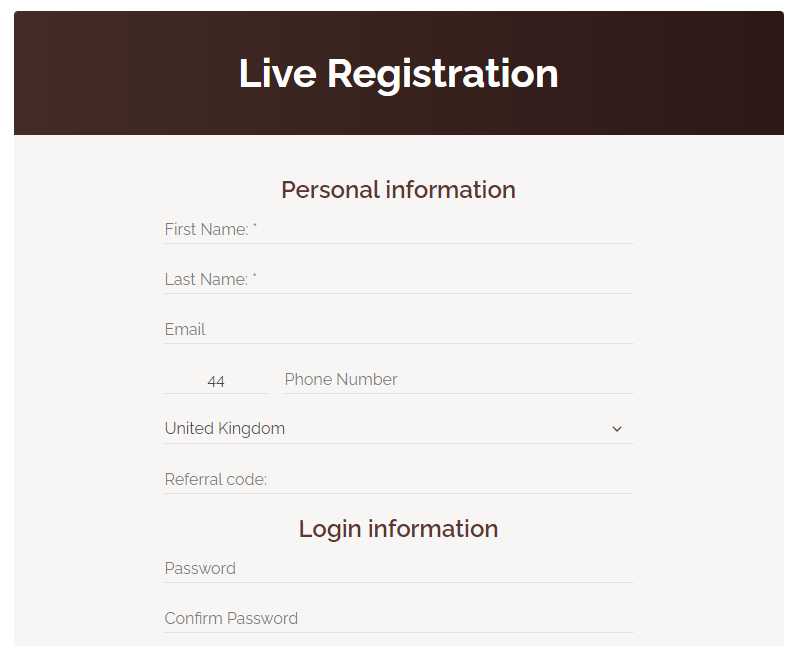

Let’s examine how to create an account, the interface of the personal account, and other features. Registration starts with providing personal information (name, surname, email, phone, country, and referral code) and creating a password. Agreement with the terms is also required. The referral code is entered if available.

Next, a familiar personal account opens, where on the left side there are sections for identity verification, personal data, deposit/withdrawal, history, contacts, and the referral program. From the Quant Finance Limited client portal, you can access the web platform. However, a demo account was not found, so beginners will have to invest real money to learn how to use the terminal and test strategies. This can hardly be called a plus.

Verification

Unfortunately, there is no mention of KYC, not even a separate document dedicated to AML and KYC policies. While there is functionality for uploading documents in the personal account, it is unknown whether verification in Quant Finance Limited is mandatory.

A client simply needs to select the type of document and then specify the path to the file on their computer. How long the KYC verification will take and what documents are needed are also unknown.

- Not found.

- It does not provide a KYC policy.

- The required documents are not specified, and the verification processing time is unknown.

Trading Software

Now let’s look at the terminal the firm offers for trading, as it is also important. In the client portal, not only a web version is mentioned but also a mobile one. However, we did not notice any links to download the platform on Android/iOS. It appears that Quant Finance Limited meant that the terminal is adapted for mobile browsers. So essentially, it’s a WebTrader.

The terminal is available in several languages and three color schemes (Dark, blue, and white). The rest of the features are easier to list:

- Timeframes from 5 seconds to 1 month.

- Indicators.

- Levels, including Fibonacci.

- Type of chart: Japanese candles, area, line, and bars.

Traders can also enable multi-window mode, use pending orders, mark favorite assets, and view trading history. That’s where the platform’s functionality ends. Quant Finance Limited offers clients a primitive web-trader with scant capabilities.

It’s not possible to upload your own indicators, nor can you save settings in templates for future use. Auto-trading is not available, nor are advanced options such as open interest, order book, horizontal volume, and others.

| Features | Quant Finance Limited | CryptoGo365 | Tools4Deals |

|---|---|---|---|

| Demo Account | ❌ | ❌ | ❌ |

| Mobile App | ❌ | ✔️ | ❌ |

| Own Development | ❌ | ❌ | ❌ |

How Can I Trade With Quant Finance Limited?

For trading, the main market classes are available: Forex (majors, minors, and exotic currencies), stocks, commodities, indices, metals, and cryptocurrencies. In total, there are over 200 CFDs. The platform also offers the use of leverage up to 1:200, but one should not forget the risks associated with borrowed funds, as both potential profit and loss are significantly increased.

Now we need to consider the types of accounts, as the available opportunities depend on them.

All Info About Accounts

Quant Finance Limited did not reinvent the wheel and offered traders four types of accounts:

- Forex/crypto. A tariff with no services except daily news. The minimum amount to open is £100.

- Commodities. The minimum deposit starts from £5,711. It includes access to webinars, contract trading, and weekly reports from the ECB. Commissions are lower than the previous tariff.

- Stock. Deposit requirements are even higher – from £16,594. Differences from “Commodities” include PAMM, IPO, copy-trading, and a personalized plan.

- Indices. The last account type requires a deposit of at least £121,144, and additionally includes arbitrage, insurance, investor accreditation, and out-of-market investments.

Apart from these four account types, Quant Finance Limited offers an investment tariff called a “Savings account”. The yield ranges from 21% to 37%, but the time interval is not specified. Is this annual or monthly? In any case, the company does not even indicate the source of such high percentages, but payments are made every month, flexible conditions, online management of capital, and full insurance.

