Magni Markets focuses on providing the best trading conditions, calling itself a prime broker. Online reviews are scarce, and it seems to be lacking a license. At the same time, the company is legally based in the offshore state of St. Lucia. Can the firm be trusted, or is it a scam? What trading conditions are available to traders? What are the organization’s pros and cons? Join our review to find out whether or not you should open an account here.

Table of Contents

Highlights

| 🏛️ Country | St. Lucia |

| ⚠️ Regulation | – |

| 🖥️ Website | https://magnimarkets.com/ |

| 🎲 Demo Account | No |

| ⏳ Start Time | 2022 |

| 💲 Minimum Deposit | $100 |

| ⚖️ Minimum and Maximum Leverage | 1:500 |

| ⚙️ Trading Platform | MetaTrader 5 |

| support@magnimarkets.com | |

| 📞 Phone | – |

First Impression of Magnimarkets.com

Magni Markets has developed a fairly standard and typical website. You can find similar resources with most other brokers. At the top, there is a panel with the main sections:

- Account types, deposit and withdrawal, asset classes, and security tools.

- Economic calendar.

- About company.

- Partnership.

- Contacts.

On the main page, you can see the advantages, merits, and other conditions of the firm. There is some graphical design in the form of images with charts and people sitting at computers.

The official website is translated into several languages besides English. These are mainly European languages, but Chinese and Arabic are also available. Magni Markets provides little information about itself, does not disclose details of its activities, and has not provided legal documents apart from the standard user agreement, risk disclosure, and privacy policy.

Partnership and Bonuses

Magni Markets has developed two types of partnership programs: introducing broker and regional partner. In the first case, the broker pays a commission for the trading of referred clients. The second type is suitable for experienced entrepreneurs who have their own client base in their region. Partners receive support, marketing materials, and detailed statistics.

Based on the absence of information on the website, bonus promotions seem to be nonexistent. Perhaps Magni Markets offers bonuses to existing clients, but this can only be speculated.

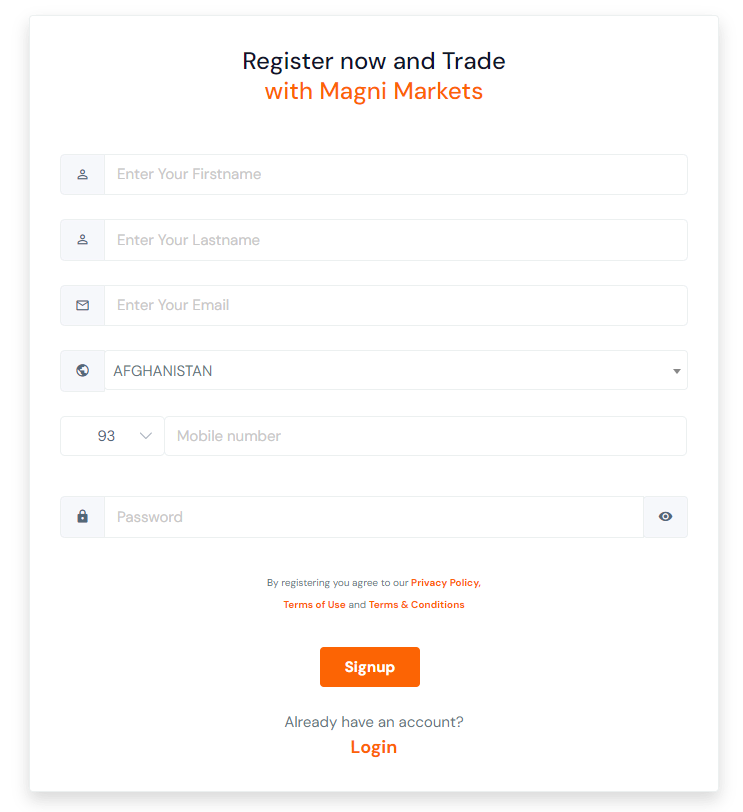

Account Opening on Magnimarkets.com

The process of creating an account consists of providing your name, password, phone number, and email address. Magni Markets also requires clients to agree to the terms of use. After entering this information, a confirmation email should be sent to your inbox. Once confirmed, the process is complete, and your account is registered.

The personal cabinet in Magni Markets appears to be without any frills. It’s a standard dashboard where traders can manage their accounts:

- Deposit and withdraw funds.

- Create tickets for technical support.

- View the economic calendar.

- Access Webtrader.

- Change personal information and upload documents for KYC.

The situation with the demo account in Magni Markets is ambiguous. The main page of the site mentions the availability of such an option for clients. However, during registration and account connection, we were unable to find an option to open a demo account. Does it really exist?

Verification

Documents dedicated to AML & KYC policies are absent from the website. The verification procedure is not mentioned in Magni Markets, and it is unclear whether it is mandatory or recommended. However, in the personal cabinet, there is functionality for uploading documents to verify identity and residential address.

- It’s convenient to upload documents.

- There is no AML&KYC policy explaining this process.

Trading Software

The broker indicates that it uses the MetaTrader 5 platform, which can even be downloaded to a smartphone or computer, as links are provided in the dashboard. However, Magni Markets is not found in the list of companies connected to MetaTrader 5 for some reason. Moreover, it is worth noting that downloading programs and applications occurs not from the official website, but directly from the company’s personal account. In short, all of this looks very suspicious and dubious.

The web platform looks quite primitive. Traders can use lines, text inserts, Fibonacci, indicators, two types of charts, 9 timeframes, Elliott waves, and pending orders, including stop losses and take profits. The functionality is quite limited. We have not risked downloading programs for Windows or applications for smartphones, as they may contain dangerous viruses, so we will stop at Webtrader. In general, the terminal at Magni Markets did not impress.

| Features | Magni Markets | Investus Pro | BitBlanco |

|---|---|---|---|

| Demo Account | ❌ | ❌ | ✔️ |

| Mobile App | ✔️ | ❌ | ❌ |

| Own Development | ❌ | ❌ | ❌ |

How Can I Trade With Magni Markets?

