Meet the brokerage company AME Capitals, which attracts clients with its supposedly advanced trading platform, favorable conditions, absolute security and additional services. Sounds interesting, but where are the licenses and registration documents? If it’s such a great firm, why isn’t it popular among traders, especially since the reviews online are too ambiguous and contradictory? We believe this is yet another scam where trading should be avoided. If you want to know why, join us in exposing it.

Table of Contents

Highlights

| 🏛️ Country | St. Vincent and the Grenadines, Singapore, United Kingdom |

| ⚠️ Regulation | SVGFSA |

| 🖥️ Website | https://amecapitals.com/ |

| 🎲 Demo Account | No |

| ⏳ Start Time | 2023 |

| 💲 Minimum Deposit | $500 |

| ⚖️ Minimum and Maximum Leverage | 1:50-1:500 |

| ⚙️ Trading Platform | WebTrader |

| support@amecapitals.com, compliance@amecapitals.com, inbox@amecapitals.com | |

| 📞 Phone | +442037693927 |

First Impression of Amecapitals.com

In front of us is a typical brokerage website where the upper part contains the broker’s logo, sections with information about conditions, the platform, available services, company activities, and contacts. AME Capitals’ website is translated from English only into Russian. The main page lists the company’s advantages, opportunities, and some facts: operational since 2014, insurance up to $50,000, and partnerships with major cryptocurrency exchanges and banks. However, there is no evidence to support these claims.

Overall, AME Capitals has created a decent website that doesn’t look like the typical and templated resources of other brokers. However, important details are missing, such as legal documents that could confirm their operational history since 2014 and the presence of insurance. The news feed is rarely updated; for example, only three news articles have been released in September, although three weeks of the month have already passed.

Partnership and Bonuses

AME Capitals offers bonuses to clients under certain conditions. It is an automatic bonus that will be accrued at a rate of 2.5% of the initial deposit every month. At the same time, the trader must maintain a certain balance level throughout the year and also trade a volume 30 times exceeding the received bonus. Most importantly, you cannot withdraw funds during the year. Who would agree to such unreasonable terms? Only those who have not read the bonus policy and agreed.

AME Capitals also has an affiliate program, but the terms for it are completely unknown. Clients can earn money by inviting referrals, but it’s unclear what the reward structure and its size will be.

Account Opening on Amecapitals.com

Creating an account with AME Capitals occurs in several stages. The firm requires personal information, residential address, password, phone number, and email. The registration process is standard but lengthy. Moreover, the company asks you to decide on the type of account at the account creation stage, which seems a bit strange. It would be better to allow the trader to make this decision later in the personal account area, providing additional detailed information on each tariff.

Creating an account without verification is impossible, as AME Capitals immediately asks you to upload documents for KYC, and only then does access to the dashboard become available. The interface of the personal account is primitive and lacks any interesting or unique design. Users have access to basic functions: edit data, deposit and withdraw money, track statistics on the referral program, and upload documents for KYC. There is a demo account, but it’s unclear how to open it. The tab for the demo is available, but you can’t open an account.

Verification

Verification in AME Capitals is mandatory. The company requires standard documents for KYC: to confirm the trader’s identity and place of residence. If a bank card will be used to make a deposit, it also needs to be verified.

- It’s convenient to upload documents.

- Requires you to take a picture of your bank card.

Trading Software

Since we couldn’t fully create an account due to mandatory KYC, we can’t practically test the AME Capitals platform and its features. The broker claims its terminal as if it’s the best and most popular software. The platform supports all types of orders, tools for technical and graphical analysis, multiple types of execution, 21 timeframes, and auto-trading.

Clients can trade not only from computers but also from mobile phones, as AME Capitals has developed apps for Android/iOS. However, they provide no links for these apps. Well, we have to take the company’s word for it, despite the absurdity of this situation.

| Features | AME Capitals | The Investment Center | LiquidChart |

|---|---|---|---|

| Demo Account | ❌ | ✔️ | ❌ |

| Mobile App | ✔️ | ❌ | ✔️ |

| Own Development | ✔️ | ❌ | ✔️ |

How Can I Trade With AME Capitals?

It is a CFD broker, so trading is limited to CFDs only, with no provision for spot or futures assets. Although AME Capitals offers its clients bonds, mutual funds, trust management, and IPOs, we didn’t find any of these instruments or features in the dashboard. The size of the leverage and the minimum deposit depend on the account type.

