“Unlock the world of CFD trading with us!” — a tempting offer from the brokerage company InsideTheFund. Despite the scant number of reviews and mentions of the broker on the internet, the website claims that over 100,000 clients trade here. However, there are questions regarding the safety and legality of operations. For example, where is the regulation, and where are the legal documents confirming the presence of offices in Switzerland and the United Kingdom? Why does the user agreement mention the offshore jurisdiction of Saint Vincent and the Grenadines? It is very likely that we are dealing with a scam. To prove this, we will conduct a thorough investigation.

Table of Contents

Highlights

| 🏛️ Country | Switzerland, United Kingdom, Saint Vincent and the Grenadines |

| ⚠️ Regulation | – |

| 🖥️ Website | https://insidethefund.com/, https://insidethefund.io/ |

| 🎲 Demo Account | No |

| ⏳ Start Time | 2023 |

| 💲 Minimum Deposit | $10,000 |

| ⚖️ Minimum and Maximum Leverage | 1:500 |

| ⚙️ Trading Platform | MetaTrader 5 |

| support@insidethefund.io | |

| 📞 Phone | +41 345 087 268 |

First Impression of Insidethefund.io

The official website introduces us to the advantages of cooperation, described superficially and without confirmations, and information about the company’s activities, but many aspects remain ignored, such as the business model. The design of this website is standard. At the top, you can see the main sections explaining the trading conditions, platform, and other aspects of the broker.

Besides English, there is a translation into Russian, hinting at the company’s orientation towards this region. The design is poorly chosen, just dry text on a white-green background without beautiful and unique graphical elements. InsideTheFund has made such a site that it’s difficult to study. It is unlikely that beginner traders are ready to dig through a ton of unnecessary text to find the necessary information. Meanwhile, the broker constantly mentions guaranteed safety and the most favorable conditions. Typically, such self-praise is a red flag.

Partnership and Bonuses

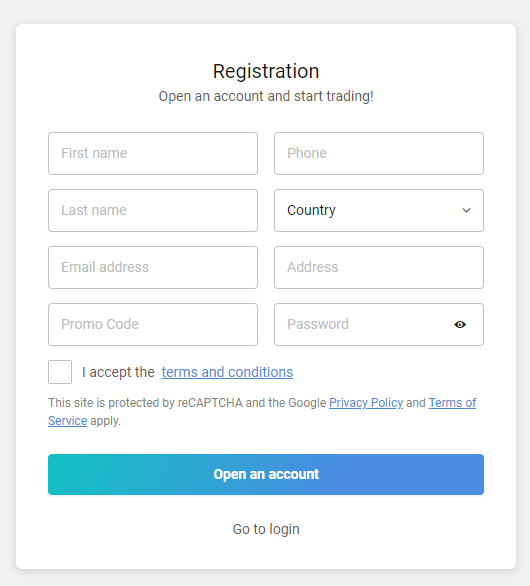

There is no word about the affiliate program on the official website, but when creating an account, users have the opportunity to enter some promo code. Apparently, this is the affiliate program, but InsideTheFund has not disclosed anything about it.

Additionally, traders can receive a bonus for deposit replenishment. The firm does not offer them forcibly, but at the customer’s discretion. However, one must not forget that receiving a bonus implies certain conditions for its processing. Nevertheless, the broker does not disclose specific conditions for processing, as this is set individually for each promotion.

Account Opening on Insidethefund.io

The account creation process starts with a simple registration, where it is necessary to provide a name, phone number, email, country, residential address, password, and a promo code (if available). Also, the system requests an agreement with the terms.

However, the registration process ends with the input of personal data. Pressing the “open an account” button leads to no action, although the system should redirect to the client portal or to an email confirmation window. This might be related to the promo code, which possibly is mandatory. Thus, it’s not possible to freely register on InsideTheFund for unknown reasons.

It’s also worth noting the absence of a demo account. Such an option is not mentioned on the company’s official website.

Verification

InsideTheFund has an identity verification procedure, as the company tries to comply with the AML&KYC policy. Therefore, using the platform’s services without KYC is not possible, and users need to provide several documents when depositing:

- Passport copy.

- Debit/credit card copy.

- Proof of residence.

The list of specific documents suitable for submission is indicated in the KYC policy on the official website. How quickly the verification process goes and how convenient it is to upload documents is unknown. Access to the personal account is closed without registration, and no information about processing times is provided.