Traders have access to CFDs on currency pairs, metals, energy resources, indices, stocks, and cryptocurrencies. The balance cannot fall below zero, as there is a special negative balance protection. Next, let’s look at the tariffs Magni Markets offers to its clients.

All Info About Accounts

Magni Markets has developed only 2 types of accounts:

- Classic. The minimum deposit is $100. Traders can use leverage up to 1:500. Zero commission and spreads from 1 pip.

- VIP. The minimum deposit is $500. More favorable spreads compared to the Classic account.

Additionally, an Islamic account type can be activated, which allows you to pay no interest on your positions held overnight. Switching between swap-free and no-swap-free is done with just one click.

Zero commission and spreads from 0.5-1 pips seem very suspicious. The fact is that a broker somehow needs to make money from providing brokerage services. And it does so through commissions paid by traders. However, in Magni Markets, the commission is zero and the spreads are very low. How does the company earn money? Most likely, we are dealing with a 100% b-book business model broker. And this is a conflict of interest.

Moreover, the leverage up to 1:500 is disturbing. It hints at the absence of a license from a serious regulator. Regulated brokers can hardly offer such high leverage. Typically, it is limited to 1:30.

- There is an Islamic account.

- Zero commission and low spreads.

- With a high probability business model of 100% B-Book.

- A scarce set of assets to trade.

Market Analysis and Education With Magnimarkets.com

Additional services from Magni Markets include free research, daily webinars, unlimited access to video tutorials, and trading signals. Also, the website features a table with online quotes of popular instruments, information about traded assets, an economic calendar, and a FAQ section.

Deposit, Withdrawal, and Fees

Money transfers at Magni Markets are available via credit/debit cards, bank wire transfers, and cryptocurrency (Bitcoin or Tether). Transactions are executed without commission, and the time it takes to credit funds depends on the payment system. However, the processing time for withdrawal requests is not specified.

| Features | Magni Markets | StockScale | Parenta Financial Services Limited |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ✔️ |

| Electronic Payments | ❌ | ❌ | ❌ |

| Crypto Transfers | ✔️ | ✔️ | ✔️ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ❌ | ❌ | ❌ |

How Can I Contact It?

To contact the managers, there is an email address. In addition, you can create a feedback request in a special form in the “contacts” section. Magni Markets also has accounts on social networks Instagram, Twitter, and Facebook, but there are few subscribers and low activity there. A phone number, as well as online chat for prompt communication, are absent. However, what is even more interesting, the specified email turned out to be non-existent.

- There are social media accounts.

- Email doesn’t exist.

- There is no phone number and no online chat.

Is Magni Markets Dangerous?

The broker presents a contradictory and rather suspicious picture, with both pros and cons. It is currently impossible to definitively take one side or the other. A thorough investigation of Magni Markets’ operational duration, registration, and potential licenses is required.

How Long Does The Broker Work?

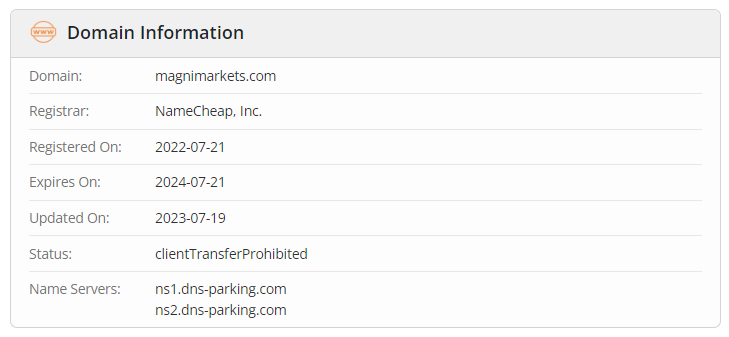

The duration of operation is one of the most crucial aspects of a brokerage company. The longer a firm has been serving traders in the industry, the more trust it generally garners. The founding date of Magni Markets is not specified, but it is clear that it is not an old broker, as there are too few reviews available online. However, the website’s domain was registered in July 2022, which leads to the assumption that the organization was launched around that time. Is this duration considered long and serious? Probably not, but it also means the platform can no longer be considered brand new, given that more than a year has passed since.

How Is Magni Markets Regulated?

The broker does not provide a specific legal address, but it is known to be under the jurisdiction of Saint Lucia. To verify if Magni Markets is indeed legally based in this offshore country, or if this information is false, the registry of legal entities in Saint Lucia needs to be checked. Upon investigation, such an organization is present there.

The broker’s license status can be verified with the FSRA Saint Lucia. However, Magni Markets is not listed here, which means that while the firm is officially registered and has been operational for over a year, it does not have a license. Plus, you need to realize that there is no standard regulation of forex brokers in Saint Lucia.

| Features | Magni Markets | Equithy Global | Impresamarkets |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ❌ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ❌ | ❌ | ❌ |

Frequently Asked Questions (FAQ)

How to Trade With Magni Markets?

Is Magni Markets Legit?

How Risky Is It?

Kevin Berry

Kevin Berry Throughout my time trading on Forex, I’ve come to realize one thing – it’s better not to trade with offshore brokers. The only scenario in which an offshore company can be trusted is if it has branches in onshore jurisdictions. Only then is it advisable to open an account and start trading. However, Magni Markets doesn’t have any representatives; it is only registered in St. Lucia. It is a risky location, so it’s better to steer clear. At any moment, such a broker could bid you farewell, and you might find yourself unable to withdraw your funds ever again.

Magni Markets rating