All Info About Accounts

The broker has six different types of accounts, and their names hint at the available asset classes for trading: “Forex”, “Raw material”, “Metals”, “Stock”, “Indices”, and “Portfolio.” The minimum deposit is high, starting at $500. At the same time, popular companies offer to start trading even with just $10 in your pocket. Spreads in AME Capitals start from 0.01, with leverage up to 1:500, but the commissions are unknown. Additional services include personal support, webinars and conferences.

Essentially, the tariffs differ in the available asset classes and leverage. Dubious conditions, to be honest. Why not then remove such a division and give traders a single account, offering all asset classes and flexible leverage? AME Capitals clearly doesn’t know about adequacy and normal trading conditions. The broker tries to extract more money from clients by offering more services and opportunities for more money. One cannot help but notice the absence of an Islamic account and hidden commissions.

- None.

- Inadequate and insane conditions.

- Islamic account is missing.

- Commissions are not specified.

Market Analysis and Education With Amecapitals.com

Traders can enable auto-trading, which is conducted using bots provided by the company. Additionally, a copy-trading service is available. AME Capitals also offers a news feed, live quotes for popular assets, an order book, guides, instructions, and educational seminars.

Deposit, Withdrawal, and Fees

AME Capitals does not charge transaction fees, meaning deposits and withdrawals are carried out without fees. The company allows you to deposit and withdraw funds in various ways:

- Bank card and bank wire transfer.

- E-wallets: Revolut, Qiwi, and Wise.

- Crypto: BTC, ETH, USDT (TRC-20/ERC-20).

| Features | AME Capitals | Xeodis | Odyssey Investment Group |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ✔️ |

| Electronic Payments | ✔️ | ✔️ | ✔️ |

| Crypto Transfers | ✔️ | ❌ | ✔️ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ❌ | ❌ | ❌ |

How Can I Contact It?

For contacting the managers, AME Capitals provides a phone number and three different email addresses for different purposes. There is an icon for online chat in the personal cabinet, but it is not clickable. Social media accounts have not been created, which are usually a mandatory attribute for any online business.

The provided phone number is British, but it is not available. AME Capitals’ email also turned out to be a fake; it does not exist. Interesting contact information was provided by the broker, which turned out to be fake.

- None.

- Contact information turned out to be fake.

- No online chat.

- No social media accounts have been created.

Is AME Capitals Dangerous?

Looking at the outrageous trading conditions, fake contact information, and a plethora of negative reviews on the internet, there’s nothing good to say about the company. AME Capitals already raises significant doubts about its credibility, and we haven’t even looked into licenses, legal addresses, and operation time yet.

How Long Does The Broker Work?

AME Capitals assures us that it has been operating since 2014. Well, it’s a bold statement, but there’s nothing to back it up: registration documents that could serve as evidence are missing. Additionally, the domain of the website was created on December 25, 2022. The broker also lists a legal entity in Saint Vincent and the Grenadines. If you check this information in the SVGFSA registry, you can see that the organization was added there on May 30, 2023. That is, the official founding date of the firm is May 2023. Can it be considered a long and solid track record? Definitely not, as even one year has not yet passed.

How Is AME Capitals Regulated?