The promise of receiving a fixed income without explaining its source is a direct sign that we are dealing with an HYIP. Where does the profit come from, especially in such a large amount?

Demo and Islamic accounts are not offered, and these are important options. Furthermore, Quant Finance Limited does not disclose information regarding commissions and spreads; their size and type are unknown. Contract specifications are missing. There is no clarity on whether trading is profitable or not, as the data is simply hidden. Such an attitude towards users cannot be called open and good, but quite the opposite.

It can also be added that the tariff plans are compiled as unfavorable. For example, the first tariff does not include any additional services except for news. What’s the point of such an account type? And the second tariff requires £5,700 – which is a serious minimum deposit. There is no doubt that Quant Finance Limited is simply extracting money from people.

- Low minimum deposit.

- Important conditions are unknown.

- Demo and Islamic accounts are not available.

Market Analysis and Education With Quantfinanceltd.vip

On the company’s official website, you can find a news feed and basic information about asset classes. Unfortunately, Quant Finance Limited offers nothing more. For some reason, there are no economic calendar, news feed, fresh analytics, and other useful tools and services that could help traders in trading. It’s unclear how the broker plans to compete with other firms offering a variety of additional opportunities to their clients.

Deposit, Withdrawal, and Fees

The system offers several methods to top up the balance: SEPA, Visa, Mastercard, and cryptocurrency (Bitcoin). The commission for both depositing and withdrawing funds is zero, but the payment system may charge a fee.

| Features | Quant Finance Limited | Fidelis Wealth Management | Choose Capital |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ✔️ |

| Electronic Payments | ❌ | ❌ | ❌ |

| Crypto Transfers | ✔️ | ❌ | ✔️ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ❌ | ❌ | ❌ |

How Can I Contact It?

Customers can write to the support email, but no response will follow because Quant Finance Limited provides a fake email address. There is also a phone number available. No online chat for prompt problem-solving and questions is created, and no accounts on social networks.

- None.

- Fake email.

Is Quant Finance Limited Dangerous?

It’s unlikely that a safe broker would provide a non-existent email. In addition, the crazy and hidden trading conditions also hint at the potential danger awaiting all who wish to trade here. Ultimately, it’s necessary to check when the project started operating and whether it holds any licenses.

How Long Does The Broker Work?

The founding date is one of the most crucial facts in a company’s activity. Quant Finance Limited does not share such information with us, so we need to find out independently. This can be done using the domain, or more precisely, the date it was registered. So, the official website’s domain was registered on October 26, 2023. Therefore, the platform has only been operating for a few months. This explains why there are so few reviews on the internet and why the firm hides its founding date.

We need to note that the operators of this site are now operating on the domain https://quantfinanceltd.vip/. It has existed for about three months and who knows how many people will still fall victim to it.

How Is Quant Finance Limited Regulated?

According to the website, the headquarters is located in the United Kingdom, so the firm is obliged to obtain a license from the FCA. Let’s check whether this is true. The registry check showed that the organization did not receive a brokerage license. The system yielded several similar names, but not the subject of our review.

Additionally, we checked the Companies House legal registry. There is an organization with such a name, but it was founded in 2013, which does not match the information we found in the previous section. Moreover, the legal address differs from what is indicated on the website. Therefore, it is unlikely that the firm we are investigating is the same company that we can observe on the registry.

Quant Finance Limited boasts of having a license from CySEC, the Cyprus regulator. However, no such broker was found there. This means the organization operates illegally and also misleads users.

| Features | Quant Finance Limited | Trade Galactica | FINdeto |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ❌ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ✔️ |

| Offshore | ❌ | ❌ | ❌ |

Frequently Asked Questions (FAQ)

Kevin Berry

Kevin Berry Thus, another scam broker has been exposed, created solely for the purpose of deceiving traders and stealing their money. In general, Quant Finance Limited is no different from other fraudulent firms because it has exactly the same signs of an illegal brokerage intermediary: a fake license, a fictitious legal address, a fabricated email, a template website, and a lack of transparency. Also, add the absence of a large number of reviews on the internet, which speaks to the company’s obscurity, and a business model based on a conflict of interest. After all, the platform has no benefit in clients’ earnings. On the contrary, it is interested in their losses. So don’t believe the fraudsters and don’t transfer your deposits here.

Quant Finance Limited rating

2 reviews about Quant Finance Limited

Despicable and pathetic fraudsters, BURN IN HELL!!! YOU STOLE £3,500 FROM ME!!! How dare you call yourself the most profitable and safe broker? You are a disgrace to the forex industry! Your website should be blocked, AND YOU SCAMMERS SHOULD BE IN JAIL! People be careful, these anonymous swindlers seek victims, and then deceive them out of money. I lost all my funds here!!! Please spread the word about quant finance ltd.

This is a typical scam project, no different from others like it. Quant Finance Limited will appropriate your funds for itself, and you will be unable to do anything. Fraudsters have engaged in such illegal activity many times before, having many fake websites.

I fell for a similar scam three years ago and lost $1,000. Now I perfectly understand when I see a similar site that it’s another fraudster, only wanting to steal my funds. So, be sure to check your future brokerage intermediary for red flags to avoid falling into a forex trap from which it’s impossible to withdraw the deposit.