If a client deposits funds but does not upload documents for KYC, a 5% commission on the deposit amount will be charged each week after 5 working days.

- None.

- The processing time for documents is unknown.

- The firm requires uploading a photo of the bank card.

- It is unclear how convenient it is to upload documents.

Trading Software

We couldn’t access the personal account, so we had to rely on the description of the trading platform available on the official website.

The broker offers trading on the well-known and popular MetaTrader 5 platform. Whether this is true or not is hard to say. We want to remind you that many unscrupulous brokerage companies on their websites indicate one trading terminal but actually provide another. We cannot verify this, so we will trust what InsideTheFund indicates. We also will not discuss or consider MetaTrader 5, as it is a popular software about which there are many articles, guides, and YouTube videos with instructions and descriptions of features.

| Features | InsideTheFund | Park Financial Consulting LTD | Grossfield Limited |

|---|---|---|---|

| Demo Account | ❌ | ❌ | ✔️ |

| Mobile App | ✔️ | ❌ | ❌ |

| Own Development | ❌ | ❌ | ❌ |

How Can I Trade With InsideTheFund?

Looking at the company’s homepage, it’s easy to guess that we are dealing with a CFD broker, meaning trading here is only possible with this type of instrument. Futures contracts and spots are not available. The firm allows trading of more than 300 cryptocurrencies, oil and gas, indices of different countries, commodities, metals, popular stocks, and currencies, including not only majors but also minors and exotics. Traders can use leverage up to 1:500 to increase trading volumes.

All Info About Accounts

InsideTheFund has developed 7 types of accounts with different minimum deposits and sets of additional services. In short, the firm adheres to the principle favored by scammers: “pay more money if you want better conditions and more opportunities”. For example, the first tariff plan requires a colossal $10,000, and the last type of account starts from 1 million dollars. Who would be ready to invest such serious amounts in a little-known firm without guarantees?

Thus, newcomers need to invest a minimum of $10,000, which is a huge amount. And as we noted earlier, a demo account is absent. Is it worth risking such money? On the first tariff, the company offers assistance from a personal manager, an introduction to the trading platform, guides, risk management strategy, and basic training.

The second type of account requires $25,000, but only adds personalized trading alerts. And what is the sense of such a tariff, where the deposit is 2.5 times larger, but there are almost no additional services? Other tariffs are not worth considering, as one needs to be a wealthy individual to afford them.

The sizes of the spreads are not specified, nor are the trading commissions, which are only known for cryptocurrencies — 0.01%. Additionally, InsideTheFund charges some monthly commission of 5%, leaving this without explanation.

Besides brokerage services, the company offers trust management. Investors will have to pay 2% of the capital regardless of the company’s results, as well as a performance fee of 20%. Commission fees can be reduced by locking funds in InsideTheFund for 30-90 days. Statistics for previous periods of work and a detailed description of the strategy are absent.

- Many additional services.

- $10,000 — high minimum deposit.

- Demo, Islamic, and ECN account types are missing.

- Commissions are partially disclosed, and spreads are unknown.

Market Analysis and Education With Insidethefund.io

All additional features are described in the tariff plans. Free and available tools, such as an economic calendar, news feed, or online calculator, are absent. The company doesn’t even offer analytics. However, there is a ticker showing current quotes of popular financial assets.

Deposit, Withdrawal, and Fees

Money transfers are possible using credit/debit cards, bank wire transfers, and crypto. InsideTheFund supports fiat currencies USD, EUR, and GBP, as well as cryptocurrencies ETH, LTC, BTC, and Dash. The minimum amount for withdrawal is $100, or its equivalent in other currencies, including digital. The processing time for withdrawal requests is relatively long — up to 3-5 business days, and the broker warns that it may take another 5 business days for the money to reach the client’s account.

In addition to the lengthy withdrawal process, the broker also charges a fee. For credit/debit cards it’s 5%, for bank transfers $10-$25, and for digital currency, it’s unknown. Don’t forget about the inactivity fee, so traders need to make at least 3 trades per month with a volume of more than $100.

| Features | InsideTheFund | AU Venture | Neotrades |

|---|---|---|---|

| Debit/Credit Cards | ✔️ | ✔️ | ✔️ |

| Electronic Payments | ❌ | ❌ | ✔️ |

| Crypto Transfers | ✔️ | ❌ | ✔️ |

| Deposit Fee | ❌ | ❌ | ❌ |

| Withdrawal Fee | ✔️ | ❌ | ❌ |

How Can I Contact It?