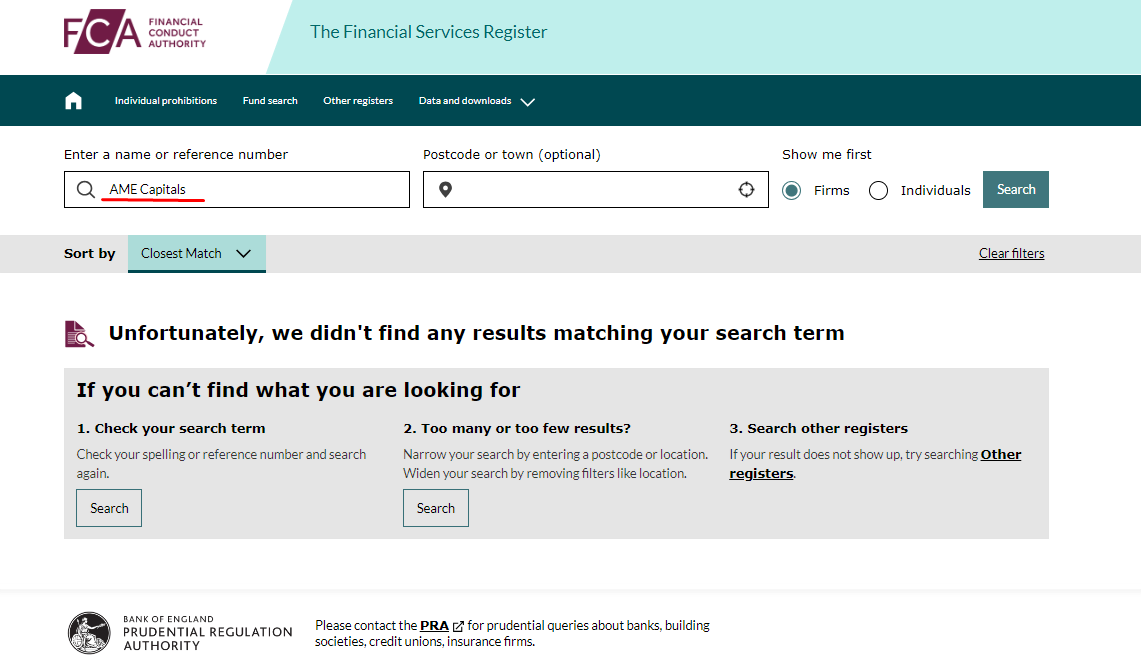

In the previous point, we found out that the broker is listed in the SVGFSA registry, but this doesn’t mean it is regulated. The fact is that this registry doesn’t perform the usual functions of a financial regulator; it is merely a list of brokers registered in Saint Vincent and the Grenadines. Furthermore, it’s unlikely that such a financial commission would compensate for losses or damages to clients in the case of a scam. However, AME Capitals also claims to have offices in the United Kingdom and Singapore. Therefore, it’s important to verify the existence of licenses in these countries.

MAS is the Singaporean regulator, and the FCA is the financial commission in the United Kingdom. We checked the registries of these regulators but did not find any mention of AME Capitals. How, then, can the broker claim to have offices in these jurisdictions if there are no licenses? There’s no need to guess; the addresses provided are fake.

| Features | AME Capitals | RiveGarde | All Capital Trade |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ❌ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ✔️ | ❌ | ❌ |

Frequently Asked Questions (FAQ)

How to Trade With AME Capitals?

Is AME Capitals Legit?

How Risky Is It?

Kevin Berry

Kevin Berry Why can’t brokerage services be conducted legally, honestly, and transparently? Why deceive people? AME Capitals is deceptive about its operating period, as the company has been in operation since 2023, not 2014. Why claim to have non-existent offices in the United Kingdom and Singapore when it can be easily checked within a minute on the internet? Why not conduct business legally by indicating the real date of establishment and offering reasonable and profitable conditions? I have no answer to this question. Scammers want to trick people into giving them money, to profit through dishonest means. It is their choice, but I hope that these fraudsters will deeply regret engaging in such bad practices. I also hope that no one will fall for this scam and transfer their money.

AME Capitals rating

3 reviews about AME Capitals

An illegal brokerage company with fake contact information and fake addresses. What else is there to comment on? Obvious scam and fraud.

I don’t understand how people can give money to such an obvious scam. It’s some kind of fake platform, and the liquidity and charts are even more fake. There’s no withdrawal of transactions to interbank liquidity and there never will be. These are just fairy tales. That’s why AME Capitals operates as a dealing desk, hindering traders from making money and profiting in the forex market.

How can you trade in a place that’s going to hinder you? Trading is already a complex endeavor, and here the platform is also working against you. If you decide to trade here, be prepared for fake charts, unclear stop-loss triggers, and so on. Moreover, withdrawing funds is impossible.

Trading with AME Capitals is extremely risky because the company could easily turn out to be scambroker. I don’t think you’d want to realize, after two weeks of waiting for a funds withdrawal, that you’ve fallen into a fraud scheme. In general, scammers should be prosecuted for creating a fraudulent company. Moreover, they should be held accountable for fabricating offices in the UK and Singapore, inventing a nearly 10-year operational history, and claiming to offer insurance up to $50,000. Of course, the scammers did this to scam people so that more unsuspecting individuals would invest their money, thinking they were safely collaborating with AME Capitals.

So, walk away; don’t invest your money in this fraud broker, and you’ll be happier. It’s better to find a legal broker who has been operating for 10-20 years and actually has all the required licenses, not just claims to have them.