The broker shares a Swiss phone number and email for contacting managers. Additionally, there is a special form for creating a feedback request. InsideTheFund promises to respond within one hour, and support operates 24/5.

Checking the firm’s contact data yielded nothing. However, there are still downsides. Online chat and social media accounts are absent.

- You can contact the managers via phone and email.

- An online chat for prompt communication is absent.

- There are no social media accounts.

Is InsideTheFund Dangerous?

Let’s not beat around the bush. The company looks like blatant fraud: a boring website, inadequate conditions with high commissions and leverage of 1:500, the impossibility to register an account, secrecy and anonymity, absence of a demo account, and more. Too many negative factors are gathered in one place. However, before making a conclusion, it’s necessary to consider the duration of operation and the legitimate status of the organization.

How Long Does The Broker Work?

There are almost no mentions on the internet related to InsideTheFund. Looking at when the website’s domain was registered, which happened on November 14, 2023, it’s easy to guess about the short duration of the operation. Therefore, information about satisfied 100,000 clients is clearly fake.

According to our observations, this is the second time this platform has made the move. Right now they are accepting customers on https://insidethefund.io/, created less than a month ago, on April 23, 2024. Commendable determination!

How Is It Regulated?

After studying the official website, mentions of three jurisdictions were found: Switzerland, the United Kingdom, and Saint Vincent and the Grenadines. At the same time, licenses from FINMA and FCA are not indicated. However, it’s necessary to check the presence of InsideTheFund in the registries of financial commissions of these countries. The check gave the following results:

- FINMA is absent.

- FCA is absent.

- SVGFSA is absent.

Additionally, the legal registries of Switzerland and the United Kingdom were checked. It’s not surprising that InsideTheFund was not found there either. Thus, it can be confidently assumed that addresses in the United Kingdom and Switzerland are fake.

| Features | InsideTheFund | RiveGarde | BitBlanco |

|---|---|---|---|

| European Zone | ❌ | ❌ | ❌ |

| Asian Zone | ❌ | ❌ | ❌ |

| American Zone | ❌ | ❌ | ❌ |

| African Zone | ❌ | ❌ | ❌ |

| Offshore | ❌ | ❌ | ❌ |

Frequently Asked Questions (FAQ)

How to Trade With InsideTheFund?

Is InsideTheFund Legit?

How Risky Is It?

Kevin Berry

Kevin Berry Is it necessary to say that under no circumstances should one open a brokerage account and deposit money here? Or is this obvious to everyone, even beginners? We are faced with a classic scam, created in November 2023, to swindle people out of their money. Nothing unusual, as in the Forex/CFD industry, such fake platforms make up 99%. InsideTheFund lies about 100,000 traders, offices, and security. There is nothing but a scam here. And this doesn’t even uncover the 100% b-book business model. That is, the number of negative factors in this brokerage disgrace and dumpster simply skyrockets.

InsideTheFund rating

3 reviews about InsideTheFund

Why can’t I get in touch with the managers? My withdrawal request has been pending unprocessed for a long time. Where’s my money? What’s this? Is it really a scam?

I have serious doubts about the reliability and legality of InsideTheFund. Nothing is mentioned about licenses on the official website, although a broker with offices in European countries should be regulated. It is not even up for discussion.

Moreover, I tried searching for reviews on the internet but found almost nothing. An absolutely unknown company that couldn’t possibly have 100k clients even in theory. So the broker is also deceiving site visitors. Therefore, it is not worth trusting them, as scammers try to create trust in themselves to later steal your money. It’s easy to deposit money, but it will be impossible to withdraw. Remember my words, do not feed fraudsters and crooks who create their fake brokerage pseudo-platforms. Let them earn money honestly.

After depositing £200 I was persuaded to invest more and more

£3000 was my total investment witch is a lot for me and had my mind made up to withdraw what I could but after high pressure sales I took the offer of £10000 credit with no risk .

So now they want £10000 payment to settle the free credit and I can’t use the money from my account I must invest £10000 before I can withdraw. I have came to the conclusion that I have lost it all